Calculating The Intrinsic Value Of Sunshine Global Circuits Co.,Ltd. (SZSE:300739)

Calculating The Intrinsic Value Of Sunshine Global Circuits Co.,Ltd. (SZSE:300739)

Key Insights

主要見解

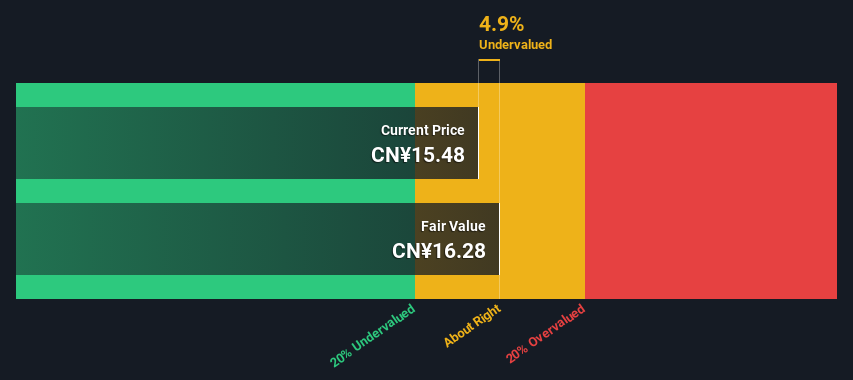

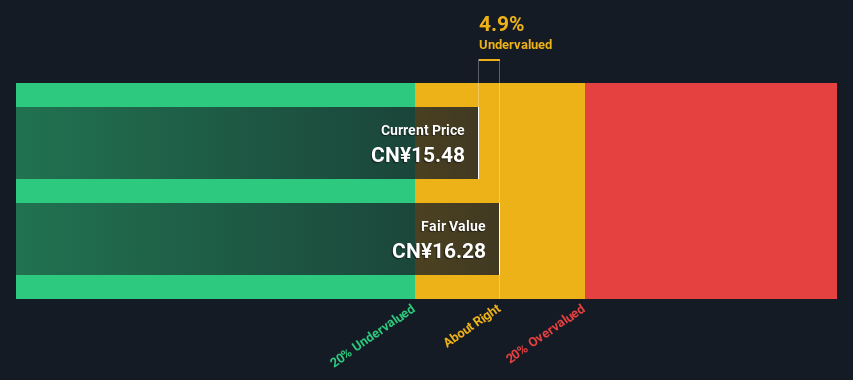

- The projected fair value for Sunshine Global CircuitsLtd is CN¥16.28 based on 2 Stage Free Cash Flow to Equity

- With CN¥15.48 share price, Sunshine Global CircuitsLtd appears to be trading close to its estimated fair value

- The average premium for Sunshine Global CircuitsLtd's competitorsis currently 74,398%

- 陽光環球電路有限公司的預計公允價值為16.28加元,基於兩階段自由現金流轉股權

- 以15.48元人民幣的股價,陽光環球電路有限公司的股價似乎接近其估計的公允價值

- 陽光全球電路有限公司的競爭對手目前的平均保費為74,398%

How far off is Sunshine Global Circuits Co.,Ltd. (SZSE:300739) from its intrinsic value? Using the most recent financial data, we'll take a look at whether the stock is fairly priced by projecting its future cash flows and then discounting them to today's value. The Discounted Cash Flow (DCF) model is the tool we will apply to do this. Believe it or not, it's not too difficult to follow, as you'll see from our example!

陽光環球電路股份有限公司(SZSE:300739)離其內在價值還有多遠?使用最新的財務數據,我們將通過預測未來的現金流,然後將其貼現到今天的價值,來看看股票的定價是否公平。貼現現金流(DCF)模型是我們將應用的工具。信不信由你,遵循它並不太難,正如您將從我們的示例中看到的那樣!

Remember though, that there are many ways to estimate a company's value, and a DCF is just one method. If you still have some burning questions about this type of valuation, take a look at the Simply Wall St analysis model.

