Do DRDGOLD's (NYSE:DRD) Earnings Warrant Your Attention?

Do DRDGOLD's (NYSE:DRD) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

投資者往往以發現“下一個大事件”為指導,即使這意味著在沒有任何收入、更不用說利潤的情況下買入“故事股”。不幸的是,這些高風險的投資往往不太可能獲得回報,許多投資者為此付出了代價。雖然一家資金雄厚的公司可能會虧損多年,但它最終需要創造利潤,否則投資者就會離開,公司就會枯萎。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like DRDGOLD (NYSE:DRD). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

因此,如果這種高風險和高回報的想法不適合,你可能會對盈利的、成長型的公司更感興趣,比如DRDGold(紐約證券交易所代碼:DRD)。雖然這並不一定意味著它是否被低估了,但該業務的盈利能力足以證明它有一定的升值價值--特別是如果它在增長的話。

See our latest analysis for DRDGOLD

查看我們對DRDGold的最新分析

How Quickly Is DRDGOLD Increasing Earnings Per Share?

DRDGold的每股收益增長速度有多快?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that DRDGOLD's EPS has grown 22% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

如果一家公司能夠在足夠長的時間內保持每股收益(EPS)的增長,其股價最終應該會隨之而來。這意味著,大多數成功的長期投資者認為,每股收益的增長是一個真正的積極因素。股東們會很高興地知道,DRDGold的每股收益在過去三年裡以每年22%的復合增長率增長。一般來說,我們會說,如果一家公司能夠跟上那在某種程度上的增長,股東們將喜氣洋洋。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. DRDGOLD shareholders can take confidence from the fact that EBIT margins are up from 24% to 26%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

營收增長是一個很好的指標,表明增長是可持續的,再加上高息稅前利潤(EBIT)利潤率,這是一家公司在市場上保持競爭優勢的絕佳方式。DRDGold的股東可以從息稅前利潤從24%上升到26%,以及收入不斷增長的事實中獲得信心。在我們的書中,勾選這兩個方框是增長的一個好跡象。

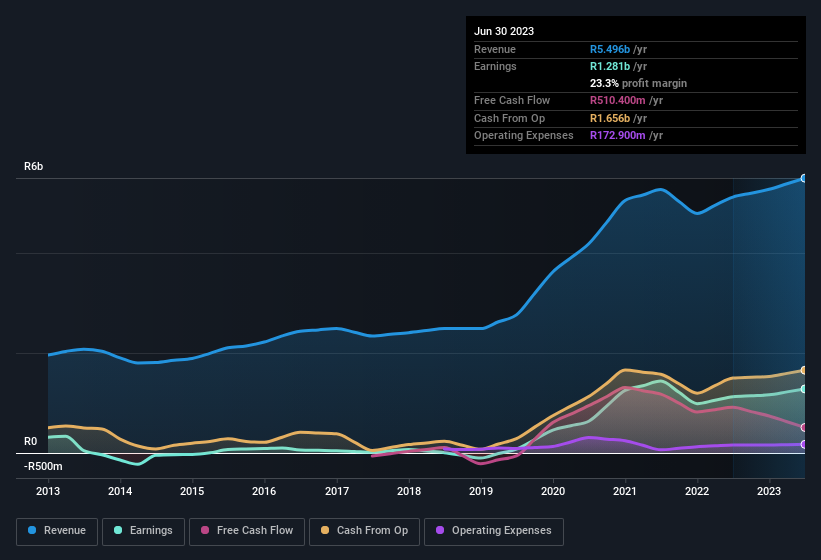

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

在下面的圖表中,你可以看到該公司如何隨著時間的推移實現了收益和收入的增長。要查看實際數位,請點擊圖表。

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check DRDGOLD's balance sheet strength, before getting too excited.

雖然看到利潤增長總是好事,但你應該始終記住,疲軟的資產負債表可能會回來產生影響。因此,在過於興奮之前,先檢查一下DRDGold的資產負債表實力。

Are DRDGOLD Insiders Aligned With All Shareholders?

DRDGold內部人員是否與所有股東一致?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to DRDGOLD, with market caps between R7.6b and R30b, is around R69m.

調查一家公司的薪酬政策是一個好習慣,以確保首席執行官和管理團隊不會將自己的利益置於薪酬過高的股東利益之上。市值在76億至30億蘭特之間、規模與DRDGold類似的公司的首席執行官的總薪酬中值約為6900萬蘭特。

DRDGOLD's CEO took home a total compensation package of R22m in the year prior to June 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

在2022年6月之前的一年裡,DRDGold的首席執行官總共拿到了2200萬蘭特的薪酬。這顯然遠低於平均水準,因此乍一看,這種安排對股東來說似乎很慷慨,也表明了一種適度的薪酬文化。CEO薪酬水準不是投資者最重要的衡量標準,但當薪酬適中時,這確實有助於加強CEO與普通股東之間的一致性。一般來說,可以認為合理的薪酬水準證明瞭良好的決策能力。

Is DRDGOLD Worth Keeping An Eye On?

DRDGold值得關注嗎?

If you believe that share price follows earnings per share you should definitely be delving further into DRDGOLD's strong EPS growth. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for DRDGOLD (1 makes us a bit uncomfortable) you should be aware of.

如果你相信股價跟隨每股收益,你肯定應該進一步研究DRDGold強勁的每股收益增長。快速的增長是個好兆頭,而非常合理的CEO薪酬有助於建立對董事會的一些信心。因此,這只股票非常值得添加到您的觀察名單中,因為它具有為股東提供巨大價值的潛力。別忘了,可能還會有風險。例如,我們已經確定2個DRDGold的警告標誌(1讓我們有點不舒服)你應該知道。

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

投資的美妙之處在於,你幾乎可以投資任何你想投資的公司。但如果你更願意關注那些表現出內幕收購的股票,這裡有一份過去三個月內有內幕收購的公司名單。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易指的是相關司法管轄區內的應報告交易.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.