Responding to Performance Concerns: Equitrans Midstream Manages Decreased Earnings and Adjusts Dividends

Responding to Performance Concerns: Equitrans Midstream Manages Decreased Earnings and Adjusts Dividends

By the end of today, February 14, 2024, Equitrans Midstream (NYSE:ETRN) is set to deliver a dividend payout of $0.15 per share, equating to an annualized dividend yield of 5.64%. The company's dividend payout went ex-dividend on February 05, 2024, so only the investors that owned the stock prior to the ex-dividend date will receive this payout.

到今天結束時,也就是 2024 年 2 月 14 日, Equitrans Midstream(紐約證券交易所代碼:TERN) 將派發每股0.15美元的股息,相當於5.64%的年化股息收益率。該公司的股息支付於2024年2月5日除息,因此只有在除息日之前擁有該股票的投資者才能獲得這筆派息。

Equitrans Midstream Recent Dividend Payouts

Equitrans 中游最近的股息支出

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2024-02-05 | 4$0.15 | 5.64% | 2024-01-23 | 2024-02-06 | 2024-02-14 | |

| 2023-11-02 | 4$0.15 | 6.8% | 2023-10-25 | 2023-11-03 | 2023-11-14 | |

| 2023-08-03 | 4$0.15 | 6.4% | 2023-07-26 | 2023-08-04 | 2023-08-14 | |

| 2023-05-04 | 4$0.15 | 12.22% | 2023-04-25 | 2023-05-05 | 2023-05-15 | |

| 2023-02-03 | 4$0.15 | 8.24% | 2023-01-24 | 2023-02-06 | 2023-02-14 | |

| 2022-11-01 | 4$0.15 | 7.56% | 2022-10-25 | 2022-11-02 | 2022-11-14 | |

| 2022-08-02 | 4$0.15 | 8.6% | 2022-07-22 | 2022-08-03 | 2022-08-12 | |

| 2022-05-03 | 4$0.15 | 7.65% | 2022-04-26 | 2022-05-04 | 2022-05-13 | |

| 2022-02-02 | 4$0.15 | 5.8% | 2022-01-24 | 2022-02-03 | 2022-02-14 | |

| 2021-11-01 | 4$0.15 | 5.36% | 2021-10-18 | 2021-11-02 | 2021-11-12 | |

| 2021-08-03 | 4$0.15 | 7.35% | 2021-07-23 | 2021-08-04 | 2021-08-13 | |

| 2021-05-04 | 4$0.15 | 7.53% | 2021-04-27 | 2021-05-05 | 2021-05-14 |

| 過期日期 | 每年付款 | 分紅 | 收益率 | 已宣佈 | 記錄 | 應付款 |

|---|---|---|---|---|---|---|

| 2024-02-05 | 40.15 | 5.64% | 2024-01-23 | 2024-02-06 | 2024-02-14 | |

| 2023-11-02 | 40.15 | 6.8% | 2023-10-25 | 2023-11-03 | 2023-11-14 | |

| 2023-08-03 | 40.15 | 6.4% | 2023-07-26 | 2023-08-04 | 2023-08-14 | |

| 2023-05-04 | 40.15 | 12.22% | 2023-04-25 | 2023-05-05 | 2023-05-15 | |

| 2023-02-03 | 40.15 | 8.24% | 2023-01-24 | 2023-02-06 | 2023-02-14 | |

| 2022-11-01 | 40.15 | 7.56% | 2022-10-25 | 2022-11-02 | 2022-11-14 | |

| 2022-08-02 | 40.15 | 8.6% | 2022-07-22 | 2022-08-03 | 2022-08-12 | |

| 2022-05-03 | 40.15 | 7.65% | 2022-04-26 | 2022-05-04 | 2022-05-13 | |

| 2022-02-02 | 40.15 | 5.8% | 2022-01-24 | 2022-02-03 | 2022-02-14 | |

| 2021-11-01 | 40.15 | 5.36% | 2021-10-18 | 2021-11-02 | 2021-11-12 | |

| 2021-08-03 | 40.15 | 7.35% | 2021-07-23 | 2021-08-04 | 2021-08-13 | |

| 2021-05-04 | 40.15 | 7.53% | 2021-04-27 | 2021-05-05 | 2021-05-14 |

When comparing Equitrans Midstream's dividend yield against its industry peers, the company sits comfortably in the middle, with its peer TORM (NASDAQ:TRMD) having the highest annualized dividend yield at 17.14%.

