Yintai Gold Co., Ltd. Recorded A 16% Miss On Revenue: Analysts Are Revisiting Their Models

Yintai Gold Co., Ltd. Recorded A 16% Miss On Revenue: Analysts Are Revisiting Their Models

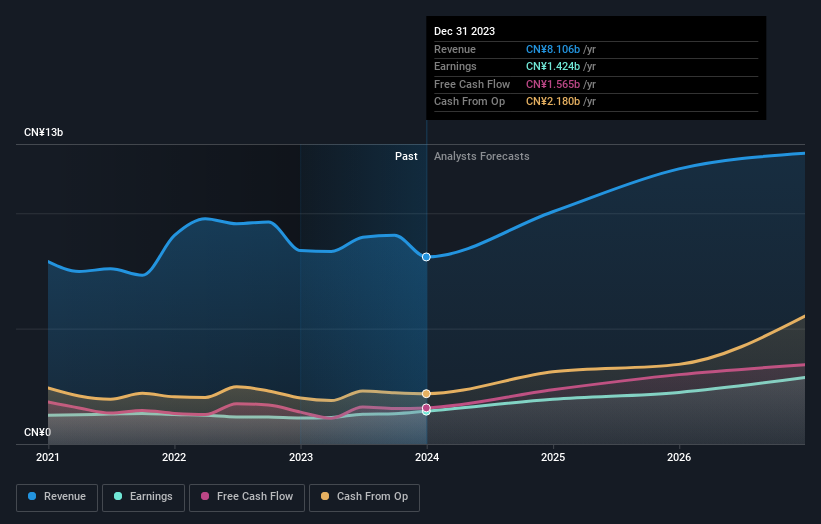

Yintai Gold Co., Ltd. (SZSE:000975) just released its latest annual report and things are not looking great. Yintai Gold reported an earnings miss, with CN¥8.1b revenues falling 16% short of analyst models, and statutory earnings per share (EPS) of CN¥0.51 also coming in slightly below expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

銀泰黃金有限公司(深圳證券交易所代碼:000975)剛剛發佈了最新的年報,但情況並不樂觀。銀泰黃金公佈盈利虧損,81億元人民幣的收入比分析師模型下降了16%,0.51元人民幣的法定每股收益(EPS)也略低於預期。對於投資者來說,盈利是一個重要時刻,因爲他們可以追蹤公司的業績,查看分析師對明年的預測,看看對公司的情緒是否發生了變化。根據這些結果,我們收集了最新的法定預測,以了解分析師是否改變了盈利模式。

Taking into account the latest results, the current consensus from Yintai Gold's eleven analysts is for revenues of CN¥10.1b in 2024. This would reflect a huge 24% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to surge 36% to CN¥0.70. In the lead-up to this report, the analysts had been modelling revenues of CN¥10.5b and earnings per share (EPS) of CN¥0.65 in 2024. If anything, the analysts look to have become slightly more optimistic overall; while they decreased their revenue forecasts, EPS predictions increased and ultimately earnings are more important.

考慮到最新業績,銀泰黃金的11位分析師目前的共識是,2024年的收入爲101億元人民幣。這將反映其收入在過去12個月中大幅增長24%。預計每股法定收益將增長36%,至0.70元人民幣。在本報告發布之前,分析師一直在模擬2024年的收入爲105億元人民幣,每股收益(EPS)爲0.65元人民幣。如果有的話,分析師總體上似乎變得更加樂觀了;儘管他們下調了收入預期,但每股收益預測有所增加,最終收益更爲重要。

There's been a 8.0% lift in the price target to CN¥18.86, with the analysts signalling that the higher earnings forecasts are more relevant to the business than the weaker revenue estimates. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Yintai Gold, with the most bullish analyst valuing it at CN¥21.50 and the most bearish at CN¥16.65 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Yintai Gold is an easy business to forecast or the the analysts are all using similar assumptions.

目標股價上調了8.0%,至18.86元人民幣,分析師表示,較高的收益預測比較疲軟的收入預期更與業務相關。研究分析師的估計範圍,評估異常值與平均值的差異也可能很有啓發性。對銀泰黃金的看法有所不同,最看漲的分析師認爲銀泰黃金爲21.50元人民幣,最看跌的爲每股16.65元人民幣。即便如此,在估值分組相對接近的情況下,分析師似乎對自己的估值相當有信心,這表明銀泰黃金是一項易於預測的業務,或者分析師都使用了類似的假設。

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Yintai Gold's growth to accelerate, with the forecast 24% annualised growth to the end of 2024 ranking favourably alongside historical growth of 13% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Yintai Gold is expected to grow much faster than its industry.

從現在的大局來看,我們可以理解這些預測的方法之一是看看它們如何與過去的業績和行業增長預期相比較。分析師們肯定預計銀泰黃金的增長將加速,預計到2024年底的年化增長率爲24%,而過去五年的歷史年增長率爲13%。相比之下,我們的數據表明,預計類似行業的其他公司(有分析師報道)的收入將以每年11%的速度增長。考慮到收入增長的預測,很明顯,銀泰黃金的增長速度預計將比其行業快得多。

The Bottom Line

底線

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Yintai Gold's earnings potential next year. They also downgraded Yintai Gold's revenue estimates, but industry data suggests that it is expected to grow faster than the wider industry. Still, earnings are more important to the intrinsic value of the business. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

對我們來說,最大的收穫是共識的每股收益上調,這表明圍繞銀泰黃金明年盈利潛力的情緒將明顯改善。他們還下調了銀泰黃金的收入預期,但行業數據表明,銀泰黃金的增長速度預計將快於整個行業。儘管如此,收益對企業的內在價值更爲重要。目標股價也大幅提高,分析師顯然認爲該業務的內在價值正在提高。

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Yintai Gold analysts - going out to 2026, and you can see them free on our platform here.

根據這種思路,我們認爲該業務的長期前景比明年的收益重要得多。根據多位銀泰黃金分析師的估計,到2026年,你可以在我們的平台上免費查看。

You still need to take note of risks, for example - Yintai Gold has 1 warning sign we think you should be aware of.

您仍然需要注意風險,例如——銀泰黃金有1個我們認爲您應該注意的警告信號。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。