On April 2, “AIGC's first share” went out and asked through the Hong Kong Stock Exchange hearing and published a collection of data after the hearing. This also meant that it was about to start a stock offering in the Hong Kong stock market. As a star company on the big model circuit, it attracted the attention of many investors, but it also bothered many people about whether they actually wanted to participate in the upcoming launch.

Judging from the recent performance of the Hong Kong stock market and the IPO market situation, the listing window to go out and ask questions is actually quite good.

On the one hand, since Hong Kong stocks bottomed out in late January, they have emerged from a volatile upward trend. Recently, with the announcement of results exceeding expectations by Zhongke Online Stock, it is also driving the overall trend of the market to improve.

Furthermore, considering the Federal Reserve's interest rate cut cycle, the continued recovery of the domestic economy, and the introduction of a series of favorable policies, and the advantages of the current bottom valuation of Hong Kong stocks, all have brought a lot of expectations to the future performance of the Hong Kong stock market.

Recently, CITIC Securities research opinions have also been mentioned. Investors are advised to pay attention to the Hong Kong stock market in the second quarter on technology, big consumption, and the right-side layout of the non-banking financial industry.

On the other hand, most of the IPOs listed in Hong Kong stocks this year have also performed very well, and the profit effect of IPOs is obvious.

Looking at market statistics, up to now, out of 12 Hong Kong IPOs this year, 8 have achieved positive returns on the first day of listing. Judging from the recent performance of the 10 IPOs, the average rise of IPOs in the dark market was 22.89%, with an average increase of 32.70% on the first day.

In addition, there are quite a few double performers among the IPOs listed this year. For example, Jingwei Tiandi, which was listed in January, surged 164% on the first day; Lexi Group also rose 665% during the period since its listing; Hongji Group also rose more than 100% during the period since its listing.

In addition to the active market and IPO market bringing a good listing environment to go out and ask questions, you can also see some of the company's opportunities and advantages more clearly from the following aspects.

First, from a racetrack level, the popularity of AIGC is still online.

Since last year, AIGC concept stocks have performed very well in the secondary market.

Although it experienced a long period of correction after reaching a high point of hype in June of last year, now, with the strengthening of the overall market environment, the entire sector has begun a rebound cycle.

In terms of the A-share AIGC Concept Index, the cumulative increase in the index has reached 40% since the February low.

(Source: iFind)

In the primary market, the AIGC concept also showed its appeal to the capital market.

According to research by Extraordinary Industrial Research, in 2023, the total financing of the AIGC industry reached 19.18 billion yuan, and the number of financing times was 168. In particular, in the second half of the year, financing activities increased significantly, which is enough to see the enthusiasm of market capital to participate in this field.

Furthermore, judging from the valuation situation of the AIGC project, the valuation given by the market is also quite generous. Looking at recent market trends in 2024, there are also quite a few large domestic model AI companies that can easily reach 2 to 3 billion US dollars in valuation after completing a new round of financing.

Looking ahead to the future market, as the market continues to recognize the maturity of AIGC technology and the continuous expansion of industry applications, there is reason to believe that AIGC's potential will continue to receive attention from the capital market, thereby driving innovation and growth in the entire industry.

It can be said that when asked about this listing, as the first stock listed on the Hong Kong stock AIGC, it is also likely to become the focus of market capital attention in this sector as the market heats up.

Second, judging from the question itself, the company's growth potential is also quite impressive.

Generally speaking, in the emerging field of AIGC, most companies are currently still in the phase of strong investment, that is, burning money, and there are not many that can achieve commercialization results.

And if you go outside and ask, not only is it ahead of the industry in terms of commercialization, but its performance is also quite strong.

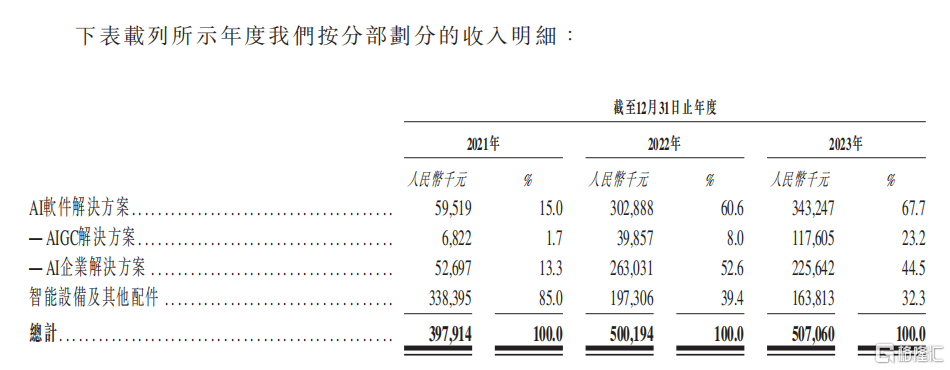

Financial data confirms this. From 2021 to 2022, the revenue from going out and asking was 398 million yuan and 500 million yuan respectively, and the corresponding adjusted net profit was -73 million yuan and 109 million yuan, respectively. The growth rate of revenue and net profit was very impressive.

