As the “strongest A-share” that “boosted” 9 times in the first half of the year, Liante Technology's three-quarter report was not as good as expected.

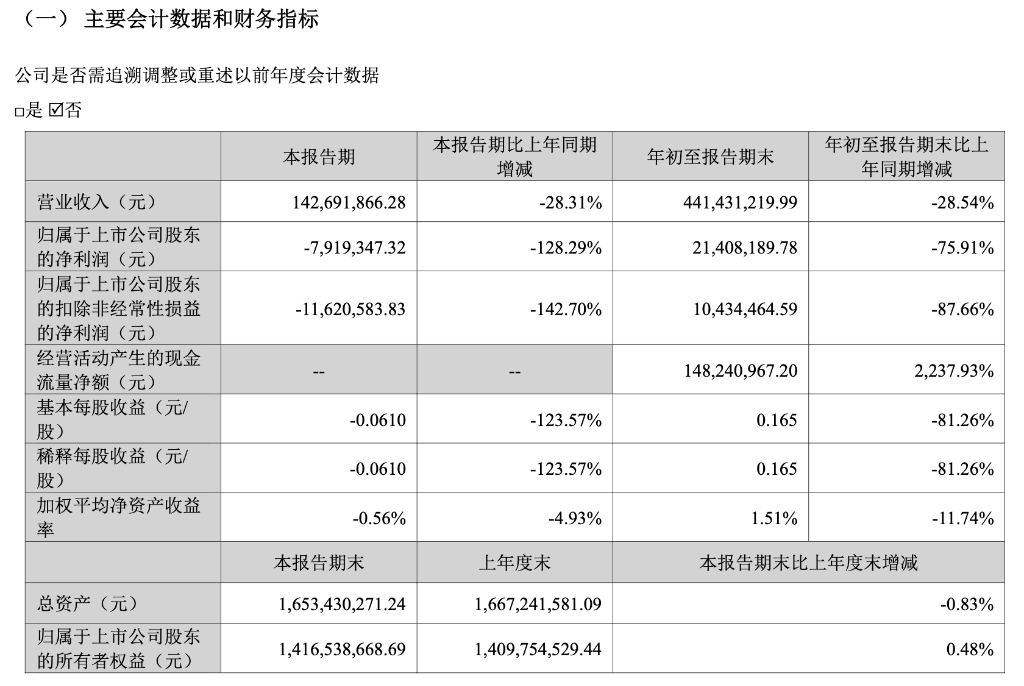

After the market on October 23, Liante Technology released its third quarter report. During the reporting period, Liante Technology achieved revenue of 143 million yuan, a year-on-year decrease of 28.31% and a month-on-month increase of 19.76%; net loss of 7.9193 million yuan, a year-on-year decrease of 128.30%.

In the first three quarters of this year, Liante Technology's revenue was 441 million yuan, down 28.54% year on year, and net profit was 21.4082 million yuan, down 75.81% year on year.

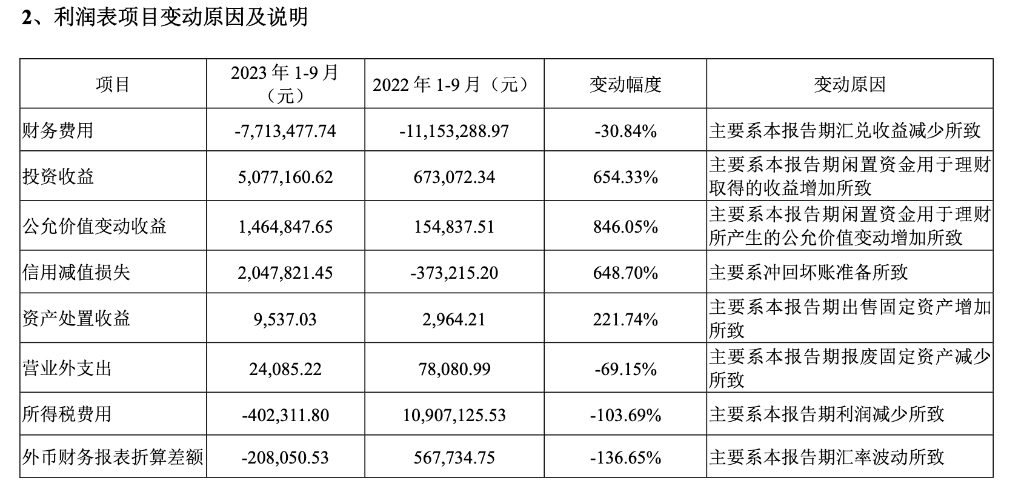

In terms of remaining expenses, the company's R&D expenses for the third quarter were 163.51 million yuan, a year-on-year decrease of 5.44% and a decrease of 0.99% month-on-month; sales expenses were 4.721,000 yuan, a decrease of 23.65% year-on-year.

Liante Technology did not explain the drastic changes in key profit statement items such as operating income and net profit. In the third quarter, Liante Technology's investment income increased by 654.33%, and the income from changes in fair value increased by 846.05%. The company explained that this was due to income from idle funds and wealth management.

Liante Technology stated in the report that during the reporting period, some of the company's shares already issued prior to the initial public offering were lifted and applied for listing circulation. The total number of shareholders lifted the sales restrictions was 35,522,280 shares, accounting for 27.38% of the company's total share capital. The sales restriction period was 12 months from the date of the company's initial public offering and listing, or 36 months from the date of completion of the registration of the industrial and commercial changes to acquire the company's shares. The above tradable shares with limited conditions of sale were listed and circulated on October 9, 2023.

“Top stocks” in the first half of the year

In the first half of this year, the “AI wave” set off by ChatGPT sparked popularity in the capital market. Liante Technology, which started with an optical module, was hailed by the market as a “CPO concept stock”. At one point, the stock price soared more than 9 times to 195 yuan/share, and was once hailed as “the best individual stock in the first half of the year.”

CPO is optoelectronic co-packaging technology. This technology packages optical modules and chips together to improve work efficiency and reduce energy consumption, providing a high density, high energy efficiency, and low cost high-speed interconnection solution for rapidly increasing computing power requirements. The concept is highly correlated with the AI chip and AIGC concept.

According to public information, Liante Technology focuses on R&D, production and sales of optical communication transceiver modules, adheres to the development strategy of independent innovation and differentiated competition, has mastered a series of key technologies in optoelectronic chip integration, optical devices, and optical module design and production processes, and has the ability to design and manufacture optical chips to optical devices, optical devices to optical modules. Relying on self-developed core technology, the company is committed to developing high-end optical module products with high speed, intelligence, low cost, and low power consumption to provide optical module solutions for customers in the fields of telecommunications and digital communication. Based on independent innovation, the company has accumulated rich experience in product R&D, technology and manufacturing, and its products and core technology have reached the leading level in China.

However, at the investor conference, Zhang Jian, founder of Liante Technology, confessed that the company is still actively building the CPO (Optoelectronic Co-Packaging) core technology and process platform. What this means is that the company is still in the technological development period.

Since July, Liante Technology has begun a continuous correction, and recently it has even reaped “nine consecutive declines.”

As of the close of trading on October 23, Liante Technology's stock price was 69.53 yuan, the same level as at the end of April this year, with a total market value of 9.122 billion yuan.