-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Options Corner: What the Options Market Tells Us About Nucor

Options Corner: What the Options Market Tells Us About Nucor

Financial giants have made a conspicuous bullish move on Nucor. Our analysis of options history for $Nucor (NUE.US)$ revealed 14 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $402,619, and 9 were calls, valued at $314,549.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $225.0 for Nucor over the recent three months.

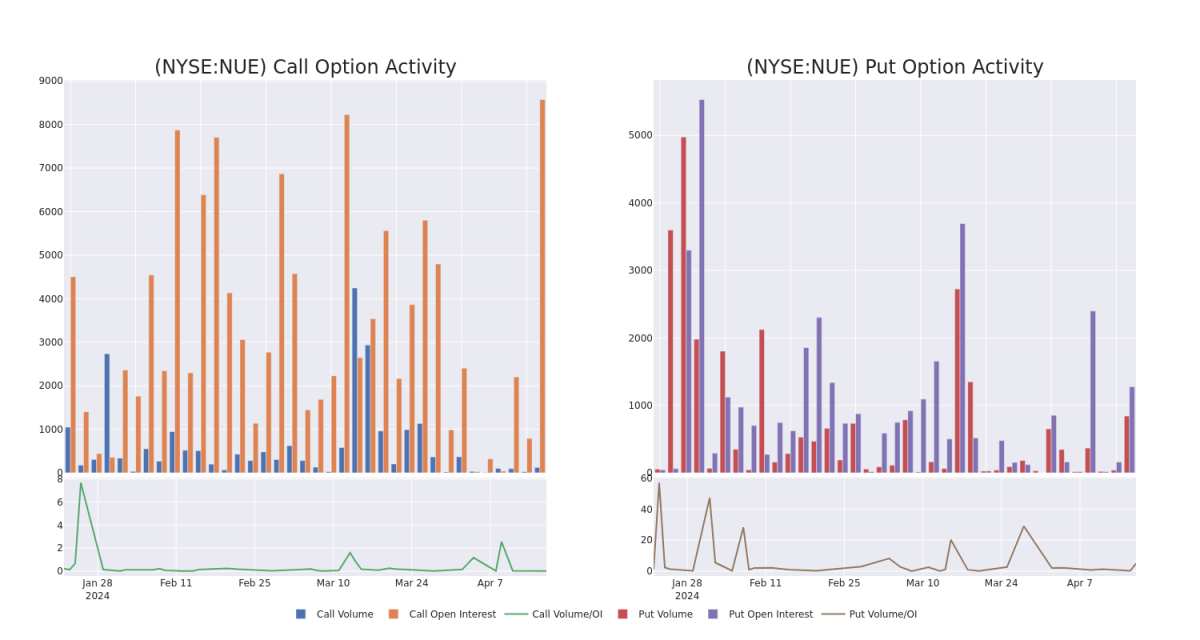

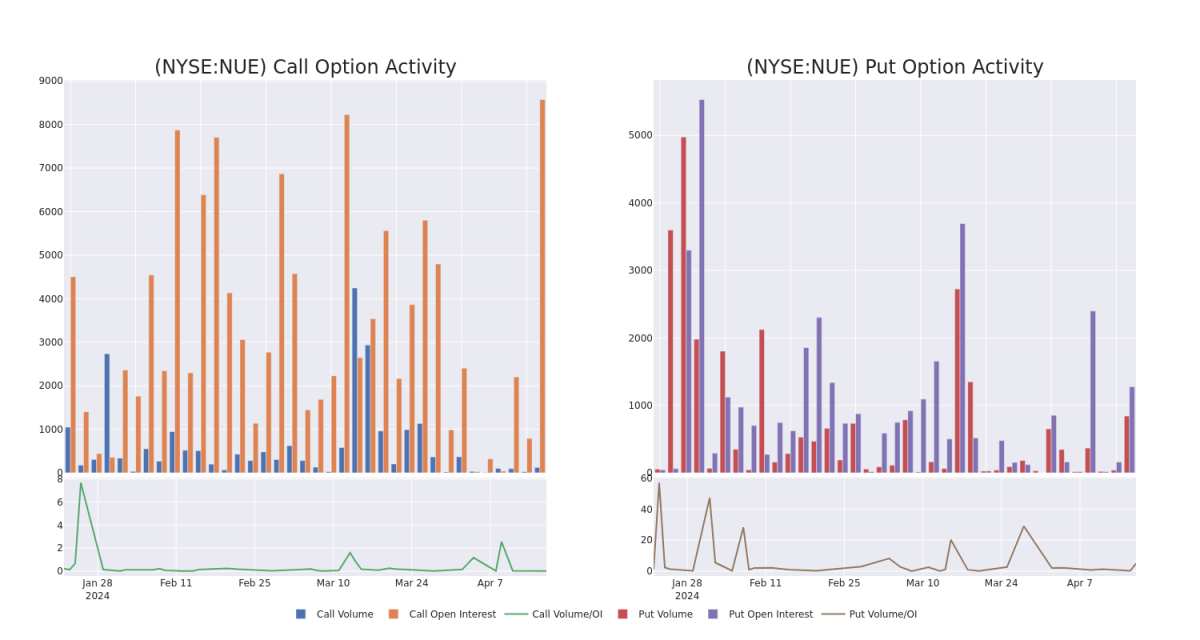

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Nucor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Nucor's substantial trades, within a strike price spectrum from $150.0 to $225.0 over the preceding 30 days.

Nucor Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

NUE | PUT | TRADE | BULLISH | 06/21/24 | $5.8 | $5.5 | $5.5 | $185.00 | $220.0K | 922 | 413 |

NUE | PUT | SWEEP | BULLISH | 05/17/24 | $3.9 | $3.6 | $3.67 | $185.00 | $74.1K | 98 | 402 |

NUE | CALL | TRADE | BULLISH | 01/16/26 | $30.0 | $28.7 | $29.6 | $210.00 | $53.2K | 2.2K | 0 |

NUE | PUT | TRADE | BEARISH | 04/26/24 | $34.7 | $30.9 | $33.4 | $225.00 | $50.1K | 6 | 0 |

NUE | CALL | TRADE | BEARISH | 01/16/26 | $26.2 | $24.6 | $25.1 | $220.00 | $47.6K | 334 | 0 |

About Nucor

Nucor Corp manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills. The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others. The operating business segments are: steel mills, steel products, and raw materials, the steel mills segment derives maximum revenue. The steel mills segment includes carbon and alloy steel in sheet, bars, structural and plate; steel trading businesses; rebar distribution businesses; and Nucor's equity method investments in NuMit and NJSM.

