Gold Bull Peter Schiff Thinks We Should Brace For Double-Digit Inflation Rate Because Fed's Powell 'Can't Walk The Talk'

Gold Bull Peter Schiff Thinks We Should Brace For Double-Digit Inflation Rate Because Fed's Powell 'Can't Walk The Talk'

The February consumer price inflation report came in hotter than expected, but traders shrugged off the number and indulged in buying, anticipating that the central bank would lower the Fed funds rate this year. However, comments from economist and gold bull Peter Schiff on Tuesday tell an altogether different story.

2月份的消費者物價通脹報告比預期的要熱,但交易員對這一數字不屑一顧,沉迷於買入,他們預計央行今年將降低聯儲局基金利率。但是,經濟學家兼黃金多頭彼得·希夫週二的評論卻講述了一個完全不同的故事。

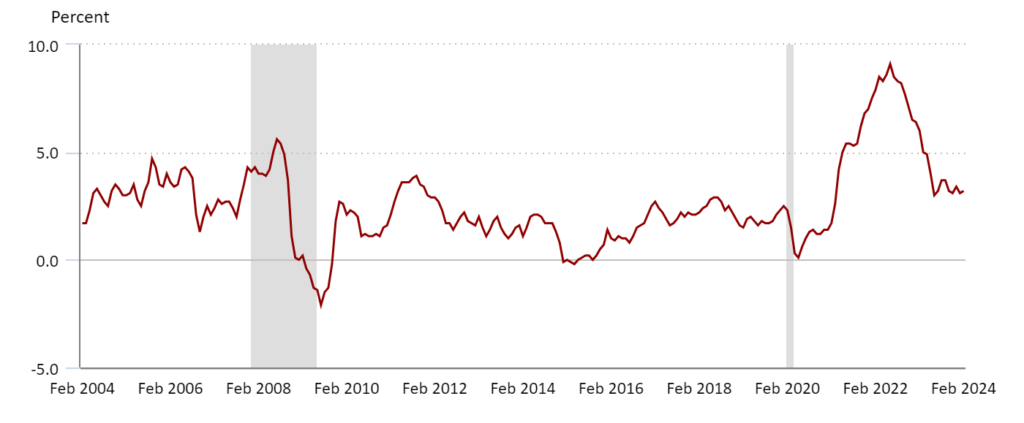

What Happened: According to Schiff, the February inflation number confirms that the disinflation trend ended months ago. He stated in a post on X that inflation bottomed and was now on the rise.

發生了什麼:根據希夫的說法,2月份的通貨膨脹數據證實了反通貨膨脹趨勢在幾個月前就結束了。他在X上的一篇文章中表示,通貨膨脹觸底,現在正在上升。

Source: Bureau of Labor Statistics

資料來源:勞工統計局

"Rather than falling back down to the #Fed's 2% target, the rate is far more likely to head back up to 9%, then ultimately breaking into double digits," the economist warned.

這位經濟學家警告說:“與其回落至 #Fed 的2%的目標,不如回升至9%,然後最終跌至兩位數。”

In the current cycle, headline annual inflation peaked at 9.1% in June 2022 and was on a decelerating trend until June 2023. It has been moving sideways since then.

在本週期中,總體年通脹率在2022年6月達到9.1%的峯值,並在2023年6月之前一直呈減速趨勢。從那以後它一直在橫向移動。

Schiff criticized the Federal Reserve for its inaccurate inflation forecasts. "The #Fed is as wrong now about #inflation on track to return to 2% as it was about the uptick in inflation being transitory in 2021," he remarked.

希夫批評聯儲局的通脹預測不準確。他說:“#Fed 現在的錯誤是 #inflation 有望恢復到2%,就像2021年通貨膨脹率的上升是暫時性的。”

He took potshots at Fed Chair Jerome Powell for his ineffectiveness in reining in inflation. "The Fed's only real means of fighting inflation is to talk the talk. #Powell just hopes that markets don't figure out that he can't walk the walk," he added.

他對聯儲局主席傑羅姆·鮑威爾大肆抨擊,因爲他在控制通貨膨脹方面無效。“聯儲局對抗通貨膨脹的唯一真正手段就是說話。#Powell 只是希望市場不要發現他無法順其自然,” 他補充說。

Best Inflation Stocks

最佳通脹股票

Extravagant Spending: Schiff also commented on the February federal budget released on Tuesday. He noted that the budgetary deficit climbed 12.9% year-over-year to $296 billion, marking the highest February deficit ever since February 2021 during the COVID-19 pandemic.

奢侈支出:希夫還對週二發佈的2月份聯邦預算髮表了評論。他指出,預算赤字同比增長12.9%,達到2960億美元,這是自2021年2月 COVID-19 疫情期間以來的最高2月份赤字。

Compared to February 2020, spending was up 50%, he observed.

他觀察到,與2020年2月相比,支出增長了50%。

"Most shockingly, the government borrowed more money than it collected in taxes," he emphasized.

他強調說:“最令人震驚的是,政府借的錢比徵收的稅款還要多。”

Why It's Important: The Fed's fixation on inflation suggests that the central bank may not be ready to cut interest rates until it sees the indicator heading sustainably toward its 2% target.

爲何重要:聯儲局對通貨膨脹的關注表明,在看到該指標持續朝着2%的目標邁進之前,央行可能尚未準備好降息。

Much of the increase in inflation in February was due to higher gasoline and shelter costs. LPL Chief Economist Jeffrey Roach remarked, "Outside of shelter and gas prices, inflation would be benign."

2月份通貨膨脹率的上升在很大程度上是由於汽油和住房成本的上漲所致。LPL首席經濟學家傑弗裏·羅奇表示:“除了住房和天然氣價格外,通貨膨脹將是良性的。”

"The long-term disinflation trajectory has probably not changed, but the path to the Fed's 2% target will be choppy."

“長期反通貨膨脹軌跡可能沒有改變,但實現聯儲局2%目標的道路將是波動的。”

Despite the stickiness of inflation, the economist views the current Fed policy as clearly restrictive.

儘管通貨膨脹居高不下,但這位經濟學家認爲聯儲局當前的政策顯然是限制性的。

In the market, the iShares TIPS Bond ETF (NYSE:TIP), which tracks inflation-protected U.S. Treasury bonds, closed Tuesday's session down 0.20 at $107.19, according to Benzinga Pro data.

在市場上,根據Benzinga Pro的數據,追蹤受通脹保護的美國國債的iShares TIPS債券ETF(紐約證券交易所代碼:TIP)週二收盤下跌0.20美元,至107.19美元。

Photo via Shutterstock.

照片來自 Shutterstock。