Review of today's ETF market

The three major A-share indexes closed down today. by the close, the Prev index was down 0.70%, the Shenzhen index was down 0.56%, and the gem index was down 0.53%. The turnover in Shanghai and Shenzhen is 774.7 billion yuan. More than 3100 stocks in the two markets fell, with a net sale of 5.472 billion yuan for northward funds. Plate theme, Hongmeng concept, Huawei Euler, memory chips and other sectors led the rise; weight loss drug concept, Chinese prefix stocks fell.

As for ETF, Japanese stocks rose, with Huaan fund Nikkei 225ETF and Nikkei 225ETF up 2.43% and 2.22% respectively. Science and Internet stocks rose across the board, with Warburg Fund Hong Kong stock Internet ETF up 1.76 per cent. Us stocks rose overnight, with PowerShares QQQ Trust, Series 1, the foreign exchange fund, up 1.62 per cent.

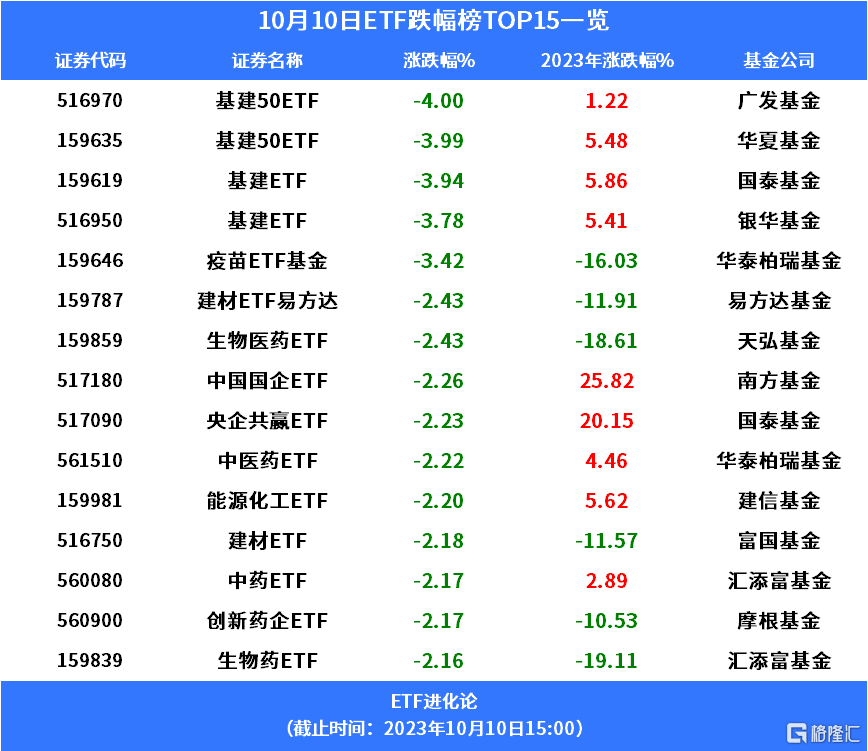

Infrastructure stocks fell across the board, with infrastructure 50ETF and infrastructure ETF down 4 per cent and 3.94 per cent respectively. Vaccine stocks fell back, vaccine ETF fund and biomedical ETF fell 3.42% and 2.43% respectively. Chinese prefix stocks weakened, with Chinese state-owned enterprise ETF and state-owned enterprise win-win ETF down 2.26% and 2.23% respectively.

II. Today's ETF transaction

In terms of turnover, bond ETF and currency ETF ranked top, and index ETF was also favored by investors. Today, the turnover of 17 ETF is more than 1 billion yuan, and that of 115 ETF is more than 100 million yuan.

Among them, the turnover of short-term ETF was 15.929 billion yuan, ranking first, while Huabao Tianyi ETF and Yinhua ETF also ranked second and third, respectively, with a turnover of more than 10 billion yuan. Among the stock ETF, Shanghai and Shenzhen 300ETF, Hang Seng Internet ETF and Kechuang 50ETF are in the forefront.

Comments on today's ETF market

Today, the A-share market opened high, then fell back, and the three major indexes collectively closed down. By the close, the Prev index was down 0.7 per cent at 3075.24 points, the Shenzhen index was down 0.56 per cent, and the gem index was down 0.53 per cent. Individual stocks fell more than rose less, the city's more than 3100 stocks fell.

