Director Filings & Buybacks Continue Stronger Pace

Director Filings & Buybacks Continue Stronger Pace

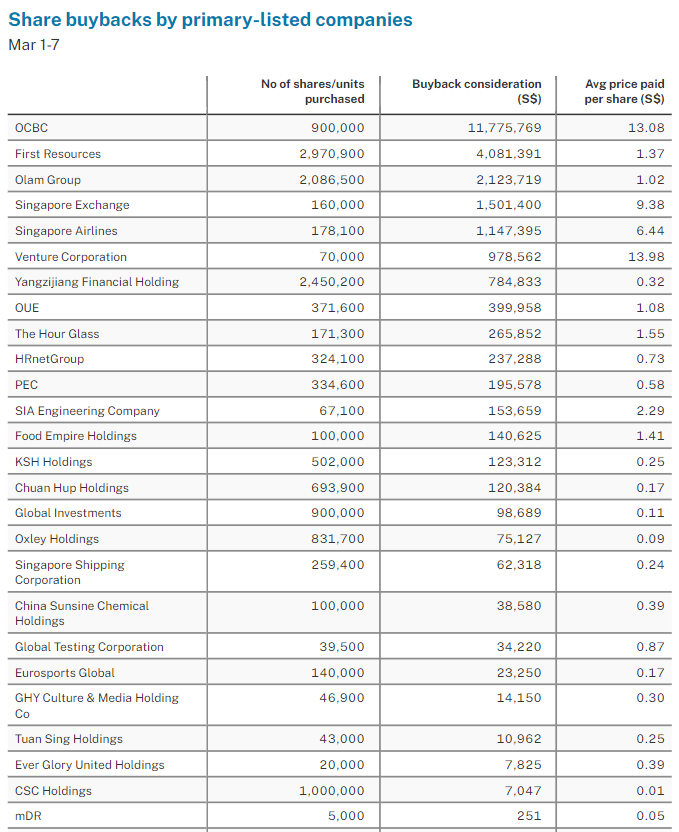

INSTITUTIONS were net sellers of Singapore stocks over the five trading sessions through to Mar 7, with S$224 million of net institutional outflow, as 26 primary-listed companies conducted buybacks with a total consideration of S$24.4 million, quadrupling the buyback consideration of the preceding five sessions.

在截至3月7日的五個交易日中,機構是新加坡股票的淨賣家,機構淨流出2.24億新元,26家主要上市公司進行了回購,總對價爲2440萬新元,是前五個交易日的回購對價的四倍。

Digital Core Reit Management continued to buy back units of Digital Core Reit over the week, while ESR-Logos Funds Management also acquired 8.5 million units of ESR-Logos Reit on Mar 1.

數字核心房地產投資信託基金管理公司本週繼續回購數字核心房地產投資信託基金的單位,而ESR-Logos基金管理也於3月1日收購了850萬個ESR-Logos房地產投資信託基金。

Leading the net institutional outflow over the five sessions were DBS, UOL, OCBC, Jardine Cycle & Carriage, CapitaLand Integrated Commercial Trust, Mapletree Logistics Trust, Mapletree Pan Asia Commercial Trust, CapitaLand Investment, UOB and Frasers Logistics & Commercial Trust.

在這五個交易日中,領先的機構淨流出量是星展銀行、華僑銀行、怡和運輸、凱德綜合商業信託、豐樹物流信託、豐樹泛亞商業信託、凱德置地投資、大華銀行和弗雷澤物流與商業信託。

Meanwhile, Yangzijiang Shipbuilding Holdings, Seatrium, Singapore Technologies Engineering, Frencken Group, Wilmar International, Singtel, City Developments, Cromwell European Reit, Aztech Global, and Singapore Airlines led the net institutional inflow over the five sessions.

同時,揚子江造船控股公司、Seatrium、新加坡科技工程公司、Frencken集團、豐益國際、新加坡電信、城市發展、克倫威爾歐洲房地產投資信託基金、Aztech Global和新加坡航空在這五個交易日的機構淨流入量中處於領先地位。

The five trading sessions saw over 100 changes to director interests and substantial shareholdings filed for 50 primary-listed stocks. Directors or CEOs filed 35 acquisitions and one disposal while substantial shareholders filed 10 acquisitions and two disposals.

