[Focus on hot topics]

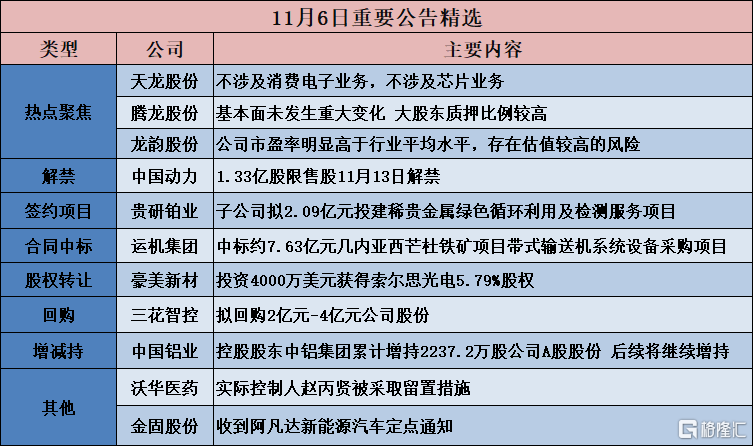

Tianlong Co., Ltd. (603266.SH): Does not involve consumer electronics business, does not involve chip business

Tianlong Co., Ltd. (603266.SH) announced a risk warning on stock trading. The company is mainly engaged in mold, injection molding, and assembly business. The main products are plastic functional structural parts. Although there are many application scenarios, they are not core components, and the added value of the products is not high. Currently, the company's main source of revenue is still mainly auto parts for traditional fuel vehicles, and the NEV business accounts for a relatively small share. The company is not involved in the consumer electronics business or the chip business. Foreign-invested chip companies are shareholding companies. Currently, they have not achieved profit, and their impact on the company's performance is limited.

Pearl River Co., Ltd. (600684.SH): Plans to raise no more than 748 million yuan in capital from controlling shareholders

Pearl River Co., Ltd. (600684.SH) announced plans to issue A-shares to specific targets in 2023. The issuer for issuing A-shares to specific targets this time is Guangzhou Pearl River Industrial Group Co., Ltd., which is the issuer's controlling shareholder, and the issuer subscribes in cash. The total amount of capital raised for this issue of shares to specific targets did not exceed 748 million yuan. After deducting the relevant issuance fees, all of it was used to supplement working capital and repay debts.

Great Wall Motor (601633.SH): Total sales volume in October was 13,1308 units, up 31.04% year on year

Great Wall Motor (601633.SH) announcedOctober production and sales report,Sales volumetotals131308Taiwan, year on year31.04%;Overseas sales were 35,350 units in October, and cumulative sales in January-October were 247,046 units. In October, 30,551 new energy vehicles were sold, and in January-October, a total of 200,897 units were sold.

Longyun Co., Ltd. (603729.SH): The company's price-earnings ratio is significantly higher than the industry average, and there is a risk of high valuation

Longyun Co., Ltd. (603729.SH) announced a stock trading risk alert announcement. The company's stock rose and stopped for three consecutive trading days on November 2, November 3, and November 6, 2023. Recently, the company's stock price has fluctuated greatly. The short-term increase in stock prices is significantly higher than the Shanghai Stock Exchange Index during the same period, but the company's fundamentals have not changed significantly. As of November 6, 2023, the company's rolling price-earnings ratio is 324.47 and the net price-earnings ratio is 5.49 (China Securities Market Earnings Ratio data). According to the Securities Regulatory Commission industry price-earnings ratio and rolling price-earnings ratio data published on the official website of China Securities Index Co., Ltd., the rolling price-earnings ratio of the company's “L leasing and business services industry” is 25.88 and the net market ratio is 1.98. The company's price-earnings ratio is significantly higher than the industry average. There are high valuation risks. Investors are kindly requested to pay attention to investment risks.

Tamron Co., Ltd. (603158.SH): There have been no major changes in fundamentals, and the majority shareholder's pledge ratio is high

Tamron Co., Ltd. (603158.SH) announced abnormal fluctuations in stock trading. The company's stock closing price increased by more than 20% over three consecutive trading days, and the stock price fluctuated greatly. The cumulative increase was significant, and there were no major changes in the company's fundamentals.As of the disclosure date of this announcement, the number of pledged shares maturing within the next six months of the company's controlling shareholder Tenglong Technology Group Co., Ltd. is 51,396,000 shares, accounting for 38.42% of its shares, 10.47% of the company's total share capital, and the corresponding financing amount is 145 million yuan; the number of pledged shares maturing in the next 7-12 months is 35,280,000 shares, accounting for 26.37% of its shares and 7.19% of the company's total share capital. The corresponding financing amount is 150 million yuan, and the majority shareholder's pledge ratio is high.

