Certara, Inc.'s (NASDAQ:CERT) Price Is Out Of Tune With Revenues

Certara, Inc.'s (NASDAQ:CERT) Price Is Out Of Tune With Revenues

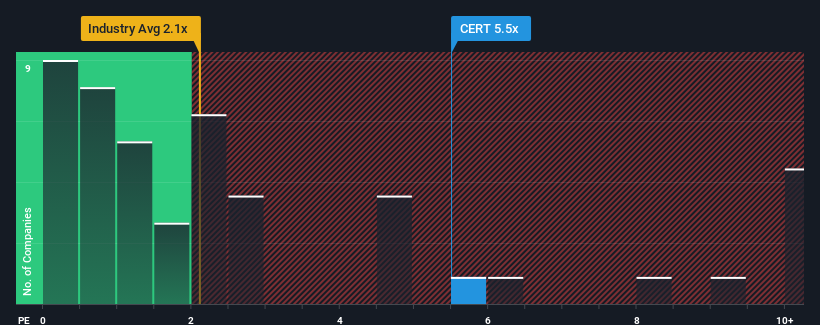

When you see that almost half of the companies in the Healthcare Services industry in the United States have price-to-sales ratios (or "P/S") below 2.1x, Certara, Inc. (NASDAQ:CERT) looks to be giving off strong sell signals with its 5.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

當你看到美國醫療保健服務行業幾乎一半的公司的市銷率(P/S)低於2.1倍時,Certara,Inc.納斯達克(Sequoia Capital:CERT)的本益比為5.5倍,似乎正在發出強烈的賣出信號。儘管如此,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此之高。

See our latest analysis for Certara

查看我們對Certara的最新分析

How Has Certara Performed Recently?

Certara最近表現如何?

Recent times haven't been great for Certara as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Certara最近的日子並不好過,因為它的營收增速一直低於大多數其他公司。或許,市場預期未來的營收表現將發生逆轉,這推高了本益比與S的比率。你真的希望如此,否則你會無緣無故地付出相當大的代價。

What Are Revenue Growth Metrics Telling Us About The High P/S?

收入增長指標告訴我們關於高本益比的哪些資訊?

The only time you'd be truly comfortable seeing a P/S as steep as Certara's is when the company's growth is on track to outshine the industry decidedly.

唯一能讓你真正放心地看到像Certara這樣高本益比的時候,就是當該公司的增長走上了明顯超過行業的軌道時。

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Pleasingly, revenue has also lifted 56% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

回顧過去一年,該公司的收入實現了12%的可觀增長。令人欣喜的是,收入也比三年前增長了56%,這在一定程度上要歸功於過去12個月的增長。因此,股東肯定會歡迎這些中期收入增長率。

Looking ahead now, revenue is anticipated to climb by 9.5% per year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 14% growth each year, the company is positioned for a weaker revenue result.

根據跟蹤該公司的六位分析師的說法,展望未來三年,收入預計將以每年9.5%的速度增長。由於該行業預計每年將實現14%的增長,該公司的營收結果可能會較弱。

With this in consideration, we believe it doesn't make sense that Certara's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

考慮到這一點,我們認為Certara的P/S超越行業同行是沒有道理的。似乎大多數投資者都希望該公司的業務前景有所好轉,但分析師們對此並不是很有信心。如果本益比與S的本益比跌至更符合增長前景的水準,這些股東很有可能會讓自己未來感到失望。

The Final Word

最後的結論

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

一般來說,我們傾向於將市銷率的使用限制在確定市場對公司整體健康狀況的看法上。

It comes as a surprise to see Certara trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

鑑於營收預測看起來不那麼出色,Certara的交易價格如此之高令人驚訝/S。該公司營收預估的疲弱對升高的本益比S來說不是好兆頭,如果營收情緒沒有改善,本益比可能會下跌。這使股東的投資面臨重大風險,潛在投資者面臨支付過高溢價的危險。

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Certara with six simple checks on some of these key factors.

一家公司的資產負債表中可能隱藏著許多潛在風險。看看我們的免費Certara的資產負債表分析,對其中一些關鍵因素進行了六個簡單的檢查。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然了,利潤豐厚、盈利增長迅速的公司通常是更安全的押注那就是。所以你可能想看看這個免費其他本益比合理、盈利增長強勁的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.