-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Nvidia Captures 92% of Data Center GPU Market, Underlining US Leadership in Generative AI

Nvidia Captures 92% of Data Center GPU Market, Underlining US Leadership in Generative AI

Nvidia Corp is a prime example of U.S. dominance in the generative artificial intelligence market.

From consumer applications to foundational technologies, cloud infrastructure, and semiconductors, U.S. firms lead, with Nvidia capturing a staggering 92% market share in data center GPUs.

This market leadership is underpinned by the widespread use of Nvidia's CUDA development platform, which has been embraced by over 4 million developers worldwide for AI and parallel computing applications, Nikkei Asia reports.

Also Read: Nvidia Leads AI Chip Rivalry with New GPUs, While AMD and Intel Bet Big on AI PCs

The U.S. generative AI market, valued at $16.1 billion last year and projected to reach $65 billion by 2030, showcases the country's expansive role in the field.

This growth is driven by significant investments from U.S. tech giants, including $Meta Platforms (META.US)$ plan to integrate 350,000 Nvidia H100 GPU graphics cards into its infrastructure.

Furthermore, American companies command two-thirds of the global cloud infrastructure market, with $Amazon (AMZN.US)$, $Microsoft (MSFT.US)$, and $Alphabet-A (GOOGL.US)$ Google at the forefront.

Recent reports indicated Nvidia expanding its operations by forming a new division to design custom chips for cloud computing providers and others, focusing on sophisticated AI processors.

Nvidia commands around 80% of the market for high-end AI chips.

This dominance has been pivotal in boosting its market value by 40% to $1.73 trillion in 2024 after witnessing a more than threefold surge in 2023.

Nvidia previously acknowledged the lack of impact from the U.S. sanctions on China for AI technology.

Analysts had flagged Nvidia's leading position in the accelerator market, valued at over $85 billion, with its dominance in the data center segment contributing the most to its revenue.

They expect sales from data centers to make up over 85% of Nvidia's total revenue, marking a substantial rise from about 25% five years prior.

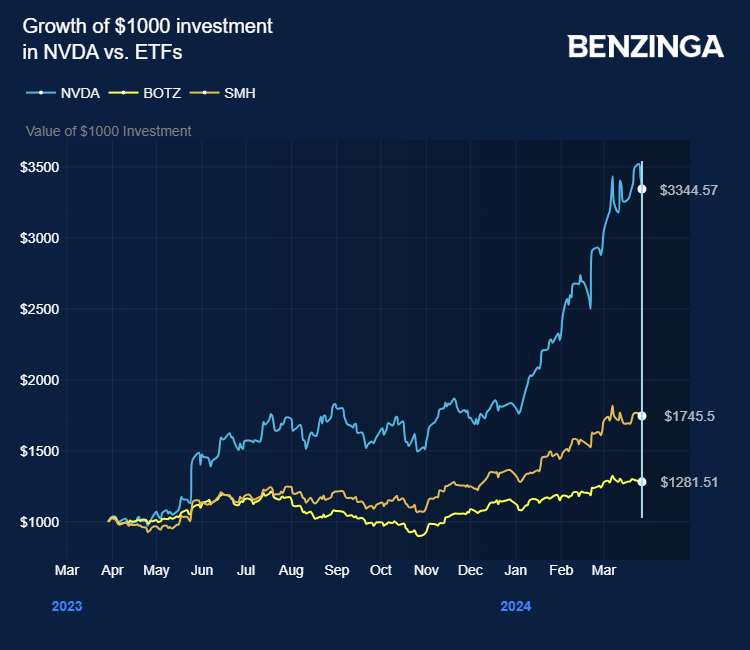

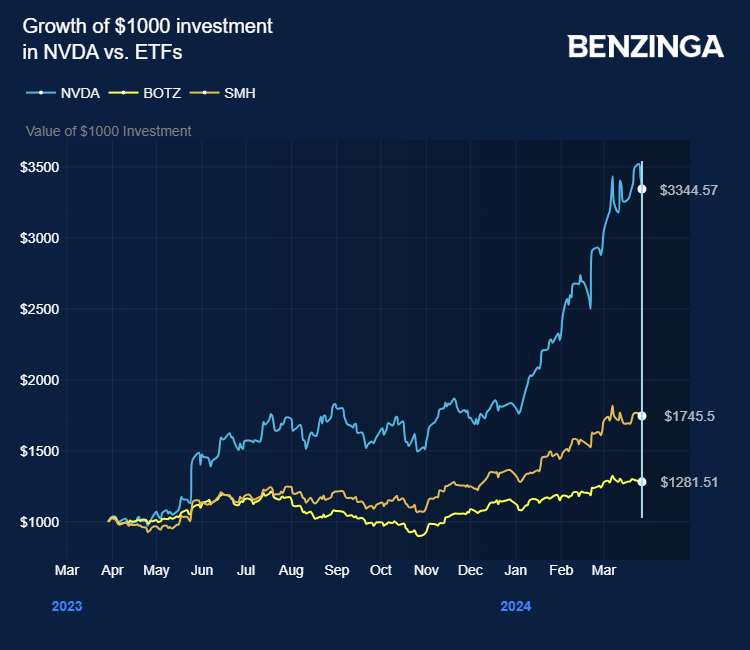

The stock surged 242% in the last 12 months. Investors can gain exposure to the stock via $VanEck Semiconductor ETF (SMH.US)$ and $Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ.US)$.

