Despite an already strong run, Transphorm, Inc. (NASDAQ:TGAN) shares have been powering on, with a gain of 32% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

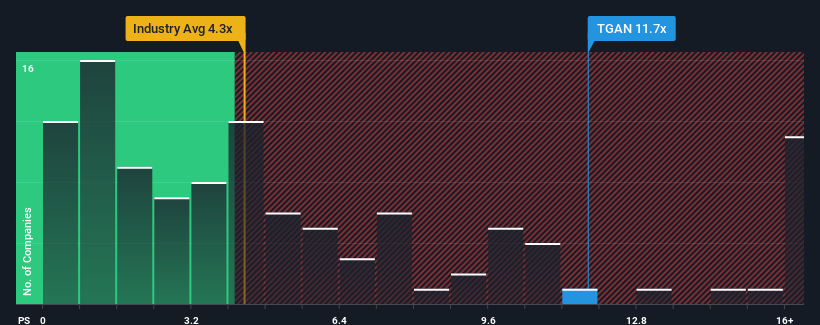

Since its price has surged higher, Transphorm may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 11.7x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4.3x and even P/S lower than 1.6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Transphorm

How Transphorm Has Been Performing

Recent times haven't been great for Transphorm as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Transphorm.What Are Revenue Growth Metrics Telling Us About The High P/S?

Transphorm's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 3.6% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 75% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 40%, which is noticeably less attractive.

In light of this, it's understandable that Transphorm's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Transphorm's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Transphorm maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Transphorm (of which 1 shouldn't be ignored!) you should know about.

If you're unsure about the strength of Transphorm's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.