在這五個交易日中,50只初級上市股票的董事權益發生了100多次變動,並申請了大量股權。董事或首席執行官提交了35項收購和一項處置,而大股東提交了10項收購和兩項出售。

Wilmar International

豐益國際

Between Mar 1 and 5, Wilmar International chairman and CEO Kuok Khoon Hong increased his deemed interest in the global agri-business by 2,172,600 shares. This increased his total interest from 13.66 per cent to 13.70 per cent. HPRY Holdings, Longhlin Asia, Hong Lee Holdings and Jaygar Holdings each acquired 543,150 shares at an average price of S$3.33 per share. Kuok has been gradually increasing his total interest in Wilmar International from 12.94 per cent in October 2022.

3月1日至5日之間,豐益國際董事長兼首席執行官郭昆洪將其在全球農業企業的認定權益增加了2,172,600股。這使他的總利息從13.66%增加到13.70%。HPRY Holdings、Longhlin Asia、Hongle Lee Holdings和Jaygar Holdings各以每股3.33新元的平均價格收購了543,150股股票。郭一直在逐步增加對豐益國際的總興趣,從2022年10月的12.94%逐步增加。

Raffles Medical Group

萊佛士醫療集團

Between Feb 29 and Mar 6, Raffles Medical group executive chairman Loo Choon Yong acquired 6.4 million shares at an average price of S$1.02 per share. This increased his total interest from 53.27 per cent to 53.61 per cent. This followed his acquisition of 4.5 million shares between Feb 27 and 28.

2月29日至3月6日期間,萊佛士醫療集團執行主席盧春勇以每股1.02新元的平均價格收購了640萬股股票。這使他的總利息從53.27%增加到53.61%。在此之前,他在2月27日至28日期間收購了450萬股股票。

On Feb 26, Raffles Medical Group reported FY 2023 (ended Dec 31) revenue of S$706.9 million, 14.1 per cent lower than that for FY 2022. The group's core hospital services division remained strong and profitable, registering revenue growth of 4.5 per cent to S$330.6 million, while the group's healthcare services division revenue registered lower revenue of S$283.4 million.

2月26日,萊佛士醫療集團報告2023財年(截至12月31日)收入爲7.069億新元,比2022財年下降14.1%。該集團的核心醫院服務部門保持強勁和盈利,收入增長4.5%,至3.306億新元,而該集團的醫療服務部門收入則下降2.834億新元。

JB Foods

JB Foods

Between Feb 29 and Mar 6, JB Foods CEO Tey How Keong acquired 885,500 shares at an average price of S$0.49 per share. With a consideration of S$437,161, this increased his total interest in the global cocoa ingredient producer from 46.93 per cent to 47.22 per cent. His preceding acquisition was on Mar 2, 2023, with 120,800 shares acquired at S$0.50 per share.

2月29日至3月6日期間,JB Foods首席執行官泰豪強以每股0.49新元的平均價格收購了885,500股股票。對價爲437,161新元,這使他對這家全球可可原料生產商的總興趣從46.93%增加到47.22%。他之前的收購是在2023年3月2日,以每股0.50新元的價格收購了120,800股股票。

With his 25 years plus of experience in the cocoa business, Tey is responsible for the overall strategic, management and business development of the group. On Feb 28, the group reported its FY 2023 (ended Dec 31) profit after tax decreased to US$1.8 million, from US$16.7 million in FY 2022.

Tey 擁有超過 25 年的可可業務經驗,負責集團的整體戰略、管理和業務發展。2月28日,該集團報告稱,其2023財年(截至12月31日)的稅後利潤從2022財年的1,670萬美元降至180萬美元。

While FY 2023 revenue increased 17 per cent from FY 2022, to US$596 million, the cost of sales also increased by 20 per cent to US$556 million, mainly due to increases in cocoa bean prices. Finance costs also increased 132 per cent to US$15.5 million in FY 2023.

雖然2023財年的收入比2022財年增長了17%,達到5.96億美元,但銷售成本也增長了20%,達到5.56億美元,這主要是由於可可豆價格的上漲。2023財年,財務成本也增長了132%,達到1,550萬美元。

Tey also noted the shortage of the cocoa bean supply has contributed to a sharp spike in cocoa bean prices to an unprecedented historical high in February 2024. He added that in the short-term, this may create a potential global cocoa bean supply crunch until crop production improves and the group will manage and monitor closely the execution of the cocoa bean deliveries by its suppliers in a timely manner.