Current Position of Nucor

With a volume of 1,150,369, the price of NUE is up 0.35% at $192.78.

RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

Next earnings are expected to be released in 5 days.

What The Experts Say On Nucor

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $195.0.

An analyst from JP Morgan persists with their Neutral rating on Nucor, maintaining a target price of $195.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Financial giants have made a conspicuous bullish move on Nucor. Our analysis of options history for $Nucor (NUE.US)$ revealed 14 unusual trades.

金融巨頭對紐柯採取了明顯的看漲舉動。我們對期權歷史的分析 $紐柯鋼鐵 (NUE.US)$ 透露了14筆不尋常的交易。

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $402,619, and 9 were calls, valued at $314,549.

深入研究細節,我們發現50%的交易者看漲,而50%的交易者表現出看跌的趨勢。在我們發現的所有交易中,有5筆是看跌期權,價值爲402,619美元,9筆是看漲期權,價值314,549美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $225.0 for Nucor over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將紐柯的價格範圍從150.0美元擴大到225.0美元。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Nucor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Nucor's substantial trades, within a strike price spectrum from $150.0 to $225.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了紐柯期權在指定行使價下的流動性和投資者對Nucor期權的興趣。即將發佈的數據可視化了與紐柯大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從150.0美元到225.0美元不等。