[Contract project]

Huashen Technology (000790.SZ): The subsidiary plans to invest no more than 480 million yuan to build a green production base project for high-end new materials and APIs (including pharmaceutical intermediates) with an annual output of 15,000 tons (phase I)

Huashen Technology (000790.SZ) announced that on November 6, 2023, the company held the sixth meeting of the 13th board of directors to deliberate and pass the “Subsidiary Investment Project for 15,000 tons/year of high-end new materials and APIs (including pharmaceutical intermediates) green production base (phase I)” (“Project”), and agreed to carry out the first phase of the project construction at the holding subsidiary Shandong Lingkai Pharmaceutical Co., Ltd. (“Shandong Lingkai”). The first phase of the project is planned to be built in stages, with an investment of no more than 480 million yuan in the first phase of the project.

Guiyan Platinum (600459.SH): Subsidiary to invest in green recycling and testing service projects for rare and precious metals

Guiyan Platinum (600459.SH) announced that in order to further expand and strengthen the comprehensive recycling and deep processing industry of rare metals, Yongxing Guiyan Resources Co., Ltd., a subsidiary holding subsidiary, plans to invest in the construction of a rare metals green recycling and testing service project on reserved land on Yongxing Guiyan's existing construction site, with a total investment of 208.8708 million yuan.The project plans to build two new plants, including a production plant, a testing service building and supporting facilities. The production plant includes silver electrolysis production line, gold refining production line, platinum and palladium refining production line, silver powder production line, and silver beads production line. The testing service building includes functional layouts such as analysis and testing centers and R&D centers.

Qiaoyuan Co., Ltd. (301286.SZ): Signed a 375 million yuan pipeline gas preparation integrated operation and maintenance service cooperation agreement

Qiaoyuan Co., Ltd. (301286.SZ) announced that Qiaoyuan Gas (Meishan) Co., Ltd., a wholly-owned subsidiary, and Tongwei Solar (Chengdu) Co., Ltd. signed a “Pipeline Gas Preparation Integrated Operation and Maintenance Service Cooperation Agreement” in Shuangliu District, Chengdu City, Sichuan Province. The agreement amount is about RMB 375 million. The final settlement is subject to actual settlement.

[Contract won the bid]

Henghua Technology (300365.SZ): Signed a contract for the procurement and construction of materials for energy storage engineering equipment for the Yuxian County Source Network Load Storage Integration Demonstration Project (750 MW PV) of about 336 million yuan

Henghua Technology (300365.SZ) announced that the company (“contractor”) and Sichuan Electric Power Design Consulting Co., Ltd. (“Sichuan Electric Power”, “contractor”) signed the “Yuxian Source Network Load Storage Integration Demonstration Project (750 MW PV) Energy Storage Engineering Equipment Material Procurement and Construction Contract” on November 6, 2023. The total contract price is tentatively set at about 336 million yuan.

Yunji Group (001288.SZ): Won the bid of about 763 million yuan for the belt conveyor system equipment procurement project for the Simandou iron ore project in Guinea (bid section 3)

Yunji Group (001288.SZ) announced that the company recently received the “Notice of Winning Bid” issued by Winning CONSORTIUM SIMANDOU SAU, confirming that the company was the winning bidder for the belt conveyor system equipment procurement project (bid section 3) for the Simandou Iron Ore Project in Guinea. The total price of the winning contract was RMB 763 million.

Energy-saving Tetsuhan (300197.SZ): The consortium won the bid for an integrated construction and operation project to improve the quality of supporting infrastructure construction projects in Guanqiao Town, Nan'an

Energy-saving Tetsuhan (300197.SZ) announced that China Energy-saving Construction Engineering Design Institute Co., Ltd. (consortium leader) and the company formed a bidding consortium (“consortium”) and the company recently participated in the public bidding for an integrated construction and operation project for quality improvement supporting infrastructure construction projects in Guanqiao Town, Nan'an City. According to information released by the Quanzhou Public Resources Exchange Information Network on November 3, 2023, the consortium has been listed as the first successful candidate recommended by the bid evaluation committee. The pre-bid price for the project is about 178 million yuan. The company is responsible for all procurement, construction, operation, and design work other than construction industry (construction engineering) majors of the project.

Petrochemical Oil Service (600871.SH): won the bid for the 888 million yuan project

Petrochemical Oil Service (600871.SH) announced that recently, Sinopec Petroleum Engineering Construction Co., Ltd., a wholly-owned subsidiary, won the bid for the Luoyang-Xinzheng International Airport aviation pipeline EPC project of the Luoyang Branch of China Petroleum & Chemical Corporation. The total pipeline length of the project is 178 kilometers, and the winning bid amount is RMB 888 million, accounting for about 1.22% of the company's 2022 revenue under China accounting standards.

