More Unpleasant Surprises Could Be In Store For Affluent Partners Holdings Limited's (HKG:1466) Shares After Tumbling 27%

More Unpleasant Surprises Could Be In Store For Affluent Partners Holdings Limited's (HKG:1466) Shares After Tumbling 27%

To the annoyance of some shareholders, Affluent Partners Holdings Limited (HKG:1466) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 241% in the last twelve months.

令一些股東惱火的是,富豪合夥控股有限公司(HKG:1466)股價在過去一個月大幅下跌27%,延續了該公司可怕的漲勢。當然,從長遠來看,許多人仍希望自己持有股票,因為該公司股價在過去12個月裡飆升了241%。

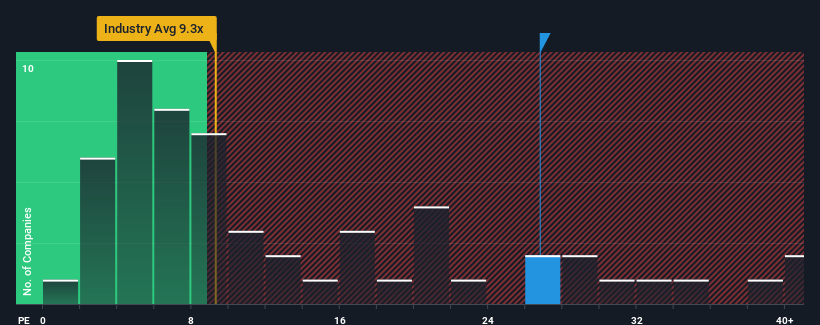

Even after such a large drop in price, Affluent Partners Holdings may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 26.8x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

即使股價出現如此大的跌幅,富裕合夥控股目前仍可能發出非常看跌的信號,本益比(P/E)為26.8倍,因為香港近一半的公司本益比低於9倍,即使本益比低於5倍也並不罕見。然而,本益比可能相當高是有原因的,需要進一步調查才能確定它是否合理。

For example, consider that Affluent Partners Holdings' financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

例如,考慮到富裕夥伴控股公司最近的財務表現相當普通,因為收益增長是不存在的。這可能是因為許多人預計未來一段時間平淡無奇的盈利表現會有所改善,這種表現阻止了本益比的崩潰。你真的希望如此,否則你會無緣無故地付出相當大的代價。

Check out our latest analysis for Affluent Partners Holdings

查看我們對富裕夥伴控股公司的最新分析

Does Growth Match The High P/E?

增長是否與高本益比相匹配?

The only time you'd be truly comfortable seeing a P/E as steep as Affluent Partners Holdings' is when the company's growth is on track to outshine the market decidedly.

只有當該公司的增長明顯超過市場時,你才會真正放心地看到該公司的本益比如此之高。

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

先回過頭來看,過去一年,該公司的每股收益幾乎沒有任何增長。這基本上是我們在過去三年中所看到的情況的延續,因為在整個時期內,它的每股收益增長幾乎為零。因此,股東們可能不會對完全沒有中期增長感到滿意。

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

這與其他市場形成對比,後者預計明年將增長25%,大大高於該公司最近的中期年化增長率。

With this information, we find it concerning that Affluent Partners Holdings is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

有了這些資訊,我們發現富裕夥伴控股公司的本益比高於市場。似乎大多數投資者忽視了最近相當有限的增長率,並希望該公司的業務前景有所好轉。只有最大膽的人才會認為這些價格是可持續的,因為最近盈利趨勢的延續最終可能會對股價造成沉重壓力。

The Bottom Line On Affluent Partners Holdings' P/E

富裕合夥人控股公司的本益比底線

Even after such a strong price drop, Affluent Partners Holdings' P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

即使在如此強勁的價格下跌之後,富裕夥伴控股公司的本益比仍然遠遠高於市場的其他部分。一般來說,我們傾向於限制本益比的使用,以確定市場對公司整體健康狀況的看法。

We've established that Affluent Partners Holdings currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

我們已經確定,富裕夥伴控股公司目前的本益比遠高於預期,因為該公司最近三年的增長低於更廣泛的市場預測。目前,我們對高本益比越來越感到不安,因為這種盈利表現不太可能長期支撐這種積極情緒。如果近期的中期盈利趨勢持續下去,將使股東的投資面臨重大風險,潛在投資者面臨支付過高溢價的危險。

And what about other risks? Every company has them, and we've spotted 3 warning signs for Affluent Partners Holdings (of which 1 can't be ignored!) you should know about.

還有其他風險呢?每家公司都有它們,我們已經發現富裕夥伴控股公司的3個警告信號(其中1個不容忽視!)你應該知道。

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果你對本益比感興趣,你可能想看看這個免費其他盈利增長強勁、本益比較低的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。