[Business Data]

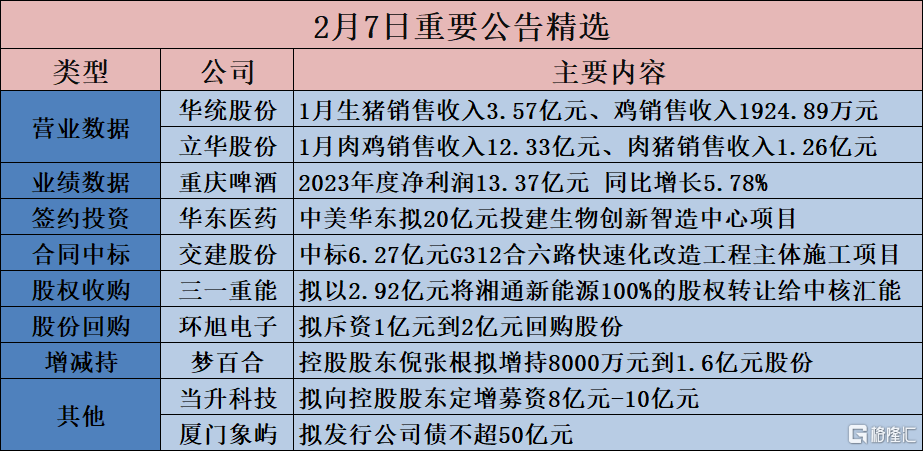

Huatong Co., Ltd. (002840.SZ): January pig sales revenue of 357 million yuan and chicken sales revenue of 19.2489 million yuan

Huatong Co., Ltd. (002840.SZ) announced that in January 2024, the company sold 235,878 pigs (including 22,391 piglets), a change of 2.30% month-on-month and a year-on-year change of 45.84%. In January 2024, the company's pig sales revenue was 357.1118 million yuan, a month-on-month change of -4.55% and a year-on-year change of 33.91%. In January 2024, the average sales price of commercial pigs was 13.81 yuan/kg, up 0.07% from December 2023. The number of chickens sold in January 2024 was 1.786,800, a month-on-month change of 56.79% and a year-on-year change of 223.40%. Chicken sales revenue in January 2024 was 19.2489 million yuan, a month-on-month change of -9.46% and a year-on-year change of 108.95%.

Tianbang Food (002124.SZ): Commercial pig sales revenue of 639 million yuan in January

Tianbang Foods (002124.SZ) announced that in January 2024, the company sold 701,500,000 commercial pigs (including 236,200 piglets), with sales revenue of 639.413,800 yuan, and an average sales price of 13.20 yuan/kg (average price of commercial fat pigs was 12.92 yuan/kg), with month-on-month changes of -16.97%, -30.97%, and -2.28%, respectively; year-on-year changes were 83.11%, 17.19%, and -8.63%, respectively.

Tang Renshen (002567.SZ): Total pig sales revenue in January was 414 million yuan

Tang Renshen (002567.SZ) announced that in January 2024, the company sold 328,200 pigs (including 293,700 commercial pigs and 34,500 piglets), and sold 358,900 pigs in December 2023 (including 338,400 commercial pigs and 205,000 piglets), up 41.28% year on year, down 8.55% month on month; total sales revenue was 414.57%, up 14.57% year on year, down 22.90% month on month.

Lihua Co., Ltd. (300761.SZ): January broiler sales revenue of 1,233 million yuan, pork sales revenue of 126 million yuan

Lihua Co., Ltd. (300761.SZ) announced that in January 2024, the company sold 43.4098 million broilers (including chicken, butcher and cooked products), with sales revenue of 1,233 billion yuan and an average sales price of 12.97 yuan/kg. The month-on-month changes were 3.54%, 1.82%, and -2.33%, respectively, and the year-on-year changes were 21.68%, 22.20%, and -2.85%, respectively. The company sold 79,000 pork heads in January 2024, with sales revenue of 126 million yuan. The average sales price of pork pigs was 1,408 yuan/kg. The month-on-month changes were -19.31%, -10.64%, and 4.30%, respectively. The year-on-year changes were 15.33%, 5.88%, and -7.85%, respectively.

[Investment projects]

Ziguang Guowei (002049.SZ): The subsidiary plans to invest 355 million yuan to build an ultra-miniature quartz crystal resonator production base project

Ziguang Guowei (002049.SZ) announced that in order to optimize the industrial layout and enhance competitive advantage, the wholly-owned subsidiary Tangshan Guoxin Jingyuan Electronics Co., Ltd. plans to establish a project company with its own or self-funded investment in Chenglingji New Port Area, Yueyang City, Hunan Province. The total investment of the project is 355 million yuan. After completion, the project will achieve an annual output of 768 million units (design capacity) of ultra-miniature quartz crystal resonators.

