Fraser and Neave, Limited (SGX:F99) Investors Are Less Pessimistic Than Expected

Fraser and Neave, Limited (SGX:F99) Investors Are Less Pessimistic Than Expected

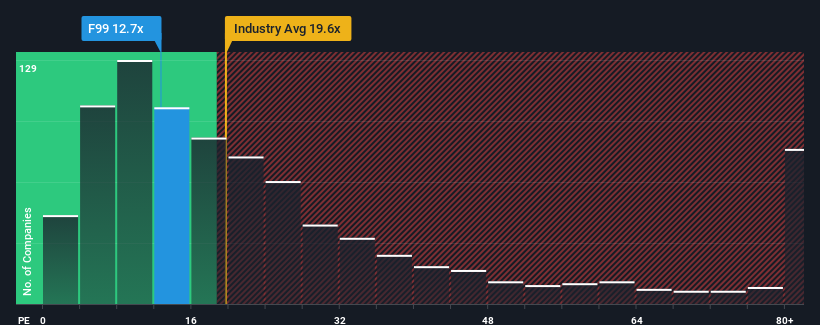

It's not a stretch to say that Fraser and Neave, Limited's (SGX:F99) price-to-earnings (or "P/E") ratio of 12.7x right now seems quite "middle-of-the-road" compared to the market in Singapore, where the median P/E ratio is around 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

這麼說一點也不牽強弗雷澤和尼夫,有限公司(新加坡證券交易所股票代碼:F99)12.7倍的本益比(或“本益比”)與新加坡市場相比似乎相當“中等”,新加坡股市的本益比中值約為12倍。儘管如此,在沒有解釋的情況下簡單地忽視本益比是不明智的,因為投資者可能會忽視一個獨特的機會或代價高昂的錯誤。

As an illustration, earnings have deteriorated at Fraser and Neave over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

舉例來說,弗雷澤和尼夫的收入在過去一年裡一直在惡化,這根本不是理想的情況。許多人可能預計,該公司在未來一段時間內將把令人失望的收益表現拋在腦後,這讓本益比不會下降。如果不是,那麼現有股東可能會對股價的生存能力感到有點緊張。

View our latest analysis for Fraser and Neave

查看我們對Fraser和Neave的最新分析

Does Growth Match The P/E?

增長是否與本益比匹配?

Fraser and Neave's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

弗雷澤和尼爾的本益比對於一家預計只會實現適度增長,而且重要的是表現與市場一致的公司來說是典型的。

Retrospectively, the last year delivered a frustrating 1.0% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 17% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

回顧過去一年,該公司的利潤令人沮喪地下降了1.0%。因此,三年前的整體收益也下降了17%。因此,不幸的是,我們不得不承認,在這段時間裡,該公司在盈利增長方面做得並不出色。

In contrast to the company, the rest of the market is expected to grow by 8.3% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

與該公司形成鮮明對比的是,市場其他部分預計明年將增長8.3%,這確實讓人對該公司最近中期收益的下降有了正確的認識。

In light of this, it's somewhat alarming that Fraser and Neave's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

有鑒於此,弗雷澤和尼夫的本益比與大多數其他公司的本益比持平,這有點令人擔憂。顯然,該公司的許多投資者並不像最近的情況所顯示的那樣悲觀,他們現在不願拋售自己的股票。如果本益比下降到與最近負增長更一致的水準,現有股東很可能會讓自己未來感到失望。

The Bottom Line On Fraser and Neave's P/E

弗雷澤和尼爾本益比的底線

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

僅僅用本益比來決定你是否應該出售你的股票是不明智的,但它可以成為公司未來前景的實用指南。

We've established that Fraser and Neave currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

我們已經確定,弗雷澤和尼夫目前的本益比高於預期,因為它最近的收益在中期內一直在下降。當我們看到盈利出現倒退,表現遜於市場預期時,我們懷疑股價有下跌的風險,導致溫和的本益比走低。如果近期的中期盈利趨勢持續下去,將使股東的投資面臨風險,潛在投資者面臨支付不必要溢價的危險。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Fraser and Neave (at least 1 which is concerning), and understanding them should be part of your investment process.

總是有必要考慮到投資風險的幽靈無處不在。我們在弗雷澤和尼夫身上發現了兩個警告信號(至少有1個是相關的),理解它們應該是你投資過程的一部分。

If these risks are making you reconsider your opinion on Fraser and Neave, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果這些風險讓你重新考慮你對弗雷澤和尼夫的看法,探索我們的高質量股票互動列表,以瞭解還有什麼。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.