Hongcheng Environment (600461.SH): The consortium won a bid of about 2.186 billion yuan for the expansion of the Nanchang County Sewage Treatment Plant and the franchise for supporting pipeline networks

Hongcheng Environment (600461.SH) announced that Jiangxi Hongcheng Water Industry Environmental Protection Co., Ltd. (“Hongcheng Environmental Protection”), a wholly-owned subsidiary of the company (consortium members: Nanchang Water Engineering Co., Ltd., Nanchang Municipal Engineering Development Group Co., Ltd., China Municipal Engineering Zhongnan Design and Research Institute Co., Ltd.) won the bid for the Nanchang County Sewage Treatment Plant expansion and supporting pipeline network franchise project (project number: ZHGC2023-G002). The winning bid situation has entered the publicity stage. Recently, Hongcheng Environmental Protection received a notice of winning the bid from the bidding agency, confirming the winning bid results. The winning bid amount was about 2.186 billion yuan.

[[Share acquisition]

Haomei New Materials (002988.SZ): Investing 40 million US dollars to obtain 5.79% of Sols Optoelectronics

Haomei New Materials (002988.SZ) announced that on November 6, 2023, the company held the 11th meeting of the fourth board of directors to deliberate and pass the “Proposal on Foreign Investment”, agreeing that the company would invest $2.6179 per share in Source Photonics Holdings (Cayman) Limited (hereinafter referred to as “Solse Optoelectronics” or “investment target”) with an investment amount of 40 million US dollars (about 290 million yuan at the current RMB exchange rate). After the execution of convertible bonds It obtained 15,279,422 shares of Sols Optoelectronics. After the investment was completed, it accounted for about 5.79% of Sols Optoelectronics's shares (after the additional 5% equity incentive exercise was diluted), and the company's management was authorized to hire intermediaries to conduct due diligence on investment targets, sign investment agreements and other related supporting documents, and go through relevant approval procedures.

Fujian Jinsen (002679.SZ): Plans to buy 21.66% of Jinhu Electric Power's shares in cash

Fujian Jinsen (002679.SZ) announced that the company plans to purchase 21.66% of the shares of Fujian Huadian Jinhu Electric Power Co., Ltd. (“Jinhu Electric Power” for short) held by Jiangle County State-owned Assets Investment Co., Ltd. in cash. After the transaction is completed, the company will become a shareholder of Jinhu Electric Power.The company believes that the hydropower project is more in line with the company's new development direction and can continue to implement the ecological development concept of “green water and green mountains are golden mountains and silver mountains”. After entering the hydropower industry, the company will be a more pure listed company implementing “green water and green mountains are golden mountains and silver mountains” in the domestic A-share market, maintaining the company as a unique representative enterprise of the country's ecological development model.

Keyuan Pharmaceutical (301281.SZ): Plans to buy 12% of Noconda's shares for 180 million yuan

Keyuan Pharmaceutical (301281.SZ) announced that on November 3, 2023, the company signed separate “Share Transfer Agreements” with Wang Chunpeng, Chen Peng, Shandong Haomai Xinxing Equity Investment Fund Partnership, Beijing Xingxing Equity Investment Partnership, Guoke Qihang (Zaozhuang) Equity Investment Partnership, Qingdao Congrong Equity Investment Fund Partnership, and Ningbo Wansheng Railway Investment Enterprise. The company used 180 million yuan of its own capital to purchase Wang Chunpeng, Chen Peng, Haomai Capital, Beijing Xingxing, Guoke Qihang, Qingdao Wancongrong, and Ningbo Wancongrong Beijing Nuoconda Pharmaceutical Technology shares held by Cheng Limited company (“Noconda”) has 12% shares (84752.27 million shares).

[[Ban lifted]

China Dynamics (600482.SH): The ban on 133 million restricted shares was lifted on November 13

China Dynamics (600482.SH) announced that the total number of shares currently listed and distributed by the company is 133 million shares. The stock listing and circulation date is November 13, 2023.

Yutong Heavy Industries (600817.SH): The ban on 333 million restricted shares was lifted on November 13

Yutong Heavy Industries (600817.SH) announced that the total number of shares listed and distributed is 333 million shares; the stock listing and circulation date is November 13, 2023.

[Repurchase]

Jiuwu Hi-Tech (300631.SZ): Plans to repurchase 30 million yuan to 50 million yuan of company shares

Jiuwu Hi-Tech (300631.SZ) announced that the company plans to use its own capital to carry out share repurchases through centralized bidding transactions for equity incentives or employee stock ownership plans (hereinafter referred to as “this repurchase”). The total capital of this repurchase is not less than RMB 30 million (inclusive), no more than RMB 50 million (inclusive), and the repurchase price is no more than RMB 38 per share (inclusive). According to the total amount and maximum repurchase price, the total number of shares that can be repurchased is estimated to be 1,315,789 shares, accounting for about 1.07% of the company's current total share capital; according to the total minimum and maximum repurchase price, the total number of shares that can be repurchased is estimated to be 789,473 shares, accounting for about 0.64% of the company's current total share capital. The implementation period for this share repurchase is within 6 months from the date the company's board of directors deliberates and approves the share repurchase plan.

