MicroStrategy's Bitcoin Holdings Help Company Surpass EBay, Delta in Market Cap

MicroStrategy's Bitcoin Holdings Help Company Surpass EBay, Delta in Market Cap

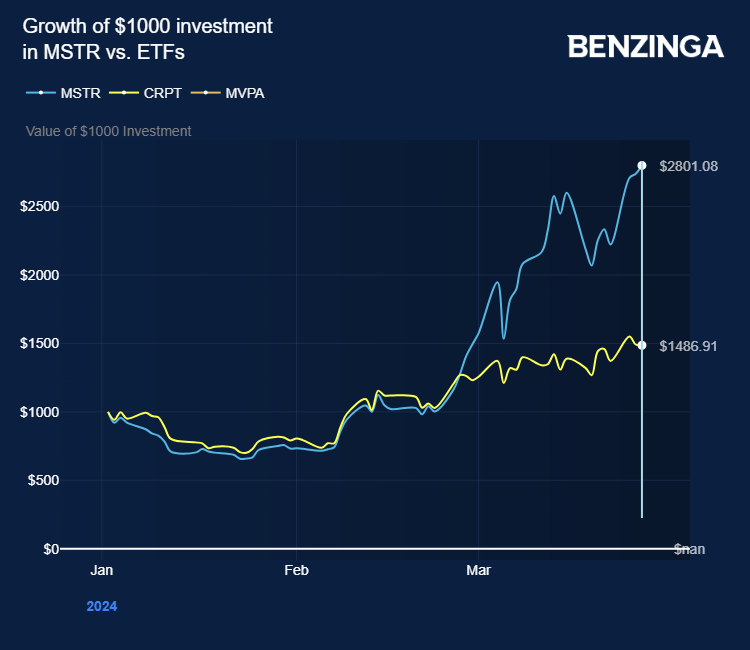

$MicroStrategy (MSTR.US)$, known for its substantial $Bitcoin (BTC.CC)$ holdings, has seen its stock surge by a staggering 204% this year, reaching $1,919 by Wednesday's close.

$MicroStrategy (MSTR.US)$,以其實質性而聞名 $比特幣 (BTC.CC)$ 持股量,其股票今年飆升了驚人的204%,截至週三收盤時達到1,919美元。

This surge has propelled its market capitalization to over $32 billion, surpassing 237 companies in the S&P 100, including well-established names like $eBay (EBAY.US)$ and $Delta Air Lines (DAL.US)$.

這種激增使其市值超過320億美元,超過了標準普爾100指數中的237家公司,其中包括知名公司,例如 $eBay (EBAY.US)$ 和 $達美航空 (DAL.US)$。

Despite being classified under the Russell 2000 Index, typically comprising smaller-cap stocks, its market value rivals that of much larger entities, Bloomberg reports.

彭博社報道,儘管被歸類爲羅素2000指數(通常包括小盤股),但其市值可與大型實體的市值相媲美。

However, MicroStrategy's inclusion in the $S&P 500 Index (.SPX.US)$ is not straightforward, as its revenue model primarily hinges on its Bitcoin holdings rather than conventional business operations.

但是,MicroStrategy 已納入 $標普500指數 (.SPX.US)$ 並不簡單,因爲其收入模式主要取決於其持有的比特幣,而不是傳統的業務運營。

Some analysts, like Steve Sosnick from Interactive Brokers, view MicroStrategy as a leveraged holding company for Bitcoin, raising questions about its suitability for S&P 500 inclusion.

一些分析師,例如盈透證券的史蒂夫·索斯尼克,將微策略視爲比特幣的槓桿控股公司,這引發了人們對其是否適合納入標準普爾500指數的質疑。

Despite its profitability in the fourth quarter of 2023, driven by a tax benefit from its Bitcoin stash, MicroStrategy has faced setbacks due to Bitcoin's volatile valuation.

儘管受比特幣儲備稅收優惠的推動,MicroStrategy在2023年第四季度實現了盈利,但由於比特幣估值的波動,MicroStrategy仍面臨挫折。

It has incurred losses in quarters when Bitcoin's value declined, complicating its eligibility for S&P 500 inclusion.

在比特幣價值下跌的幾個季度中,它蒙受了損失,這使其入選標準普爾500指數的資格變得複雜。

Also this week, MicroStrategy introduced an innovative AI-powered bot, MicroStrategy AutoTM, streamlining the delivery of business intelligence (BI) across organizations.

同樣在本週,微策略推出了一款由人工智能驅動的創新機器人MicroStrategy AutoTM,它簡化了組織間商業智能(BI)的交付。

The Auto AI Bot, which is lightweight and embeddable, can operate independently within the MicroStrategy ONE library or seamlessly integrate into third-party applications, offering extensive customization options like appearance, language, and detail level adjustments.

Auto AI Bot 輕量級且可嵌入,可以在 MicroStrategy ONE 庫中獨立運行,也可以無縫集成到第三方應用程序中,提供廣泛的自定義選項,例如外觀、語言和細節級別調整。

The stock surged over 141% year-to-date.

今年迄今爲止,該股飆升了141%以上。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:此內容部分是在人工智能工具的幫助下製作的,並由Benzinga的編輯審閱和發佈。