不過請記住,有很多方法可以評估一家公司的價值,貼現現金流只是其中一種方法。如果你對這類估值還有一些亟待解決的問題,不妨看看Simply Wall St.的分析模型。

See our latest analysis for Sunshine Global CircuitsLtd

查看我們對陽光全球電路有限公司的最新分析

The Method

該方法

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. In the first stage we need to estimate the cash flows to the business over the next ten years. Seeing as no analyst estimates of free cash flow are available to us, we have extrapolate the previous free cash flow (FCF) from the company's last reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

我們使用的是兩階段增長模型,也就是說,我們考慮了公司發展的兩個階段。在初期,公司可能有較高的增長率,而第二階段通常被假設為有一個穩定的增長率。在第一階段,我們需要估計未來十年為企業帶來的現金流。由於沒有分析師對自由現金流的估計,我們根據公司最近報告的價值推斷出了之前的自由現金流(FCF)。我們假設,自由現金流萎縮的公司將減緩收縮速度,而自由現金流增長的公司在這段時間內的增長速度將放緩。我們這樣做是為了反映出,增長在最初幾年往往比後來幾年放緩得更多。

Generally we assume that a dollar today is more valuable than a dollar in the future, so we discount the value of these future cash flows to their estimated value in today's dollars:

一般來說,我們假設今天的一美元比未來的一美元更有價值,所以我們將這些未來現金流的價值貼現到以今天美元計算的估計價值:

10-year free cash flow (FCF) forecast

10年自由現金流(FCF)預測

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF (CN¥, Millions) | CN¥183.6m | CN¥247.9m | CN¥311.1m | CN¥369.4m | CN¥421.3m | CN¥466.6m | CN¥506.1m | CN¥540.7m | CN¥571.6m | CN¥599.7m |

| Growth Rate Estimate Source | Est @ 48.76% | Est @ 35.06% | Est @ 25.46% | Est @ 18.75% | Est @ 14.05% | Est @ 10.76% | Est @ 8.45% | Est @ 6.84% | Est @ 5.71% | Est @ 4.92% |

| Present Value (CN¥, Millions) Discounted @ 11% | CN¥165 | CN¥201 | CN¥226 | CN¥242 | CN¥248 | CN¥247 | CN¥241 | CN¥231 | CN¥220 | CN¥208 |

| 2023年 | 二零二四年 | 2025年年 | 二零二六年 | 2027年 | 2028年 | 2029年 | 二0三0 | 2031年 | 2032年 | |

| 槓桿FCF(CN元,百萬元) | CN元1.836億元 | 淨額2.479億元 | CN元3.111億元 | 淨額3.694億元 | 淨額4.213億元 | CN元4.666億元 | CN元5.061億元 | CN元5.407億元 | CN元5.71.6億元 | CN元5.997億元 |

| 增長率預估來源 | Est@48.76% | Est@35.06% | Est@25.46% | Est@18.75% | Est@14.05% | Est@10.76% | Est@8.45% | Est@6.84% | Est@5.71% | Est@4.92% |

| 現值(CN元,百萬)折現@11% | CN元165元 | CN元201元 | CN元226元 | CN元242元 | 人民幣248元 | CN元247元 | CN元241元 | CN元231元 | CN元220元 | CN元208元 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = CN¥2.2b

(“EST”=Simply Wall St.預估的FCF成長率)

10年期現金流現值(PVCF)=CN人民幣22億元

The second stage is also known as Terminal Value, this is the business's cash flow after the first stage. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (3.1%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 11%.

第二階段也被稱為終端價值,這是企業在第一階段之後的現金流。出於一些原因,使用了一個非常保守的增長率,不能超過一個國家的國內生產總值增長率。在這種情況下,我們使用了10年期政府債券收益率的5年平均值(3.1%)來估計未來的增長。與10年“增長”期一樣,我們使用11%的權益成本,將未來現金流貼現到今天的價值。

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = CN¥600m× (1 + 3.1%) ÷ (11%– 3.1%) = CN¥7.6b

終端值(TV)=FCF2032年×(1+g)?(r-g)=CN元600M×(1+3.1%)?(11%-3.1%)=CN元7.6b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= CN¥7.6b÷ ( 1 + 11%)10= CN¥2.6b

終值現值(PVTV)=TV/(1+r)10=CN元76億?(1+11%)10=CN人民幣26億元

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is CN¥4.9b. The last step is to then divide the equity value by the number of shares outstanding. Relative to the current share price of CN¥15.5, the company appears about fair value at a 4.9% discount to where the stock price trades currently. The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.

