Ardagh Metal Packaging S.A. (NYSE:AMBP) Might Not Be As Mispriced As It Looks

Ardagh Metal Packaging S.A. (NYSE:AMBP) Might Not Be As Mispriced As It Looks

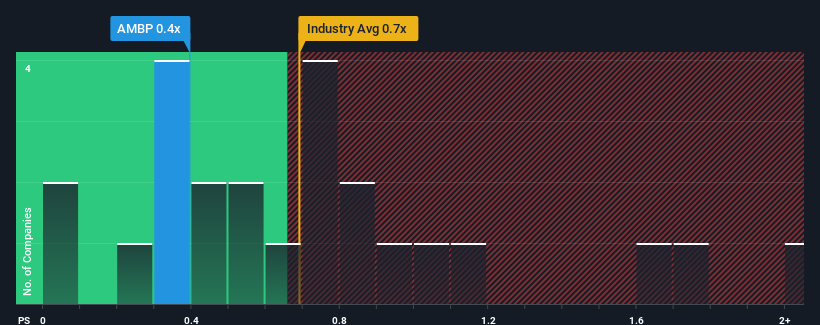

It's not a stretch to say that Ardagh Metal Packaging S.A.'s (NYSE:AMBP) price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" for companies in the Packaging industry in the United States, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

這麼說一點也不牽強阿爾達格金屬包裝股份有限公司S(紐約證券交易所股票代碼:AMBP)0.4倍的市銷率(或“P/S”)對於美國包裝行業的公司來說似乎相當“中間”,那裡的P/S比率中值約為0.7倍。儘管這可能不會令人驚訝,但如果P/S比率不合理,投資者可能會錯過潛在的機會,或者忽視迫在眉睫的失望情緒。

Check out our latest analysis for Ardagh Metal Packaging

查看我們對Ardagh金屬包裝的最新分析

How Ardagh Metal Packaging Has Been Performing

阿爾達格金屬包裝的表現如何

With its revenue growth in positive territory compared to the declining revenue of most other companies, Ardagh Metal Packaging has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

與大多數其他公司的收入下降相比,它的收入增長在積極的領域,阿爾達格金屬包裝最近一直做得很好。一種可能性是,本益比/S比率是適度的,因為投資者認為該公司未來的收入彈性將會減弱。如果不是,那麼現有股東有理由對股價的未來走向感到樂觀。

Do Revenue Forecasts Match The P/S Ratio?

收入預測是否與本益比匹配?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ardagh Metal Packaging's to be considered reasonable.

有一個固有的假設,即一家公司應該與行業匹配,使P/S比率像阿爾達格金屬包裝公司那樣被認為是合理的。

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

如果我們回顧一下去年的收入,該公司公佈的結果與一年前幾乎沒有任何偏差。不過,儘管短期表現平平,但最近三年的營收總體增長了38%,表現出色。因此,儘管該公司過去做得很好,但看到收入增長如此之快的下滑,還是有些令人擔憂的。

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 3.2% over the next year. That's shaping up to be materially higher than the 1.1% growth forecast for the broader industry.

展望未來,跟蹤該公司的五位分析師的預測顯示,該公司明年的收入將增長3.2%。這將大大高於整個行業1.1%的增長預期。

With this information, we find it interesting that Ardagh Metal Packaging is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

有了這些資訊,我們發現有趣的是,與行業相比,阿爾達格金屬包裝公司的本益比和S相當。這可能是因為大多數投資者不相信該公司能夠實現未來的增長預期。

What Does Ardagh Metal Packaging's P/S Mean For Investors?

阿爾達格金屬包裝的P/S對投資者意味著什麼?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

一般來說,我們傾向於將市銷率的使用限制在確定市場對公司整體健康狀況的看法上。

Despite enticing revenue growth figures that outpace the industry, Ardagh Metal Packaging's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

儘管誘人的收入增長數位超過了行業,阿爾達格金屬包裝的P/S並不完全是我們預期的。市場可能計入了一些風險,這阻礙了P/S比率與積極前景的匹配。至少價格下跌的風險看起來很低,但投資者似乎認為未來的收入可能會出現一些波動。

You need to take note of risks, for example - Ardagh Metal Packaging has 4 warning signs (and 2 which make us uncomfortable) we think you should know about.

你需要注意風險,例如-阿爾達格金屬包裝有4個警示標誌(和2個讓我們不舒服的)我們認為你應該知道。

If these risks are making you reconsider your opinion on Ardagh Metal Packaging, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果這些風險讓你重新考慮你對阿爾達格金屬包裝的看法,探索我們的高質量股票互動列表,以瞭解還有什麼。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.