Sanhua Intelligent Control (002050.SZ): Plans to repurchase 200 million yuan to 400 million yuan of company shares

Sanhua Intelligent Control (002050.SZ) announced that it plans to use its own funds to repurchase the company's shares through centralized bidding transactions. The repurchased shares will later be used for equity incentive plans or employee stock ownership plans. The repurchase amount is not less than RMB 20 million and no more than RMB 40 million, and the repurchase price is no more than RMB 36.00 per share.

Shenma Electric Power (603530.SH): Plans to repurchase 40 million yuan to 80 million yuan of company shares

Shenma Electric (603530.SH) announced that the total capital of the proposed share repurchase will not be less than RMB 40 million, not higher than RMB 80 million, and that the repurchase price will not exceed RMB 20 per share.

Shenghong Co., Ltd. (300693.SZ): Plans to spend 20 million yuan to 30 million yuan to repurchase the company's shares

Shenghong Co., Ltd. (300693.SZ) announced an announcement on the company's share repurchase plan. The company plans to repurchase with its own capital of not less than RMB 20 million (inclusive) and no more than RMB 30 million (inclusive). The source of capital is the company's own capital; the price range for repurchasing shares does not exceed 42.61 yuan/share (including principal amount).

Xinde New Materials (301349. SZ): Plans to spend 30 million yuan to 60 million yuan to buy back the company's shares

Xinde New Materials (301349.SZ) announced an announcement on a plan to use its own funds to repurchase the company's shares through centralized bidding transactions. The total capital for repurchasing shares is not less than RMB 30 million (inclusive) and no more than RMB 60 million (inclusive). The specific total amount of repurchase capital is based on the total amount of capital actually used at the end of the repurchase period. The stock repurchase price does not exceed 64.53 yuan/share (inclusive).

Huahai Pharmaceutical (600521.SH): Plans to repurchase 50 million yuan to 100 million yuan of company shares

Huahai Pharmaceutical (600521.SH) announced that the total capital for the proposed share repurchase will not be less than RMB 50 million, not more than RMB 10,000 million, and the repurchase price will not exceed RMB 24.49 per share.

[Increase or decrease holdings]

Minhe Co., Ltd. (002234.SZ): Controlling shareholder Sun Constitution plans to increase his holdings by 15 million yuan to 30 million yuan, and has increased his holdings by 374,300 shares

Minhe Co., Ltd. (002234.SZ) announced that the company recently received a notice from the controlling shareholder, chairman and general manager, Mr. Sun Xianzha, that it has purchased 374,300 shares of the company through centralized bidding transactions on November 6, 2023, accounting for 0.11% of the company's total share capital.Mr. Sun Xianzhu plans to increase the company's shares by 15 million yuan to 30 million yuan (including the shares already purchased) through the Shenzhen Stock Exchange trading system within 6 months from November 6, 2023, through centralized bidding transactions or bulk transactions.

China Aluminum (601600.SH): The controlling shareholder China Alcoa Group increased its holdings by a total of 22.372 million shares, and the company's A-share holdings will continue to increase in the future

China Aluminum (601600.SH) announced that as of the date of this announcement, the controlling shareholder China Alcoa Group has increased its holdings of the company's A shares by a total of 22.372 million shares through the Shanghai Stock Exchange trading system, accounting for about 0.13% of the company's total issued share capital, with an increase of approximately RMB 136 million. In the future, China Alcoa Group will continue to choose opportunities to increase its holdings in the company in accordance with the plan to increase its holdings.

[Other]

Wohua Pharmaceuticals (002107.SZ): The actual controller, Zhao Bingxian, was taken into custody

Wohua Pharmaceutical (002107.SZ) announced that the company recently learned that Mr. Zhao Bingxian, the company's chairman and actual controller, has been placed in custody to cooperate with the supervisory authority to assist in the investigation. However, the matter involved has nothing to do with the company. As of the date of publication of this announcement, the company has not received notice from the relevant authorities, nor has it received any assistance in the investigation. This matter will not have a significant impact on the normal production and operation of the company.

Jingu Co., Ltd. (002488.SZ): Received Avatar's NEV designation notice

Jingu Co., Ltd. (002488.SZ) announced that the company recently received a targeted notice from a leading new energy vehicle manufacturer (limited to confidentiality requirements, unable to disclose its name, “customer”). The company will act as the customer's parts supplier to develop Avatar low-carbon wheel products for its new energy vehicles, and the company will complete product development and delivery work according to customer requirements.