Take Care Before Jumping Onto GeneDx Holdings Corp. (NASDAQ:WGS) Even Though It's 49% Cheaper

Take Care Before Jumping Onto GeneDx Holdings Corp. (NASDAQ:WGS) Even Though It's 49% Cheaper

Unfortunately for some shareholders, the GeneDx Holdings Corp. (NASDAQ:WGS) share price has dived 49% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 95% share price decline.

不幸的是,對於一些股東來說, GenedX 控股公司 納斯達克股票代碼:WGS)的股價在過去三十天中下跌了49%,延續了最近的痛苦。對於任何長期股東來說,最後一個月的股價下跌幅度爲95%,這讓人忘記了。

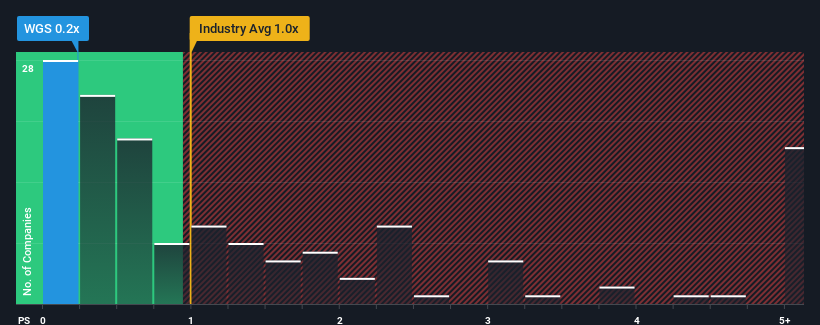

After such a large drop in price, GeneDx Holdings' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Healthcare industry in the United States, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

在價格大幅下跌之後,與美國的醫療保健行業相比,GenedX Holdings的0.2倍市盈率(或 “市盈率”)可能使其現在看起來像買入。在美國,大約有一半的公司的市盈率超過1倍,甚至市盈率也高於3倍也很常見。但是,僅按面值計算市盈率是不明智的,因爲可能有其侷限性的解釋。

Check out our latest analysis for GeneDx Holdings

查看我們對GenedX Holdings的最新分析

NasdaqGS:WGS Price to Sales Ratio vs Industry November 1st 2023

納斯達克股票代碼:WGS 市銷比率與行業對比 2023 年 11 月 1 日

What Does GeneDx Holdings' Recent Performance Look Like?

GenedX Holdings最近的表現是什麼樣子?

GeneDx Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

GenedX Holdings最近表現不佳,因爲與其他公司的收入相比,其收入下降的情況不佳,後者的平均收入有所增長。市盈率可能很低,因爲投資者認爲這種糟糕的收入表現不會好轉。因此,儘管你可以說這隻股票很便宜,但投資者在將其視爲物有所值之前會尋求改善。

Want the full picture on analyst estimates for the company? Then our free report on GeneDx Holdings will help you uncover what's on the horizon.

想全面了解分析師對公司的估計嗎?然後我們的 免費的 關於GenedX Holdings的報告將幫助你發現即將發生的事情。

How Is GeneDx Holdings' Revenue Growth Trending?

GenedX Holdings的收入增長趨勢如何?

GeneDx Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

GenedX Holdings的市盈率對於一家預計增長有限且重要的是表現比行業差的公司來說是典型的。

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 15% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

回顧過去,去年該公司的收入下降了11%,令人沮喪。這抑制了其長期的良好表現,因爲其三年的總收入增長仍爲值得注意的15%。儘管這是一段艱難的旅程,但可以公平地說,該公司最近的收入增長基本上是可觀的。

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% each year over the next three years. That's shaping up to be materially higher than the 7.8% each year growth forecast for the broader industry.

展望未來,報道該公司的三位分析師的估計表明,在未來三年中,收入每年將增長13%。這將大大高於整個行業每年7.8%的增長預期。

In light of this, it's peculiar that GeneDx Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

有鑑於此,奇怪的是,GenedX Holdings的市盈率低於大多數其他公司。看來大多數投資者根本不相信該公司能夠實現未來的增長預期。

The Key Takeaway

關鍵要點

The southerly movements of GeneDx Holdings' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

GenedX Holdings股票的向南走勢意味着其市盈率目前處於相當低的水平。有人認爲,在某些行業中,價格與銷售比率是衡量價值的次要指標,但它可能是一個有力的商業情緒指標。

A look at GeneDx Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

縱觀GenedX Holdings的收入,就會發現,儘管未來增長預測樂觀,但其市盈率仍遠低於我們的預期。可能有一些主要的風險因素給市盈率帶來下行壓力。看來市場可能會預期收入不穩定,因爲這些條件通常應該會提振股價。

Plus, you should also learn about these 5 warning signs we've spotted with GeneDx Holdings (including 2 which are concerning).

另外,你還應該了解這些 我們在GenedX Holdings發現了5個警告信號 (包括 2 個有關的)。

If these risks are making you reconsider your opinion on GeneDx Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果這些 風險讓你重新考慮你對GenedX Holdings的看法,瀏覽我們的高品質股票互動清單,了解還有什麼。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 請直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。