Price Actions: NVDA shares traded lower by 0.38% at $899.05 premarket on the last check Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Nvidia Corp is a prime example of U.S. dominance in the generative artificial intelligence market.

英偉達公司是美國在生成式人工智能市場佔據主導地位的典型例子。

From consumer applications to foundational technologies, cloud infrastructure, and semiconductors, U.S. firms lead, with Nvidia capturing a staggering 92% market share in data center GPUs.

從消費類應用程序到基礎技術、雲基礎設施和半導體,美國公司處於領先地位,Nvidia在數據中心GPU中佔據了驚人的92%的市場份額。

This market leadership is underpinned by the widespread use of Nvidia's CUDA development platform, which has been embraced by over 4 million developers worldwide for AI and parallel computing applications, Nikkei Asia reports.

日經亞洲報道,Nvidia的CUDA開發平台的廣泛使用爲這種市場領導地位提供了支持,該平台已被全球超過400萬開發人員所接受,用於人工智能和並行計算應用程序。

Also Read: Nvidia Leads AI Chip Rivalry with New GPUs, While AMD and Intel Bet Big on AI PCs

另請閱讀:Nvidia 憑藉新 GPU 引領人工智能芯片競爭,而 AMD 和英特爾則押注人工智能 PC

The U.S. generative AI market, valued at $16.1 billion last year and projected to reach $65 billion by 2030, showcases the country's expansive role in the field.

美國生成人工智能市場去年價值161億美元,預計到2030年將達到650億美元,這表明了該國在該領域的廣泛作用。

This growth is driven by significant investments from U.S. tech giants, including $Meta Platforms (META.US)$ plan to integrate 350,000 Nvidia H100 GPU graphics cards into its infrastructure.

這種增長是由美國科技巨頭的大量投資推動的,包括 $Meta Platforms (META.US)$ 計劃將35萬張英偉達H100 GPU顯卡集成到其基礎架構中。

Furthermore, American companies command two-thirds of the global cloud infrastructure market, with $Amazon (AMZN.US)$, $Microsoft (MSFT.US)$, and $Alphabet-A (GOOGL.US)$ Google at the forefront.

此外,美國公司控制着全球雲基礎設施市場的三分之二, $亞馬遜 (AMZN.US)$, $微軟 (MSFT.US)$,以及 $谷歌-A (GOOGL.US)$ 谷歌處於最前沿。

Recent reports indicated Nvidia expanding its operations by forming a new division to design custom chips for cloud computing providers and others, focusing on sophisticated AI processors.

最近的報告顯示,Nvidia通過成立一個新部門來擴大其業務,爲雲計算提供商和其他公司設計定製芯片,專注於複雜的人工智能處理器。

Nvidia commands around 80% of the market for high-end AI chips.

英偉達佔據了高端人工智能芯片市場約80%的份額。

This dominance has been pivotal in boosting its market value by 40% to $1.73 trillion in 2024 after witnessing a more than threefold surge in 2023.

在經歷了2023年增長三倍多之後,這種主導地位對於將其市值在2024年增長40%至1.73萬億美元起到了至關重要的作用。

Nvidia previously acknowledged the lack of impact from the U.S. sanctions on China for AI technology.

英偉達此前承認,美國對中國的人工智能技術制裁沒有影響。

Analysts had flagged Nvidia's leading position in the accelerator market, valued at over $85 billion, with its dominance in the data center segment contributing the most to its revenue.

分析師表示,英偉達在加速器市場處於領先地位,價值超過850億美元,其在數據中心領域的主導地位對其收入的貢獻最大。

They expect sales from data centers to make up over 85% of Nvidia's total revenue, marking a substantial rise from about 25% five years prior.

他們預計,數據中心的銷售額將佔英偉達總收入的85%以上,較五年前的約25%大幅增長。

The stock surged 242% in the last 12 months. Investors can gain exposure to the stock via $VanEck Semiconductor ETF (SMH.US)$ and $Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ.US)$.

該股在過去12個月中飆升了242%。投資者可以通過以下方式獲得股票敞口 $半導體指數ETF-VanEck (SMH.US)$ 和 $Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ.US)$。

Price Actions: NVDA shares traded lower by 0.38% at $899.05 premarket on the last check Thursday.

價格走勢:週四最後一次支票中,NVDA股價盤前下跌0.38%,至899.05美元。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:此內容部分是在人工智能工具的幫助下製作的,並由Benzinga的編輯審閱和發佈。

Photo via Shutterstock

照片來自 Shutterstock

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