In terms of volume and energy, the volume continued to enlarge slightly, with a turnover of 774.7 billion between the two cities, 4.7 billion higher than that of the previous trading day. Northbound funds are still sold, with a net outflow of 5.471 billion yuan throughout the day.

On the disk, Huawei industrial chain continued to be active, Hongmeng led the rise, surveying and mapping shares, run and software both 20cm limit, Dahua Intelligence, Changshan Beiming, Zhi du shares and other shares rose by the limit; Huawei Automobile continued to strengthen, Cyrus, Sheng long shares both rose out of the 3-link board; Star Flash concept stocks rose in late trading, Gao Hong shares rose by the limit. On the news, Huawei plans to increase smartphone shipments to 70 million next year.

The memory chip plate is active throughout the day, so that it can rise by the daily limit and get out of 5 consecutive boards. On the news, the South Korean president's office said on Monday that the United States had decided that Samsung Electronics and SK Hynix could supply chip equipment to their Chinese factories without prior approval. In addition, Lexar Rexa developed the world's first 512GB NM Card memory card to complete compatibility testing with Huawei's latest Mate 60 series.

In terms of decline, the weight loss drug plate pullback, Germany exhibition health limit. The prefix plate fell, while Sinosteel International, China Engineering International and China Timber International all fell by the limit.

Recently, the market of individual stocks related to Huawei's industrial chain has been repeatedly interpreted, becoming the main line of the market, and the internal rotation has also been formed. Before the core target ebbs, the market may continue. However, in addition to Kaihua concept stocks, most of the market fell in other directions, individual stocks fell more and rose less, and some Chinese concept stocks fell today.On the whole, there is a more differentiated trend at present..

CITIC saidAt present, the triple bottom of policy, economy and market has been established. Looking forward to the fourth quarter, positive factors gradually accumulate, risk factors are relatively limited, and the market driven by reversal is expected to be ready..

Fourth, ETF News Quick View Today

The number and scale of new ETF launches in the third quarter reached the highest level of the year.

By the end of the third quarter, a total of 107 new ETF had been established during the year, with a total issuance share of more than 75.2 billion. Among them, the number of new ETF established in the third quarter reached 49, an increase of 24 and 16 respectively over the first and second quarters, and the issuance scale was 33.029 billion, an increase of 12.724 billion and 11.076 billion respectively over the first and second quarters. The size of ETF issuance in September hit a year-high of 15.679 billion.

30 CSC 2000 related products are queued for approval.

By the end of the third quarter, the first batch of 10 CSI 2000ETF, 9 have been officially established. According to the latest product approval progress of the CSRC, as of October 7, 30 funds tracking the CSI 2000 index were waiting in line for approval, involving 27 fund managers.

Institutions huddled into the fieldETF

According to the listing documents of China Securities and Hong Kong Stock Exchange mainland Financial ETF, which will be listed on October 11, as of September 26, two foreign institutions have emerged among the top 10 holders of the product, with UBS and Barclays being the second and third largest holders respectively. The largest holder of the product is a FOF management plan under Guojun Capital Management, and a private equity fund owned by Shanghai Lizhen Investment also ranks the 10th largest holder of the ETF. Several large-scale SSE Kechuang 100ETF and CSI 2000ETF are also favored by institutions.

Wide-based ETF becomes the main battlefield of capital increase.

In the third quarter of 2023 with the overall shock adjustment of the market and the continuous rotation of the industry theme, equity ETF (including enhanced index funds, international (QDII) equity funds, passive index funds) still received a net inflow of more than 250 billion yuan, of which the wide-based index ETF has become the main battlefield of capital positions. ETF, which tracks the CSI 300 index, was the most sought after target in the third quarter of this year, with a total net inflow of more than 90 billion yuan in the third quarter.

Hong Kong Stock Exchange Pharmaceutical ETF (159776) Fund share reached a new high for the year.

Hong Kong stocks were active in early trading today, with the CSI Hong Kong Stock Exchange Medicine and Health Composite Index (930965) up 1.04 per cent. The Hong Kong Stock Exchange Pharmaceutical ETF (159776), which closely tracks the index, fluctuated slightly in intraday trading, with a turnover rate of nearly 5 per cent. In the past 10 trading days, more than 50 million of funds have flowed into Hong Kong Stock Exchange Pharmaceutical ETF (159776). In addition, the latest share of the ETF continues to be at the highest level of the year.

V. the latest developments of fund products