Huadong Pharmaceutical (000963.SZ): China and US East China plan to invest 2 billion yuan to build a biological innovation and intelligent manufacturing center project

Huadong Pharmaceutical (000963.SZ) announced that the company held the 20th meeting of the 10th board of directors on February 7, 2024 to review and pass the “Proposal on Investing in the Construction of a Biological Innovation and Intelligent Manufacturing Center Project”, agreeing that the company's wholly-owned subsidiary, Hangzhou Zhongmei Huadong Pharmaceutical Co., Ltd. (“China-US Huadong”) will invest in the construction of a biological innovation intelligent manufacturing center project according to its own development plan and new product launch plan. The total investment amount of the project is estimated to be 2 billion yuan. The final investment amount is about 1,188 billion yuan (the final investment amount is for project construction) Actual investment expenses shall prevail).

[Contract won the bid]

Guangdong Construction Engineering (002060.SZ): Foundation Group won the bid for professional foundation pit construction for the plot project on the south side of Qiaozi Street in Liwan District

Guangdong Construction Engineering (002060.SZ) announced that on February 7, 2024, Guangdong Infrastructure Engineering Group Co., Ltd. (“Foundation Group”), a wholly-owned subsidiary of Guangdong Construction Engineering Group Co., Ltd., received the “Notice of Winning Bid” (Guangzhou Public Finance (Construction) [2024] No. [00653]) from Guangzhou Trading Group Co., Ltd.

The “Notice of Winning Bid” determined that Foundation Group was the winning bidder for the “Professional Construction Contractor for the Foundation Pit Project on the South Side of Qiaozi Street in Liwan District [JG2024-0068]”. The contract details were the contract details specified in the tender documents, and the winning bid price was 71,357.686.77 million yuan. According to the tender documents, the total land area of the project is about 7,8874 square meters, and the construction scale after completion is about 255,000 square meters. The foundation pit of the project covers an area of about 49115.94 square meters, the circumference of the foundation pit is about 1026.45 meters, and the excavation depth is about 6.7 meters. The main construction contents include foundation pit support, earthwork excavation and transportation (including the removal of underground obstacles within the foundation pit), and foundation pit engineering inspection and monitoring.

Communications Construction Co., Ltd. (603815.SH): Won the bid for the main construction project of the G312 Heliu Road (Xinqiao Avenue - Xiaomiaojie) rapid renovation project of 627 million yuan

Jiaotong Construction Co., Ltd. (603815.SH) announced that the company received the “Notice of Winning Bid” from Hefei Trading Engineering Construction Management Co., Ltd., and the company became the main construction project for the G312 Hexiu Road (Xinqiao Avenue - Xiaomiaojie) rapid renovation project, with a bid amount of 627 million yuan.

Langkun Environment (301305.SZ): Won the bid for the procurement of anaerobic system equipment and services for the Beijing Shougang Food Waste Resource Utilization Project

Langkun Environmental (301305.SZ) announced that it received the “Notice of Winning Bid for the Procurement of Anaerobic System Equipment and Services for the Beijing Shougang Food Waste Resource Utilization Project” from Beijing Shougang New Energy Power Generation Co., Ltd. The company was the winning bidder for the above project, with a bid amount of 25,502,267 yuan.

[[Share acquisition]

Sany Heavy Energy (688349.SH): Plans to transfer 100% of Xiangtong New Energy's shares to CNNC HuiNeng for 292 million yuan

Sany Heavy Energy (688349.SH) announced that the company plans to transfer 100% of the shares of its wholly-owned subsidiary Xiangtong New Energy to CNNC HuiNeng. The consideration for the share transfer is RMB 291.54 million. After the transaction was completed, the company no longer held shares in Xiangtong New Energy and its subsidiaries.