那麼,總價值或股權價值就是未來現金流的現值之和,在這種情況下,現金流為49億加元。最後一步是將股權價值除以流通股數量。相對於目前15.5元的股價,該公司的公允價值似乎比目前的股價有4.9%的折讓。任何計算中的假設都會對估值產生很大影響,因此最好將其視為粗略估計,而不是精確到最後一分錢。

Important Assumptions

重要假設

The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. Part of investing is coming up with your own evaluation of a company's future performance, so try the calculation yourself and check your own assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Sunshine Global CircuitsLtd as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 11%, which is based on a levered beta of 1.134. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

上述計算在很大程度上取決於兩個假設。第一個是貼現率,另一個是現金流。投資的一部分是你自己對一家公司未來業績的評估,所以你自己試一試計算,檢查你自己的假設。DCF也沒有考慮一個行業可能的週期性,也沒有考慮一家公司未來的資本要求,因此它沒有給出一家公司潛在業績的全貌。鑑於我們將陽光全球電路有限公司視為潛在股東,股權成本被用作貼現率,而不是佔債務的資本成本(或加權平均資本成本,WACC)。在這個計算中,我們使用了11%,這是基於槓桿率為1.134的測試版。貝塔係數是衡量一隻股票相對於整個市場的波動性的指標。我們的貝塔係數來自全球可比公司的行業平均貝塔係數,強制限制在0.8到2.0之間,這是一個穩定業務的合理範圍。

Next Steps:

接下來的步驟:

Valuation is only one side of the coin in terms of building your investment thesis, and it is only one of many factors that you need to assess for a company. It's not possible to obtain a foolproof valuation with a DCF model. Instead the best use for a DCF model is to test certain assumptions and theories to see if they would lead to the company being undervalued or overvalued. If a company grows at a different rate, or if its cost of equity or risk free rate changes sharply, the output can look very different. For Sunshine Global CircuitsLtd, there are three essential factors you should look at:

就構建你的投資論點而言,估值只是硬幣的一面,它只是你需要為一家公司評估的眾多因素之一。用貼現現金流模型不可能獲得萬無一失的估值。相反,貼現現金流模型的最佳用途是測試某些假設和理論,看看它們是否會導致公司被低估或高估。如果一家公司以不同的速度增長,或者如果其股本成本或無風險利率大幅變化,產出可能看起來非常不同。對於陽光全球電路有限公司,你應該關注三個基本因素:

- Risks: We feel that you should assess the 1 warning sign for Sunshine Global CircuitsLtd we've flagged before making an investment in the company.

- Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

- Other Environmentally-Friendly Companies: Concerned about the environment and think consumers will buy eco-friendly products more and more? Browse through our interactive list of companies that are thinking about a greener future to discover some stocks you may not have thought of!

- 風險:我們認為您應該評估陽光環球電路有限公司的1個警告標誌在投資這家公司之前,我們已經做了標記。

- 其他穩固的企業:低債務、高股本回報率和良好的過去業績是強勁業務的基礎。為什麼不探索我們具有堅實商業基本面的股票的互動列表,看看是否有其他您可能沒有考慮過的公司!

- 其他環保公司:關注環境,認為消費者會越來越多地購買環保產品?瀏覽我們的互動列表,這些公司正在考慮更綠色的未來,發現一些你可能沒有想到的股票!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the SZSE every day. If you want to find the calculation for other stocks just search here.

PS.Simply Wall St.應用每天對深交所的每隻股票進行現金流貼現估值。如果你想找到其他股票的計算方法,只需蒐索此處。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。