(Source: Company Prospectus)

However, looking at 2023, there is growing pressure on both the revenue and profit aspects of going out and asking. Revenue of 507 million yuan was achieved in 2023, a year-on-year increase of only 1.4%. Gross profit declined 3% year over year to 326 million yuan, and adjusted net profit was 1.75 million yuan.

According to the analysis, the main reason for the slowdown in revenue growth is a decrease in revenue from AI enterprise solutions in its AI software solutions.

Further analysis shows that the core reason is due to reduced revenue from intellectual property arrangements relating to automotive subsidiary A's use of the company's in-vehicle AI technology. You need to know that the intellectual property arrangement project with automobile subsidiary A was launched in October 2021, and revenue was obtained one after another. The revenue for the year 21, 22, and 23 reached 3.2 million, 213 million, and 139 million, respectively, accounting for 0.8%, 42.6%, and 27.4% of the company's total revenue for each year. However, since this intellectual property arrangement project was completed in June 2023, it can also be seen that the growth rate of the company's performance fluctuated.

However, after all, this is only a one-time factor; it is only affected by the completion of specific customer cooperation projects, so it does not affect the judgment on the company's high growth potential.

Judging from the revenue performance of the company's AI software solutions, it has grown from 595.19 million yuan in 2021 to 343 million yuan in 2023, an increase of 476.70%. Among them, AIGC solutions have grown from 6.822 million yuan in 2021 to 118 million yuan in 2023, an increase of more than 16 times; AI enterprise solutions have grown from 52.697 million yuan in 2021 to 226 million yuan in 2023, an increase of 328.19%.

Furthermore, it can also be seen that when you go out and ask questions, the R&D investment is still very high. The company's R&D expenditure in 2023 reached 155 million yuan, an increase of 30.4% over the previous year.

For the AIGC circuit, competition places great emphasis on technological innovation, so continuing to invest heavily in going out and asking will help it maintain its dominant position in industry competition.

Precisely because of the support of technical attributes, there are high operating barriers, which support high gross profit margins, and the gross margin performance when you go out and ask questions is quite good. In 2021, 2022, and 2023, gross margins were 37.5%, 67.2%, and 64.3% respectively. Among them, the rapidly growing gross margins of AIGC solutions reached 68.8%, 88.0%, and 92.2%, respectively. From this, it is easy to conclude that in the future, as the size of the company's business segment increases, it will provide stronger support for its overall profit performance.

(Source: Company Prospectus)

Finally, if you pay attention to the situation of the company's founders and shareholders, you can also see many attractive points.

On the one hand, Li Zhifei, the founder of the company, is quite influential in the industry and can be called a leading expert leading the big model craze in China. According to information, he worked at the Silicon Valley Research Institute in the US and specialized in NLP (natural language processing) at Google, and has a deep academic background and rich practical experience.

It is worth mentioning that Li Zhifei is also regarded as one of the important figures who launched the first step in starting a Chinese model business. After discussing the AI big model business with Wang Huiwen, the founder of AIGC's Unicorn Lightyear, through a dinner, Wang Huiwen revealed the idea of starting a big model company outside Lightyear on February 13, '23. Following that, on February 15, Li Zhifei also announced his entry into China's OpenAI through Geek Park, setting off the first wave of actual Chinese model battles. They all say that a good company first depends on the founder of the enterprise. Judging from this point of view, it is still possible to have confidence in the “veteran” of the industry.

On the other hand, going out and asking about the shareholders' lineup is also quite luxurious. It can be said that it has brought together a number of top capital forces and strategic partners in the industry. Among them, SIG Hainer Asia, Google, Sequoia China, Goertek, Zhenge Fund, Yuanmei Optoelectronics, etc. These shareholders can not only bring strong financial support to the company, but also provide a platform for strategic cooperation and resource integration for the development of inquiries, which will greatly help the company's future development.

It is also based on the above two aspects, and will also help open up recognition in the Hong Kong stock market and attract the attention of more investors.

Overall, a successful listing will further enhance its own brand influence and market position, inject new capital and resources, and drive the company to usher in accelerated development.

And considering that the AIGC circuit will also follow the logic of the “Matthew effect,” going out and asking whether it's a leading edge in commercial monetization, an already running cash flow cycle, or strong support from the capital market will make its subsequent development interesting. I believe investors have already made their own judgments about whether this new share value is worth investing in from the above perspectives.