Zhenlan Instrument (301303.SZ): Zhenlan Precision plans to transfer 15% of Kuntong Smart's shares to natural person Han Shanling for 0 yuan

Zhenlan Instrument (301303.SZ) announced that its wholly-owned subsidiary Shanghai Zhenlan Precision Mold Co., Ltd. (“Zhenlan Precision”) signed an “Investment Cooperation Agreement” with natural person Han Shanling on February 7, 2024 to transfer 15% of the shares of Kuntong Intelligent Technology (Wuhu) Co., Ltd. (“Kuntong Intelligence” or “Target Company”), a wholly-owned subsidiary of Zhenlan Precision, to natural person Han Shanling at RMB 0. After the transaction was completed, Zhenlan Precision still holds 85% of Kuntong Smart's shares, and Kuntong Intelligence still holds Sun Company for the company. After the transaction is completed, Zhenlan Precision's unfulfilled investment obligation to sell the shares will be funded by the natural person Han Sanling.

Taihe New Materials (002254.SZ): Plans to acquire 43.50% of Ningxia's shares for 92.954,400 yuan

Taihe New Materials (002254.SZ) announced that in order to expand the strategic layout of the aramid industry, enrich and improve industrial chain construction, enhance profitability, and enhance the company's core competitiveness, the company plans to sign a conditional “Equity Transfer Agreement” with Ningxia Xinguang and shareholders Ningxia Ningdong Development and Investment Co., Ltd. (hereinafter referred to as “Ningdong Investment”) and Yantai Kangshun New Materials Co., Ltd. (hereinafter referred to as “Yantai Kangshun”) to acquire 31.11% and 12.39% of Ningxia Xinguanghe shares held by Ningdong Investment and Yantai Kangshun, respectively. After the transaction is completed, the company will hold 43.50% of Ningxia's shares and become the controlling shareholder of Ningxia Xinguanghe.

Vogue Optoelectronics (603773.SH): Plans to acquire 70% of Hubei Tonggewei's shares for 85.73 million yuan

Vogue Optoelectronics (603773.SH) announced that it plans to acquire 70% of the shares of Hubei Tongge Microcircuit Technology Co., Ltd. (“Hubei Tonggewei”) held by Hubei Tianmen Hi-Tech Investment and Development Group Co., Ltd. (“Tianmen Hi-Tech Investment”) for 85.73 million yuan in cash. Prior to this acquisition, Hubei Tonggewei was a participating company holding 30% of the company's shares. After the acquisition is completed, the company will hold 100% of Hubei Tonggewei's shares.

[Performance data]

Bank of Ningbo (002142.SZ) Performance Report: 2023 net profit of 25.535 billion yuan increased 10.66% year-on-year

Bank of Ningbo (002142.SZ) announced its 2023 annual results report. The company achieved full-year operating income of 61,584 billion yuan, an increase of 6.40% over the same period of the previous year; net profit attributable to shareholders of the parent company was 25.535 billion yuan, an increase of 10.66% over the same period of the previous year; net profit attributable to shareholders of the parent company after deducting non-recurring profit and loss was 254.26, an increase of 9.86% year on year; and basic earnings per share were 3.75 yuan.

Chongqing Beer (600132.SH) performance report: 2023 net profit of 1,337 billion yuan increased 5.78% year-on-year

Chongqing Breweries (600132.SH) announced its 2023 annual results report. During the reporting period, the company achieved total revenue of 14.815 billion yuan, an increase of 5.53% over the same period of the previous year; operating profit of 3.353 billion yuan, up 1.63% over the same period of the previous year; total profit of 3.376 billion yuan, up 2.33% over the same period of the previous year; net profit attributable to shareholders of listed companies was 1,314 billion yuan, an increase of 5.78% over the same period of the previous year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,314 billion yuan, up from the same period last year 6.45%; basic earnings per share of 2.76 yuan, an increase of 5.78% over the same period of the previous year; the weighted average return on net assets was 67.05%, down 2.20 percentage points from the same period last year.

Zhongrun Optics (688307.SH) Performance Report: 2023 net profit of 363.309 million yuan, a year-on-year decrease of 11.64%

Zhongrun Optics (688307.SH) announced the 2023 Annual Results Report. During the reporting period, the company achieved total revenue of 378.8503 million yuan, a decrease of 6.23% over the same period last year. Mainly affected by macroeconomic fluctuations and short-term fluctuations in downstream customer demand, sales revenue for products in the digital security sector declined, but sales revenue for machine vision and other emerging fields increased steadily.

During the reporting period, the company achieved a total profit of 36.5815 million yuan, a year-on-year decrease of 16.37%; realized net profit attributable to the owner of the parent company of 36.3309 million yuan, a year-on-year decrease of 11.64%; and realized net profit attributable to the owners of the parent company after deducting non-recurring profit and loss of 36.616 million yuan, a year-on-year decrease of 6.85%. Mainly affected by the increase in product types and terminal application fields, R&D investment remains at a high level, sales expenses and management expenses have increased, and government subsidies have been reduced; however, with changes in the product structure, the company's overall gross margin has increased slightly.

