Shenzhen Changfang Group Co., Ltd.'s (SZSE:300301) Price Is Right But Growth Is Lacking After Shares Rocket 35%

Shenzhen Changfang Group Co., Ltd.'s (SZSE:300301) Price Is Right But Growth Is Lacking After Shares Rocket 35%

The Shenzhen Changfang Group Co., Ltd. (SZSE:300301) share price has done very well over the last month, posting an excellent gain of 35%. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

這個深圳市長方集團有限公司。(SZSE:300301)過去一個月股價表現非常好,錄得35%的出色漲幅。從更廣泛的角度來看,儘管沒有上個月那麼強勁,但全年15%的漲幅也是相當合理的。

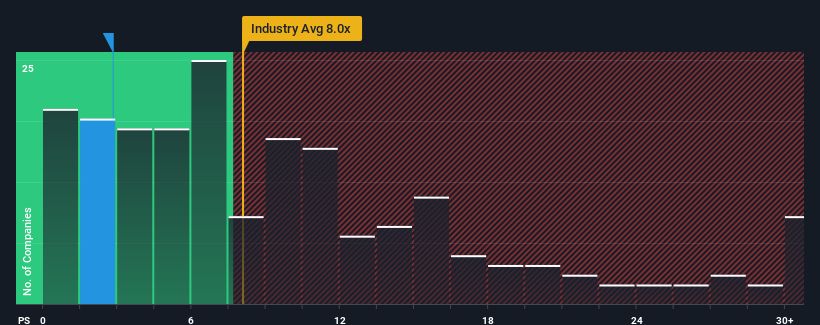

Even after such a large jump in price, Shenzhen Changfang Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.8x, since almost half of all companies in the Semiconductor industry in China have P/S ratios greater than 8x and even P/S higher than 15x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

即使在價格如此大幅上漲之後,深圳長方集團目前仍可能發出非常看漲的信號,其市售比(P/S)為2.8倍,因為在中國半導體行業,幾乎一半公司的P/S比率高於8倍,即使P/S高於15倍也並不罕見。然而,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此有限。

View our latest analysis for Shenzhen Changfang Group

查看我們對深圳長方集團的最新分析

How Shenzhen Changfang Group Has Been Performing

深圳長方集團是如何表現的

For instance, Shenzhen Changfang Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Shenzhen Changfang Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

例如,深圳長方集團近期營收下滑的情況一定值得深思。或許市場認為最近的營收表現不足以跟上行業的步伐,導致本益比與S比率受到影響。那些看好深圳長方集團的人會希望情況並非如此,這樣他們才能以較低的估值買入該股。

How Is Shenzhen Changfang Group's Revenue Growth Trending?

深圳長方集團營收增長趨勢如何?

The only time you'd be truly comfortable seeing a P/S as depressed as Shenzhen Changfang Group's is when the company's growth is on track to lag the industry decidedly.

只有當深圳長方集團的增長明顯落後於行業的時候,你才會真正放心地看到本益比/S像深圳長方集團這樣低迷。

Retrospectively, the last year delivered a frustrating 57% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 54% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

回顧過去一年,該公司的營收令人沮喪地下降了57%。這意味著它的長期營收也出現了下滑,因為過去三年的總營收下降了54%。因此,公平地說,最近的收入增長對公司來說是不可取的。

In contrast to the company, the rest of the industry is expected to grow by 39% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

與該公司形成鮮明對比的是,該行業其他業務預計明年將增長39%,這確實讓人對該公司最近的中期收入下降有了正確的認識。

In light of this, it's understandable that Shenzhen Changfang Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

有鑒於此,深圳長方集團的P/S會低於大多數其他公司也是可以理解的。儘管如此,不能保證P/S已經觸底,營收出現了逆轉。如果該公司不改善其營收增長,本益比S有可能跌至更低的水準。

What Does Shenzhen Changfang Group's P/S Mean For Investors?

深圳長方集團的P/S對投資者意味著什麼?

Even after such a strong price move, Shenzhen Changfang Group's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

即使在如此強勁的價格變動之後,深圳長方集團的本益比S仍落後於行業其他公司。我們會說,市銷率的力量主要不是作為一種估值工具,而是衡量當前投資者的情緒和未來預期。

As we suspected, our examination of Shenzhen Changfang Group revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

正如我們懷疑的那樣,我們對深圳長方集團的調查顯示,考慮到該行業將會增長,該集團中期營收萎縮是導致其本益比較低的原因之一。在這個階段,投資者認為營收改善的潛力還不夠大,不足以證明提高本益比和S比率是合理的。如果近期的中期營收趨勢繼續下去,在這種情況下,很難看到股價在不久的將來向任何一個方向強勁移動。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Shenzhen Changfang Group (at least 2 which make us uncomfortable), and understanding them should be part of your investment process.

總是有必要考慮到投資風險的幽靈無處不在。我們已經與深圳長方集團確認了3個警示標誌(至少有兩個讓我們不舒服),理解它們應該是你投資過程的一部分。

If you're unsure about the strength of Shenzhen Changfang Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不確定深圳長方集團的業務實力,為什麼不探索我們的互動列表,為其他一些你可能沒有達到預期的公司提供堅實的商業基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.