Crane (NYSE:CR) Ticks All The Boxes When It Comes To Earnings Growth

Crane (NYSE:CR) Ticks All The Boxes When It Comes To Earnings Growth

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

許多投資者,尤其是那些沒有經驗的投資者,通常會購買有好故事的公司的股票,即使這些公司虧損。但現實是,當一家公司每年虧損時,在足夠長的時間內,其投資者通常會從虧損中分擔自己的份額。虧損的公司可以像海綿一樣爭奪資本,因此投資者應謹慎行事,不要一筆又一筆地投入好錢。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Crane (NYSE:CR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

如果這種公司不是你的風格,你喜歡那些創造收入甚至賺取利潤的公司,那麼你很可能會對Crane(紐約證券交易所代碼:CR)感興趣。儘管這並不一定說明其估值是否被低估,但該業務的盈利能力足以保證一定的升值——尤其是在其增長的情況下。

How Fast Is Crane Growing?

起重機的生長速度有多快?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Crane grew its EPS by 4.8% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

通常,每股收益(EPS)增長的公司的股價應該會出現類似的趨勢。因此,經驗豐富的投資者在進行投資研究時密切關注公司的每股收益是有道理的。我們可以看到,在過去的三年中,Crane的每股收益每年增長4.8%。這可能不會點燃世界,但它確實表明每股收益呈上升趨勢。

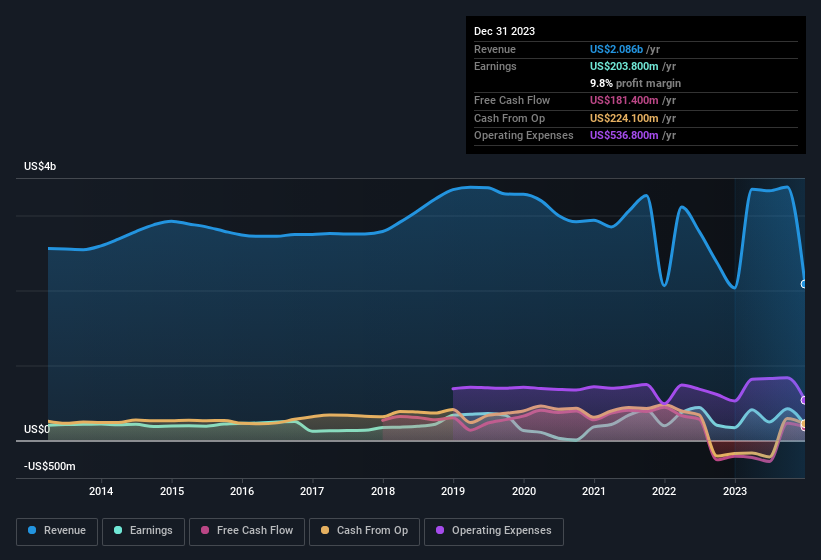

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Crane is growing revenues, and EBIT margins improved by 3.7 percentage points to 13%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

仔細檢查公司增長的一種方法是查看其收入以及利息和稅前收益(EBIT)利潤率如何變化。好消息是,與去年相比,Crane的收入正在增長,息稅前利潤率提高了3.7個百分點至13%。在我們的書中,勾選這兩個方框是增長的好兆頭。

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

您可以在下表中查看該公司的收入和收益增長趨勢。要了解更多細節,請點擊圖片。

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Crane's future profits.

你開車時不要注視後視鏡,因此你可能會對這份顯示分析師對Crane未來利潤預測的免費報告更感興趣。

Are Crane Insiders Aligned With All Shareholders?

Crane 內部人士是否與所有股東保持一致?

We would not expect to see insiders owning a large percentage of a US$7.0b company like Crane. But we are reassured by the fact they have invested in the company. Holding US$63m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This would indicate that the goals of shareholders and management are one and the same.

我們預計不會看到內部人士擁有像Crane這樣的70億美元公司的很大一部分股份。但是他們投資了該公司,這讓我們感到放心。持有該公司價值6300萬美元的股票不是笑話,內部人士將致力於爲股東帶來最佳業績。這將表明股東和管理層的目標是相同的。

Is Crane Worth Keeping An Eye On?

Crane 值得關注嗎?

One important encouraging feature of Crane is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. If you think Crane might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Crane 的一個重要令人鼓舞的特點是利潤不斷增長。對於那些追求更多收益的人來說,高水平的內部所有權增強了我們對這種增長的熱情。這種組合非常吸引人。所以是的,我們確實認爲這隻股票值得關注。如果您認爲Crane可能適合您作爲投資者的風格,則可以直接查看其年度報告,也可以先查看我們對該公司的折扣現金流(DCF)估值。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by recent insider purchases.

買入這樣的股票總是有可能表現不錯 不是 不斷增長的收入和 不要 讓內部人士購買股票。但是,對於那些考慮這些重要指標的人,我們鼓勵您查看具有這些功能的公司。您可以訪問量身定製的公司名單,這些公司在近期內幕收購的支持下實現了增長。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易是指相關司法管轄區內應報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。