Chipcom (688582.SH) Performance Report: Net profit for 2023 was 165 million yuan, up 41.84% year on year

Xindong Lianke (688582.SH) announced its 2023 annual results report. During the reporting period, the company expects to achieve operating income of 317.0868 million yuan, an increase of 39.77%; the company expects to achieve net profit attributable to owners of the parent company of 165.3881 million yuan, an increase of 41.84% year on year; net profit attributable to owners of the parent company after deducting non-recurring profit and loss is 142.4838 million yuan, an increase of 33.16% year on year.

[Repurchase]

Lansheng Co., Ltd. (600826.SH): Plans to spend 100 million yuan to 200 million yuan to buy back shares

Lan Sheng Co., Ltd. (600826.SH) announced that the company plans to repurchase shares to protect the company's value and shareholders' rights. The minimum amount of the proposed repurchase capital is RMB 100 million (inclusive), the upper limit is RMB 200 million (inclusive), and the repurchase price does not exceed RMB 12.93 per share.

Shentong Technology (605228.SH): Plans to spend 50 million yuan to 100 million yuan to repurchase shares

Shentong Technology (605228.SH) announced that the company will repurchase RMB common stock (A shares) shares already issued by the company through centralized bidding transactions, and will use the aforementioned repurchase shares for employee stock ownership plans or equity incentives at an appropriate time in the future. The total capital to be repurchased shall not be less than RMB 50 million (inclusive) and not more than RMB 10,000 million (inclusive); the repurchase price shall not exceed RMB 14.70 per share (inclusive).

Donggang shares (002117.SZ): plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

Donggang Co., Ltd. (002117.SZ) announced that the company plans to use its own funds to repurchase the company's shares through centralized bidding transactions for subsequent implementation of employee stock ownership plans or equity incentives. The total amount of shares to be repurchased is not less than RMB 100 million and not more than RMB 200 million. Price range for repurchasing shares: no more than RMB 11.20 per share (inclusive). The implementation period for this share repurchase shall not exceed 12 months from the date the board of directors reviewed and approved the share repurchase plan.

USX Electronics (601231.SH): Plans to spend 100 million yuan to 200 million yuan to repurchase shares

USI Electronics (601231.SH) announced that the company plans to repurchase shares through centralized bidding transactions, and that the repurchased shares will be used for employee stock ownership plans. The total capital for this repurchase is not less than RMB 100 million (including the principal amount, same below), and not more than RMB 200 million (including the principal amount, same below); the price of the repurchased shares is not more than RMB 15.50 per share.

[Increase or decrease holdings]

Shunbo Alloy (002996.SZ): Controlling shareholders and co-actors plan to increase their holdings of the company by 40 million yuan to 80 million yuan

Shunbo Alloy (002996.SZ) announced that the controlling shareholders and co-actors of the company: Wang Zengchao, Wang Zhenjian, Wang Qi, and Du Fuchang, plan to increase the company's shares within 6 months from February 7, 2024 through methods permitted by the Shenzhen Exchange system (including but not limited to centralized bidding transactions and bulk transactions) based on confidence in the company's future development and recognition of the company's long-term investment value. The proposed increase in holdings is not less than RMB 40,000,000 (including the number of shares) and not more than RMB 80,000,000 (including the number of shares). There is no fixed price or price range for this increase in holdings. The entities that increase their holdings will take the opportunity to gradually implement plans to increase their holdings according to the company's stock price fluctuations and overall capital market trends.

Fukushi Holdings (300071.SZ): Actual controller Chen Yongliang and his co-actors plan to increase the company's shares by no less than 50 million yuan

Fukushi Holdings (300071.SZ) announced that the company received a notice from the actual controller, Mr. Chen Yongliang, that Mr. Chen Yongliang and his co-actors plan to increase their holdings of the company within 6 months (i.e. February 8, 2024 to August 7, 2024) from the date of disclosure of this announcement, with an increase of not less than 50 million yuan.