他們還指出,可可豆供應短缺導致可可豆價格在2024年2月急劇上漲至前所未有的歷史新高。他補充說,在短期內,這可能會造成全球可可豆供應緊縮,直到作物產量改善,該集團將及時管理和密切監測其供應商交付的可可豆的情況。

Centurion Corporation

百夫長公司

Following Centurion Corporation's release of its FY 2023 (ended Dec 31) financial results after the Feb 28 close, executive director and joint chairman David Loh Kim Kang and CEO Kong Chee Min increased their direct interests in the company.

繼Centurion Corporation在2月28日收盤後公佈其2023財年(截至12月31日)財務業績後,執行董事兼聯席主席大衛·羅金康和首席執行官孔志敏增加了他們在公司的直接權益。

On Feb 29, David Loh acquired 1.25 million shares at S$0.425 per share, which increased his direct stake from 5.28 per cent to 5.43 per cent. His total interest in the accommodation developer and manager is 56.09 per cent, with deemed interests mostly through his 50 per cent shareholding interest in Centurion Global.

2月29日,David Loh以每股0.425新元的價格收購了125萬股股票,這使他的直接股份從5.28%增加到5.43%。他在這家住宿開發商和管理公司的總權益爲56.09%,認定權益主要來自他在Centurion Global的50%的股權。

Loh is responsible for the formulation of corporate and business strategies and leads the execution of strategic growth plans of the group and maintains over 20 years of experience in the investment and brokerage industry.

Loh負責制定企業和業務戰略,領導集團戰略增長計劃的執行,並在投資和經紀行業擁有超過20年的經驗。

On Mar 1, Kong acquired 72,000 shares, also at an average price of S$0.425 per share. This increased his direct interest from 0.02 per cent to 0.03 per cent.

3月1日,Kong收購了72,000股股票,平均價格也爲每股0.425新元。這使他的直接利息從0.02%增加到0.03%。

Kong was appointed Group CEO in August 2011. He is responsible for the overall management of the group's operations, implementation of business strategies and the long-term growth objectives approved by the Board.

孔於2011年8月被任命爲集團首席執行官。他負責集團運營的整體管理、業務戰略的實施和董事會批准的長期增長目標。

With the FY 2023 results, Kong noted that the continued positive demand and supply dynamics in the specialised accommodation landscape allowed Centurion Corporation to achieve healthy occupancies and positive rental revisions globally, effectively cushioning cost increases from inflation and the higher interest rate environment.

孔在2023財年的業績中指出,專業住宿領域持續積極的需求和供應動態使Centurion Corporation得以在全球範圍內實現了健康的入住率和積極的租金調整,有效地緩衝了通貨膨脹和更高利率環境造成的成本增長。

He added that the group remains committed to exploring opportunities across current and new markets to expand and enhance its portfolio of assets, to deliver sustainable long-term value to its stakeholders.

他補充說,該集團仍然致力於探索當前和新市場的機會,以擴大和增強其資產組合,爲其利益相關者創造可持續的長期價值。

The group owns and manages a strong portfolio of 34 operational accommodation assets totalling approximately 67,377 beds as of Dec 31, 2023. For FY 2023, group revenue grew 15 per cent from FY 2022 to S$207.3 million on the back of strong revenue contributions from the group's portfolio of purpose-built workers accommodation and purpose-built student accommodation across all markets in which the group operates.

截至2023年12月31日,該集團擁有並管理着由34種運營住宿資產組成的強大投資組合,總計約67,377張牀位。2023財年,集團收入較2022財年增長了15%,達到2.073億新元,這要歸因於該集團運營的所有市場的專用員工宿舍和專用學生宿舍組合的強勁收入貢獻。

The group's FY 2023 net attributable profit increased 114 per cent from FY 2022, to S$153.1 million, boosted by net fair value gains of S$84.8 million.

該集團2023財年的淨應占利潤較2022財年增長了114%,達到1.531億新元,這得益於8,480萬新元的淨公允價值收益。

Boustead Singapore

Boustead 新加坡

Between Mar 4 and 5, Boustead Singapore chairman and group CEO Wong Fong Fui acquired 192,000 shares of the listed company for a consideration of S$170,891. At an average price of S$0.89 per share, this took Wong's deemed interest in the listed company from 43.16 per cent to 43.20 per cent.

