One CSI Properties Limited (HKG:497) Analyst Just Lifted Their Revenue Forecasts By A Captivating 13%

One CSI Properties Limited (HKG:497) Analyst Just Lifted Their Revenue Forecasts By A Captivating 13%

Shareholders in CSI Properties Limited (HKG:497) may be thrilled to learn that the covering analyst has just delivered a major upgrade to their near-term forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

得知封面分析師剛剛對短期預測進行了重大上調,CSI Properties Limited(HKG: 497)的股東可能會很高興。共識估計的收入數字有所上升,他們現在的看法顯然更加樂觀該公司的業務前景。

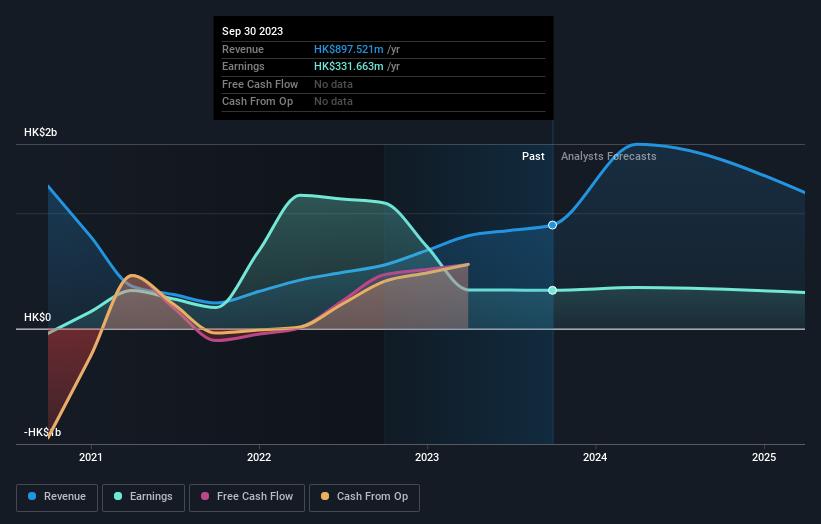

Following the upgrade, the current consensus from CSI Properties' single analyst is for revenues of HK$1.6b in 2024 which - if met - would reflect a substantial 78% increase on its sales over the past 12 months. Prior to the latest estimates, the analyst was forecasting revenues of HK$1.4b in 2024. The consensus has definitely become more optimistic, showing a nice gain to revenue forecasts.

上調後,CSI Properties的單一分析師目前的共識是,2024年的收入爲16億港元,如果得到滿足,將反映出其在過去12個月中銷售額將大幅增長78%。在最新估計之前,該分析師預測2024年的收入爲14億港元。這一共識無疑變得更加樂觀了,這表明收入預測有了不錯的增長。

Check out our latest analysis for CSI Properties

查看我們對CSI Properties的最新分析

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the CSI Properties' past performance and to peers in the same industry. For example, we noticed that CSI Properties' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 78% growth to the end of 2024 on an annualised basis. That is well above its historical decline of 50% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 8.3% per year. So it looks like CSI Properties is expected to grow faster than its competitors, at least for a while.

這些估計很有趣,但在查看預測與CSI Properties過去的表現以及與同一行業同行的比較時,可以更寬泛地描繪一些有用的特徵。例如,我們注意到,CSI Properties的增長率預計將大幅加快,預計到2024年底,按年計算,收入將實現78%的增長。這遠高於過去五年中每年50%的歷史跌幅。相比之下,我們的數據表明,業內其他公司(包括分析師報道)的收入預計每年將增長8.3%。因此,看來CSI Properties的增長速度預計將超過競爭對手,至少在一段時間內是如此。

The Bottom Line

底線

The most important thing to take away from this upgrade is that the analyst lifted their revenue estimates for this year. The analyst also expects revenues to grow faster than the wider market. Given that the analyst appears to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at CSI Properties.

從這次升級中得到的最重要的一點是,分析師上調了今年的收入預期。分析師還預計,收入增長速度將快於整個市場。鑑於分析師似乎預計銷售渠道將大幅改善,現在可能是重新審視CSI Properties的合適時機。

The covering analyst is definitely bullish on CSI Properties, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including its declining profit margins. You can learn more, and discover the 2 other flags we've identified, for free on our platform here.

封面分析師肯定看好CSI Properties,但沒有一家公司是完美的。事實上,你應該知道有幾個潛在的問題需要注意,包括其利潤率的下降。你可以在我們的平台上免費了解更多信息,並發現我們確定的其他 2 個標誌。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

當然,看到公司管理層將大量資金投資於股票與了解分析師是否在提高預期一樣有用。因此,您可能還希望搜索這份內部人士正在購買的免費股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。