Why Investors Shouldn't Be Surprised By 9F Inc.'s (NASDAQ:JFU) 33% Share Price Plunge

Why Investors Shouldn't Be Surprised By 9F Inc.'s (NASDAQ:JFU) 33% Share Price Plunge

Unfortunately for some shareholders, the 9F Inc. (NASDAQ:JFU) share price has dived 33% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

不幸的是,對於一些股東來說,玖富。納斯達克(Sequoia Capital:JFU)股價在過去30天裡暴跌33%,延續了最近的痛苦。最近的下跌為股東們災難性的12個月畫上了句號,在此期間,他們坐擁64%的損失。

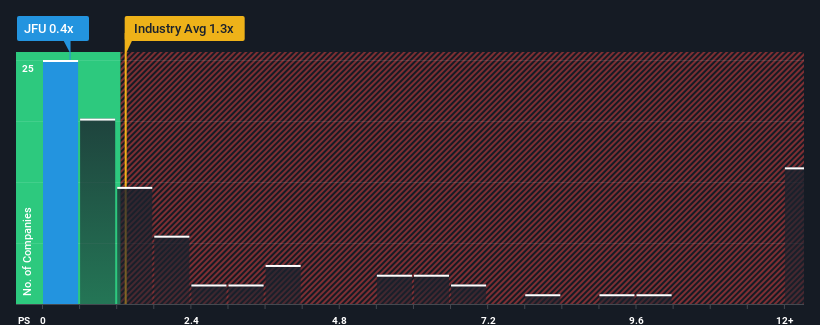

Following the heavy fall in price, 9F may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Interactive Media and Services industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

隨著價格的大幅下跌,9F目前可能發出了看漲信號,其市銷率(或稱“P/S”)為0.4倍,因為在美國互動媒體和服務行業,幾乎一半的公司P/S比率超過1.3倍,即使P/S高於4倍也並不少見。儘管如此,只看本益比/S的面值是不明智的,因為可能會有一個解釋為什麼它是有限的。

View our latest analysis for 9F

查看我們對9F的最新分析

How Has 9F Performed Recently?

9F最近的表現如何?

For example, consider that 9F's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

例如,考慮到9F最近的財務表現一直很差,因為它的收入一直在下降。或許市場認為最近的營收表現不足以跟上行業的步伐,導致本益比與S比率受到影響。然而,如果這不是最終的結果,那麼現有股東可能對未來股價的走勢感到樂觀。

How Is 9F's Revenue Growth Trending?

9F的收入增長趨勢如何?

In order to justify its P/S ratio, 9F would need to produce sluggish growth that's trailing the industry.

為了證明其本益比/S比率是合理的,9F需要產生落後於行業的低迷增長。

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. As a result, revenue from three years ago have also fallen 87% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

回顧過去一年,該公司的營收令人沮喪地下降了26%。因此,三年前的整體營收也下降了87%。因此,不幸的是,我們不得不承認,在這段時間裡,該公司在收入增長方面做得並不出色。

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's an unpleasant look.

將這一中期收入軌跡與整個行業一年內增長13%的預測進行比較,可以看出這是一個令人不快的前景。

With this information, we are not surprised that 9F is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

有了這些資訊,我們對9F的本益比低於行業並不感到驚訝。然而,我們認為,營收縮水不太可能帶來長期穩定的本益比/S,這可能會讓股東們對未來的失望感到失望。即使只是維持這些價格也可能很難實現,因為最近的收入趨勢已經在拖累股價。

What We Can Learn From 9F's P/S?

我們能從9F的P/S身上學到什麼?

9F's recently weak share price has pulled its P/S back below other Interactive Media and Services companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

9F最近股價疲軟,已將其本益比拉回低於其他互動媒體和服務公司的水準。僅僅用市銷率來決定你是否應該出售你的股票是不明智的,但它可以成為公司未來前景的實用指南。

It's no surprise that 9F maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

在中期營收下滑的情況下,9F維持較低的本益比也就不足為奇了。目前,股東們正在接受S的低本益比,因為他們承認,未來的收入可能也不會帶來任何驚喜。如果近期的中期營收趨勢繼續下去,在這種情況下,很難看到股價在不久的將來向任何一個方向強勁移動。

There are also other vital risk factors to consider and we've discovered 3 warning signs for 9F (1 shouldn't be ignored!) that you should be aware of before investing here.

還有其他重要的風險因素需要考慮,我們發現9F的3個警告標誌(1不應該被忽視!)在這裡投資之前你應該意識到這一點。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是確保你尋找的是一家偉大的公司,而不僅僅是你遇到的第一個想法。因此,如果不斷增長的盈利能力符合你對一家偉大公司的看法,不妨看看這一點免費近期收益增長強勁(本益比較低)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.