3月4日至5日期間,Boustead Singapore董事長兼集團首席執行官黃方輝以170,891新元的對價收購了這家上市公司的19.2萬股股票。按每股0.89新元的平均價格計算,這使黃在上市公司的認定權益從43.16%上升到43.20%。

Rex International

雷克斯國際

Between Mar 4 and 5, Rex International executive director and chairman Dan Broström acquired 991,000 shares at an average price of S$0.14 per share. This took Broström's total interest in the technology-driven oil company from 0.87 per cent to 0.94 per cent. His preceding acquisition on the open market was back in December 2019 at S$0.17 per share.

3月4日至5日期間,雷克斯國際執行董事兼董事長丹·布羅斯特羅姆以每股0.14新元的平均價格收購了99.1萬股股票。這使Brostrom對這家技術驅動的石油公司的總興趣從0.87%上升到0.94%。他之前在公開市場上的收購是在2019年12月以每股0.17新元的價格進行的。

PropNex

propnex

Between Feb 28 and Mar 1, PropNex executive director and deputy CEO Kelvin Fong Keng Seong acquired 100,000 shares at an average price of S$0.88 per share. This increased his total interest in Singapore's largest listed real estate group from 8.88 per cent to 8.90 per cent. His preceding acquisitions were in May and June last year.

2月28日至3月1日期間,PropNEX執行董事兼副首席執行官方景成以每股0.88新元的平均價格收購了10萬股股票。這使他在新加坡最大的上市房地產集團的總興趣從8.88%增加到8.90%。他之前的收購是在去年5月和6月。

Fong oversees the group's training development curriculum and administers the development of IT strategies and technology innovations to improve the group's competitive edge in the industry. He also spearheads the sales and leadership training programmes.

Fong 負責監督集團的培訓發展課程,管理 IT 戰略和技術創新的發展,以提高集團在該行業的競爭優勢。他還領導銷售和領導力培訓計劃。

Prior to the Feb 28 open, PropNex reported a stronger performance in H2 FY 2023 (ended Dec 31) brought the FY 2023 revenue to S$838.1 million, an 18.6 per cent dip from FY 2022, due to fewer number of transactions completed for both agency and project marketing services.

在2月28日開盤之前,PropNEX報告稱,由於代理和項目營銷服務完成的交易數量減少,2023財年下半年(截至12月31日)的強勁表現使2023財年的收入達到8.381億新元,較2022財年下降了18.6%。

The group noted that the combination of cooling measures since December 2021, market uncertainties, high interest rates, and price resistance among buyers have kept home prices in check in 2023, paving the way for a more stable and sustainable housing market in Singapore. To better position itself for opportunities, PropNex plans to expand its sales force to 15,000 by 2026.

該集團指出,自2021年12月以來的降溫措施、市場不確定性、高利率和買家的價格阻力共同控制了2023年的房價,爲新加坡更加穩定和可持續的房地產市場鋪平了道路。爲了更好地爲機遇做好準備,PropNEX計劃到2026年將其銷售隊伍擴大到15,000人。

Since listing on July 2, 2018, PropNex's scale of operations have grown substantially with the number of salespersons doubling to 12,233 as at Feb 15, 2024, from 6,684. Between FY 2019 and FY 2023, the group's revenue and net attributable profit grew at a compounded annual rate of 14.8 per cent and 19.0 per cent respectively while its market capitalisation grew 173.8 per cent from S$240.5 million at listing to S$658.6 million at Feb 15, 2024.

自2018年7月2日上市以來,PropNEX的運營規模大幅增長,銷售人員人數從6,684人翻了一番,至2024年2月15日的12,233人。在2019財年至2023財年之間,該集團的收入和淨應占利潤分別以14.8%和19.0%的複合年增長率增長,而其市值從上市時的2.405億新元增長至2024年2月15日的6.586億新元,增長了173.8%。

The stock ranks among Singapore's 100 most traded by turnover and has generated 27 per cent annualised total returns from listing in June 2018 through to Mar 7.

該股票是新加坡成交量最大的100只股票之一,從2018年6月上市到3月7日,其年化總回報率爲27%。

Inside Insights is a weekly column on The Business Times, read the original version.

Inside Insights是《商業時報》的每週專欄文章,請閱讀原始版本。

Enjoying this read?

喜歡這本書嗎?

- Subscribe now to the weekly SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即訂閱每週一次的新交所 My Gateway 時事通訊,獲取有關新交所上市公司的最新市場新聞、行業表現、新產品發佈更新和研究報告的彙編。

- 關注我們的 SGX Invest Telegram 頻道的最新動態。