Benign Growth For Applied DNA Sciences, Inc. (NASDAQ:APDN) Underpins Stock's 27% Plummet

Benign Growth For Applied DNA Sciences, Inc. (NASDAQ:APDN) Underpins Stock's 27% Plummet

Unfortunately for some shareholders, the Applied DNA Sciences, Inc. (NASDAQ:APDN) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

不幸的是,對於一些股東來說,應用DNA科學公司。納斯達克(新浪納斯達克:APDN)股價在過去30天裡暴跌27%,延續了最近的痛苦。對於任何長期股東來說,最後一個月以鎖定股價下跌57%的方式結束了一年的忘記。

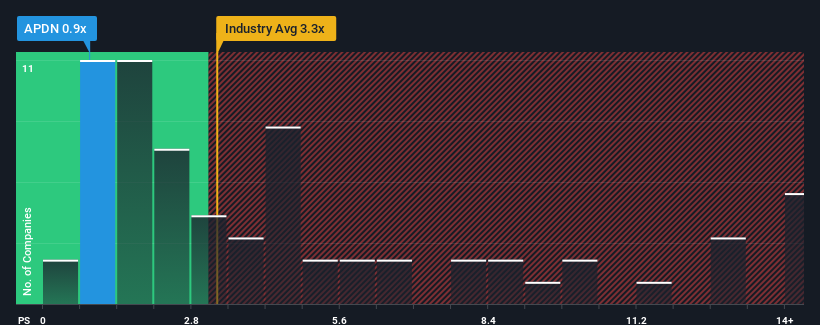

Following the heavy fall in price, Applied DNA Sciences' price-to-sales (or "P/S") ratio of 0.9x might make it look like a strong buy right now compared to the wider Life Sciences industry in the United States, where around half of the companies have P/S ratios above 3.3x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

隨著股價的大幅下跌,應用DNA科學公司0.9倍的市售比(P/S)可能會讓它看起來像是一個強勁的買入對象。在美國,大約一半的公司的P/S比率高於3.3倍,甚至P/S高於7倍的情況也很常見。然而,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此有限。

View our latest analysis for Applied DNA Sciences

查看我們對應用DNA科學的最新分析

How Has Applied DNA Sciences Performed Recently?

應用DNA科學最近表現如何?

While the industry has experienced revenue growth lately, Applied DNA Sciences' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

雖然該行業最近經歷了收入增長,但應用DNA科學的收入卻出現了逆轉,這並不是很好。本益比與S的比率之所以偏低,可能是因為投資者認為這種糟糕的營收表現不會好轉。如果是這樣的話,現有股東很可能很難對股價的未來走勢感到興奮。

How Is Applied DNA Sciences' Revenue Growth Trending?

應用DNA科學的收入增長趨勢如何?

Applied DNA Sciences' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

對於一家預計增長非常緩慢,甚至收入下降,更重要的是,表現遠遜於行業的公司來說,應用DNA科學的P/S比率是典型的。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.5%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

回顧過去一年的財務狀況,我們沮喪地看到該公司的收入下降到了8.5%。令人驚嘆的是,儘管過去12個月經歷了一些不利因素,但三年的收入增長卻激增了幾個數量級。因此,儘管該公司過去做得很好,但看到收入增長如此嚴重地下滑,有些令人擔憂。

Looking ahead now, revenue is anticipated to slump, contracting by 29% during the coming year according to the two analysts following the company. Meanwhile, the broader industry is forecast to expand by 0.7%, which paints a poor picture.

根據跟蹤該公司的兩位分析師的說法,展望未來,收入預計將大幅下滑,來年將收縮29%。與此同時,更廣泛的行業預計將增長0.7%,這描繪了一幅糟糕的圖景。

With this in consideration, we find it intriguing that Applied DNA Sciences' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

考慮到這一點,我們發現耐人尋味的是,應用DNA科學的P/S與其行業同行不相上下。然而,營收縮水不太可能帶來長期穩定的本益比/S。如果該公司不改善其營收增長,本益比S有可能跌至更低的水準。

What Does Applied DNA Sciences' P/S Mean For Investors?

應用DNA科學的P/S對投資者意味著什麼?

Applied DNA Sciences' P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

應用DNA科學公司的P/S最近看起來和它的股價一樣疲軟。一般來說,我們傾向於將市銷率的使用限制在確定市場對公司整體健康狀況的看法上。

It's clear to see that Applied DNA Sciences maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Applied DNA Sciences' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

很明顯,正如預期的那樣,應用DNA科學維持其較低的本益比S,原因是其對營收下滑的預測疲軟。就在業內其他公司都在預測營收增長之際,應用DNA科學的糟糕前景證明其低本益比是合理的。在這種情況下,很難看到股價在不久的將來強勁上漲。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Applied DNA Sciences (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

總是有必要考慮到投資風險的幽靈無處不在。我們已經確定了應用DNA科學公司的5個警告信號(至少有一個不應該被忽視),理解這些應該是你投資過程的一部分。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是確保你尋找的是一家偉大的公司,而不僅僅是你遇到的第一個想法。因此,如果不斷增長的盈利能力符合你對一家偉大公司的看法,不妨看看這一點免費近期收益增長強勁(本益比較低)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.