Nucor Call and Put Volume: 30-Day Overview

紐柯看漲和看跌交易量:30 天概述

Significant Options Trades Detected:

檢測到的重要期權交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

NUE |

PUT |

TRADE |

BULLISH |

06/21/24 |

$5.8 |

$5.5 |

$5.5 |

$185.00 |

$220.0K |

922 |

413 |

NUE |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$3.9 |

$3.6 |

$3.67 |

$185.00 |

$74.1K |

98 |

402 |

NUE |

CALL |

TRADE |

BULLISH |

01/16/26 |

$30.0 |

$28.7 |

$29.6 |

$210.00 |

$53.2K |

2.2K |

0 |

NUE |

PUT |

TRADE |

BEARISH |

04/26/24 |

$34.7 |

$30.9 |

$33.4 |

$225.00 |

$50.1K |

6 |

0 |

NUE |

CALL |

TRADE |

BEARISH |

01/16/26 |

$26.2 |

$24.6 |

$25.1 |

$220.00 |

$47.6K |

334 |

0 |

符號 |

看跌/看漲 |

交易類型 |

情緒 |

Exp。日期 |

問 |

出價 |

價格 |

行使價 |

總交易價格 |

未平倉合約 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

裸體 |

放 |

貿易 |

看漲 |

06/21/24 |

5.8 美元 |

5.5 美元 |

5.5 美元 |

185.00 美元 |

220.0 萬美元 |

922 |

413 |

裸體 |

放 |

掃 |

看漲 |

05/17/24 |

3.9 美元 |

3.6 美元 |

3.67 |

185.00 美元 |

74.1 萬美元 |

98 |

402 |

裸體 |

打電話 |

貿易 |

看漲 |

01/16/26 |

30.0 美元 |

28.7 美元 |

29.6 美元 |

210.00 美元 |

53.2 萬美元 |

2.2K |

0 |

裸體 |

放 |

貿易 |

粗魯的 |

04/26/24 |

34.7 美元 |

30.9 美元 |

33.4 美元 |

225.00 美元 |

50.1 萬美元 |

6 |

0 |

裸體 |

打電話 |

貿易 |

粗魯的 |

01/16/26 |

26.2 美元 |

24.6 美元 |

25.1 美元 |

220.00 美元 |

47.6 萬美元 |

334 |

0 |

About Nucor

關於紐柯

Nucor Corp manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills. The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others. The operating business segments are: steel mills, steel products, and raw materials, the steel mills segment derives maximum revenue. The steel mills segment includes carbon and alloy steel in sheet, bars, structural and plate; steel trading businesses; rebar distribution businesses; and Nucor's equity method investments in NuMit and NJSM.

紐柯公司生產鋼鐵和鋼鐵產品。該公司還生產直接還原鐵,用於其鋼廠。這些業務包括國際貿易和銷售公司,這些公司購買和銷售該公司和其他公司生產的鋼鐵和鋼鐵產品。運營業務部門是:鋼廠、鋼鐵產品和原材料,鋼廠板塊的收入最大。鋼廠板塊包括板材、棒材、結構和板材中的碳鋼和合金鋼;鋼鐵貿易業務;鋼筋分銷業務;以及紐柯對Numit和NJSM的股票法投資。

Current Position of Nucor

紐柯目前的立場

With a volume of 1,150,369, the price of NUE is up 0.35% at $192.78.

RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

Next earnings are expected to be released in 5 days.

NUE的交易量爲1,150,369美元,價格上漲0.35%,至192.78美元。

RSI 指標暗示,標的股票目前在超買和超賣之間保持中立。

下一份業績預計將在5天后公佈。

What The Experts Say On Nucor

專家對紐柯的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $195.0.

在過去的30天中,共有1位專業分析師對該股發表了看法,將平均目標股價定爲195.0美元。

An analyst from JP Morgan persists with their Neutral rating on Nucor, maintaining a target price of $195.

摩根大通的一位分析師堅持對紐柯的中性評級,將目標價維持在195美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