Kexiang Co., Ltd. (300903.SZ): The actual controller and some directors and supervisors plan to increase the company's shares by a total of 10 million yuan to 20 million yuan

Kexiang Co., Ltd. (300903.SZ) announced that, based on recognition of the intrinsic value of Guangdong Kexiang Electronic Technology Co., Ltd. (hereinafter referred to as the “Company”) and firm confidence in its continued stable and healthy development in the future, in order to protect shareholders' interests and enhance investor confidence, the company's actual controllers, directors, supervisors and senior management (“increase holdings entities”) intend to increase their holdings through the Shenzhen Stock Exchange trading system within 6 months from the date of the announcement of this increase plan through centralized bidding transactions. The total amount of the proposed increase in holdings is not less than 10,000 yuan (inclusive) and not higher than 20.00 million yuan (inclusive). The proposed increase in holdings is no more than RMB 10 per share, and the plan will be implemented at an opportunity based on fluctuations in the company's stock price.

Yayun Co., Ltd. (603790.SH): Actual controller, chairman and general manager Xie Bing plans to increase his shares by 15 million yuan to 20 million yuan

Yayun Co., Ltd. (603790.SH) announced that Mr. Xie Bing, the actual controller, chairman and general manager of the company, plans to use his own funds or self-raised funds to increase his holdings of the company at a price of no more than 12 yuan/share through methods permitted by the Shanghai Stock Exchange system (including but not limited to centralized bidding and bulk transactions) within 3 months from February 8, 2024. The increase in holdings will not be less than RMB 15 million and no more than RMB 20 million.

Welltech (002058.SZ): Controlling shareholders plan to increase their shares by 2.5%-5%

Welltech (002058.SZ) announced that on February 7, 2024, the company received a notification letter from Shanghai Zizhu High-tech Zone ((Group) Co., Ltd. ((“Zizhu Hi-Tech”)), the controlling shareholder of the company (“Zizhu Hi-Tech”), on February 7, 2024 (“Zizhu Hi-Tech”). Based on confidence in the company's future development prospects and a reasonable judgment on the company's long-term value, in order to maintain the health and stability of the capital market and boost the confidence of investors, Zizhu Hi-Tech plans to increase its shares within six months from February 7, 2024 through methods permitted by the Shenzhen Stock Exchange (including but not limited to centralized bidding and bulk trading, etc.). This time, it is proposed to increase the number of shares held by no more than 7,172,416 (shares (5% of the company's total share capital), no less than 3,586,208 shares (accounting for the company's total share capital) 2.5% of total share capital).

Dream Lily (603313.SH): Controlling shareholder Ni Zhanggen plans to increase shares by 80 million yuan to 160 million yuan

Dream Lily (603313.SH) announced that on February 7, 2024, the company received a notice from the controlling shareholder Mr. Ni Zhanggen regarding plans to increase the company's share holdings. The amount of shares to be increased this time is not less than RMB 80 million, not more than RMB 160 million.

Langsha Co., Ltd. (600137.SH): Controlling shareholder Langsha Holdings plans to increase the company's shares by no more than 4.5 million shares

Langsha Co., Ltd. (600137.SH) announced that the controlling shareholder of the company, Langsha Holding Group Co., Ltd. plans to increase its shareholding by no more than 4.5 million shares through methods permitted by the Shanghai Stock Exchange trading system (including but not limited to centralized bidding and bulk transactions) within 6 months from February 19, 2024.

[Other]

Dangsheng Technology (300073.SZ): Plans to raise an additional capital of 800 million yuan to 1 billion yuan from the controlling shareholder

Dangsheng Technology (300073.SZ) announced plans to issue shares to specific targets for 2024. The number of shares issued to specific targets this time does not exceed 30% of the total share capital of the company before the current issuance, that is, no more than 151,950,232 shares (including the number of shares). The price of issuing shares to specific targets this time is 27.41 yuan/share, which is not lower than the average trading price of the company's shares in the 20 trading days before the pricing benchmark date. The current issuance of shares to specific targets is the Mining and Metallurgy Group, the controlling shareholder of the company. The Mining and Metallurgy Group plans to subscribe in cash for all shares issued by the company this time. The Mining and Metallurgy Group has signed a conditionally effective “Share Subscription Agreement” with the company. The total capital raised by issuing shares to specific targets is not less than RMB 800 million (including the number of shares) and no more than RMB 1 billion (including the number of shares). After deducting the issuance fees, it is planned to use all of them to supplement the working capital.

Xiamen Xiangyu (600057.SH): Proposed issuance of corporate bonds of no more than 5 billion yuan

Xiamen Xiangyu (600057.SH) announced plans to publicly issue corporate bonds. The current corporate bond size does not exceed RMB 5 billion (including RMB 5 billion). After deducting the issuance fee, the funds raised in this bond are intended to be used for purposes permitted by laws and regulations, such as repaying corporate debts and supplementing working capital.