將Equitrans Midstream的股息收益率與行業同行進行比較時,該公司與同行輕鬆地處於中間位置 TORM(納斯達克股票代碼:TRMD) 年化股息收益率最高,爲17.14%。

Analyzing Equitrans Midstream Financial Health

分析 Equitrans 的中游財務狀況

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

支付穩定現金分紅的公司對尋求收入的投資者具有吸引力,而財務狀況良好的公司往往會維持其股息支付時間表。出於這個原因,投資者可以深入了解一家公司是增加還是減少了股息支付時間表,以及他們的收益是否在增長。

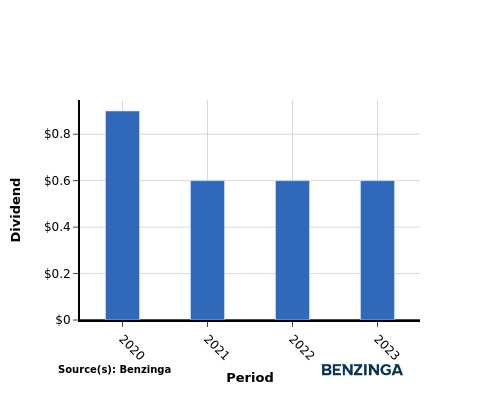

YoY Growth in Dividend Per Share

每股股息同比增長

As you can see, from 2020 to 2023, investors saw an average decrease in the company's dividend per share, decreasing from $0.90 in 2020 to $0.60 in 2023. This is not favorable for investors as it indicates a decline in the company's dividend payout over the years. Further analysis is recommended to understand the factors contributing to this decrease.

如您所見,從2020年到2023年,投資者看到公司的每股股息平均下降,從2020年的0.90美元降至2023年的0.60美元。這對投資者不利,因爲這表明該公司的股息支出多年來有所下降。建議進行進一步分析,以了解導致這種下降的因素。

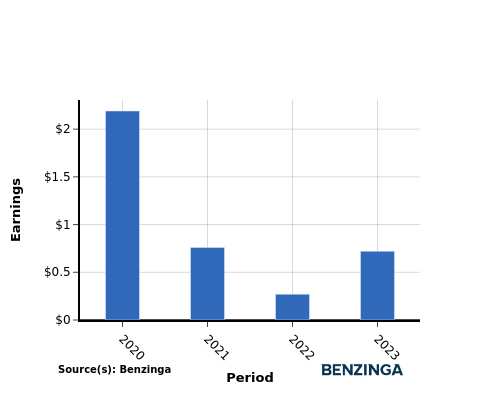

YoY Earnings Growth For Equitrans Midstream

Equitrans中游的同比收益增長

From 2020 to 2023, Equitrans Midstream experienced a decrease in earnings per share, dropping from $2.19 to $0.72. This declining earnings trend may be worrisome for income-seeking investors, as it indicates a potential impact on the company's ability to sustain or increase its cash dividend payouts. Further analysis is necessary to understand the underlying reasons for this decrease.

從2020年到2023年,Equitrans Midstream的每股收益有所下降,從2.19美元降至0.72美元。這種收益下降的趨勢可能會讓尋求收入的投資者感到擔憂,因爲這表明公司維持或增加其現金股息支付的能力可能受到影響。需要進行進一步分析,以了解這種下降的根本原因。

Recap

回顧

In this article, we explore the recent dividend payout of Equitrans Midstream and its significance for shareholders. The company has decided to distribute a dividend of $0.15 per share today, which equates to an annualized dividend yield of 5.64%.

在本文中,我們探討了Equitrans Midstream最近的股息支付及其對股東的重要性。該公司決定今天派發每股0.15美元的股息,相當於年化股息收益率爲5.64%。

When comparing Equitrans Midstream's dividend yield against its industry peers, the company sits comfortably in the middle, with its peer TORM having the highest annualized dividend yield at 17.14%.

將Equitrans Midstream的股息收益率與業內同行進行比較時,該公司處於中間位置,其同行TORM的年化股息收益率最高,爲17.14%。

The decrease in both dividend per share and earnings per share from 2020 to 2023 for Equitrans Midstream suggests financial challenges, which may require a cautious approach in distributing profits to shareholders.

從2020年到2023年,Equitrans Midstream的每股股息和每股收益均有所下降,這表明存在財務挑戰,這可能需要在向股東分配利潤時採取謹慎的態度。

It is essential for investors to closely track the company's performance in the coming quarters to remain updated regarding any alterations in financials or dividend disbursements.

投資者必須密切關注公司在未來幾個季度的業績,以隨時了解財務狀況或股息支付的任何變化。

\To stay up-to-date with the companies that are announcing their dividends, click here to visit our Dividends Calendar.

\ 要了解宣佈分紅的公司的最新情況,請點擊此處訪問我們的股息日曆。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動內容引擎生成,並由編輯審閱。