Do Omnicom Group's (NYSE:OMC) Earnings Warrant Your Attention?

Do Omnicom Group's (NYSE:OMC) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

對一些投機者來說,投資一家能夠扭轉命運的公司的興奮感是一個很大的吸引力,因此,即使是沒有收入、沒有利潤、有虧損記錄的公司,也可以設法找到投資者。但是正如彼得·林奇所說 One Up On Wall 街,“遠射幾乎永遠不會得到回報。”虧損的公司總是與時間賽跑以實現財務可持續性,因此這些公司的投資者承擔的風險可能超出了應有的範圍。

In contrast to all that, many investors prefer to focus on companies like Omnicom Group (NYSE:OMC), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

與此形成鮮明對比的是,許多投資者更願意關注像Omnicom集團(紐約證券交易所代碼:OMC)這樣的公司,該公司不僅有收入,還有利潤。儘管利潤不是投資時應考慮的唯一指標,但值得表彰能夠持續生產利潤的企業。

How Quickly Is Omnicom Group Increasing Earnings Per Share?

Omnicom 集團增加每股收益的速度有多快?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Omnicom Group has managed to grow EPS by 17% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

如果一家公司能夠在足夠長的時間內保持每股收益(EPS)的增長,那麼其股價最終應該會緊隨其後。這意味着大多數成功的長期投資者都將每股收益的增長視爲真正的積極增長。很高興看到Omnicom集團在三年內設法將每股收益增長17%。如果這樣的增長持續到未來,那麼股東們將有很多值得微笑的地方。

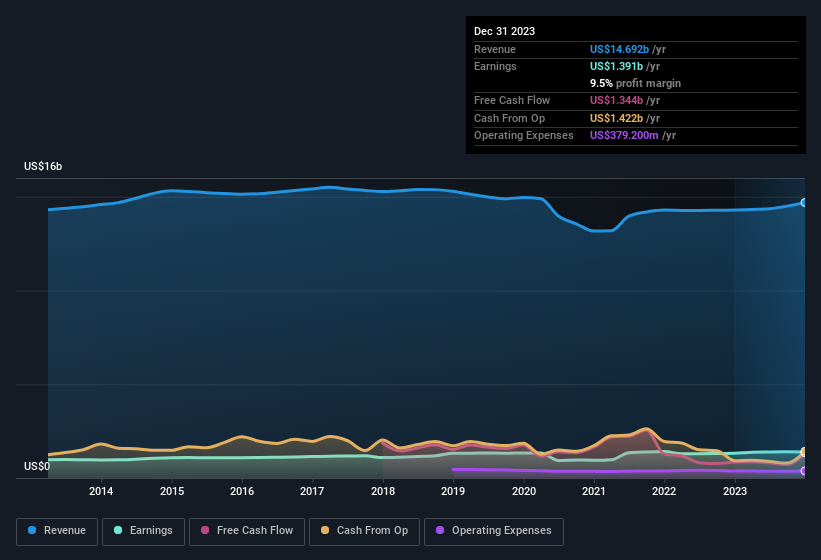

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Omnicom Group maintained stable EBIT margins over the last year, all while growing revenue 2.8% to US$15b. That's progress.

仔細考慮收入增長和息稅前收益(EBIT)利潤率有助於爲近期利潤增長的可持續性提供信息。去年,Omnicom集團保持了穩定的息稅前利潤率,同時收入增長了2.8%,達到150億美元。這就是進步。

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

下圖顯示了該公司的收入和收入隨着時間的推移是如何發展的。要查看實際數字,請單擊圖表。

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Omnicom Group.

當然,訣竅是找到未來表現最好的股票,而不是過去的股票。當然,您可以根據過去的表現來發表自己的看法,但您可能還需要查看這張專業分析師對Omnicom集團每股收益預測的互動圖表。

Are Omnicom Group Insiders Aligned With All Shareholders?

Omnicom 集團內部人士是否與所有股東保持一致?

Owing to the size of Omnicom Group, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$177m. While that is a lot of skin in the game, we note this holding only totals to 0.9% of the business, which is a result of the company being so large. This still shows shareholders there is a degree of alignment between management and themselves.

由於Omnicom集團的規模,我們預計內部人士不會持有該公司的很大一部分股份。但是,他們是公司的投資者,這確實令我們感到欣慰。我們注意到,他們在該公司的可觀股份價值1.77億美元。儘管風險很大,但我們注意到,這筆持股總額僅佔業務的0.9%,這是公司規模如此之大的結果。這仍然表明股東管理層與他們自己之間存在一定程度的一致性。

Should You Add Omnicom Group To Your Watchlist?

您是否應該將 Omnicom 群組添加到您的關注列表中?

If you believe that share price follows earnings per share you should definitely be delving further into Omnicom Group's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Of course, just because Omnicom Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

如果你認爲股價跟隨每股收益,那麼你肯定應該進一步研究Omnicom集團強勁的每股收益增長。在每股收益增長率如此之高的情況下,看到公司高層通過繼續持有大量投資對公司充滿信心也就不足爲奇了。快速增長和自信的內部人士應該足以值得進一步研究,因此看來這是一隻值得關注的好股票。當然,僅僅因爲Omnicom集團的增長並不意味着它的估值被低估了。如果你想知道估值,可以看看這個衡量其市盈率與行業相比的指標。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by recent insider purchases.

買入這樣的股票總是有可能表現不錯 不是 不斷增長的收入和 不要 讓內部人士購買股票。但是,對於那些考慮這些重要指標的人,我們鼓勵您查看具有這些功能的公司。您可以訪問量身定製的公司名單,這些公司在近期內幕收購的支持下實現了增長。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易是指相關司法管轄區內應報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。