-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Shares of ABB Inc. (NYSE:ABB) increased by 10.12% in the past three months. When understanding a companies price change over a time period like 3 months, it could be helpful to look at its financials. One key aspect of a companies financials is its debt, but before we understand the importance of debt, let's look at how much debt ABB has.

ABB Debt

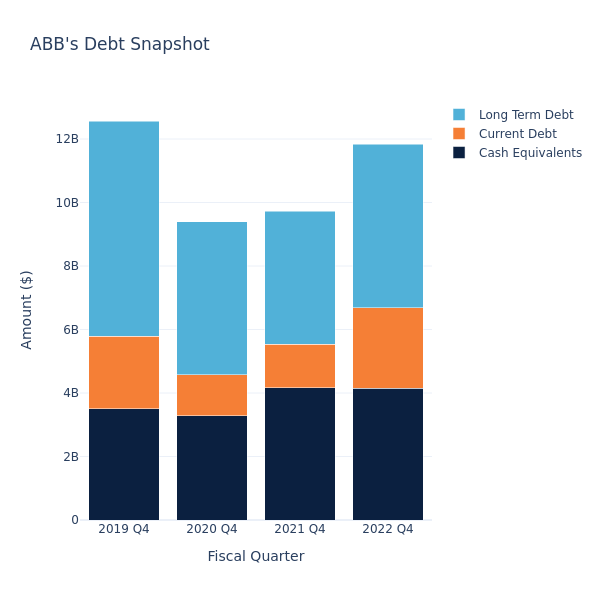

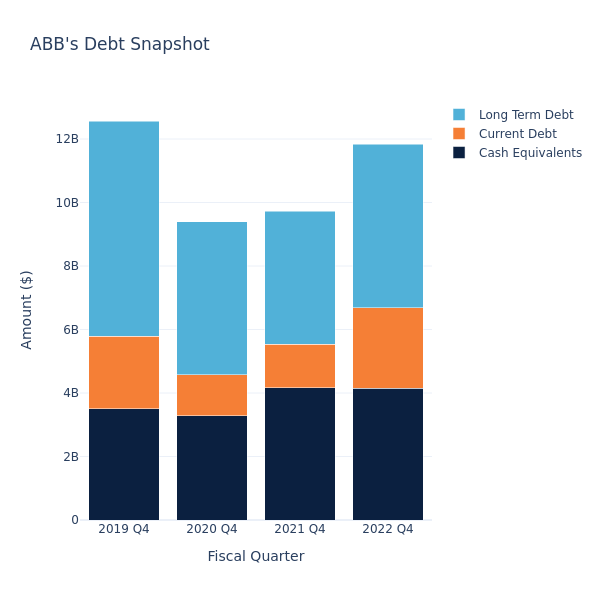

Based on ABB's balance sheet as of February 24, 2023, long-term debt is at $5.14 billion and current debt is at $2.54 billion, amounting to $7.68 billion in total debt. Adjusted for $4.16 billion in cash-equivalents, the company's net debt is at $3.52 billion.

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents includes cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

Investors look at the debt-ratio to understand how much financial leverage a company has. ABB has $39.15 billion in total assets, therefore making the debt-ratio 0.2. As a rule of thumb, a debt-ratio more than 1 indicates that a considerable portion of debt is funded by assets. A higher debt-ratio can also imply that the company might be putting itself at risk for default, if interest rates were to increase. However, debt-ratios vary widely across different industries. A debt ratio of 25% might be higher for one industry, but average for another.

Why Debt Is Important

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

Interest-payment obligations can impact the cash-flow of the company. Equity owners can keep excess profit, generated from the debt capital, when companies use the debt capital for its business operations.

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Shares of ABB Inc. (NYSE:ABB) increased by 10.12% in the past three months. When understanding a companies price change over a time period like 3 months, it could be helpful to look at its financials. One key aspect of a companies financials is its debt, but before we understand the importance of debt, let's look at how much debt ABB has.

在過去三個月中,ABB Inc.(紐約證券交易所代碼:ABB)的股價上漲了10.12%。在瞭解一家公司在3個月等時間內的價格變化時,查看其財務狀況可能會有所幫助。公司財務狀況的一個關鍵方面是其債務,但在我們瞭解債務的重要性之前,讓我們先看看ABB有多少債務。

ABB Debt

ABB 債務

Based on ABB's balance sheet as of February 24, 2023, long-term debt is at $5.14 billion and current debt is at $2.54 billion, amounting to $7.68 billion in total debt. Adjusted for $4.16 billion in cash-equivalents, the company's net debt is at $3.52 billion.

根據ABB截至2023年2月24日的資產負債表,長期債務爲51.4億美元,流動債務爲25.4億美元,總債務爲76.8億美元。經41.6億美元現金等價物調整後,該公司的淨負債爲35.2億美元。

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents includes cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

讓我們定義一下我們在上面段落中使用的一些術語。 當前債務 是公司在1年內到期的債務部分,而 長期債務 是 1 年以上到期的部分。 現金等價物 包括現金和任何到期期不超過 90 天的流動證券。 債務總額 等於當前債務加上長期債務減去現金等價物。

Investors look at the debt-ratio to understand how much financial leverage a company has. ABB has $39.15 billion in total assets, therefore making the debt-ratio 0.2. As a rule of thumb, a debt-ratio more than 1 indicates that a considerable portion of debt is funded by assets. A higher debt-ratio can also imply that the company might be putting itself at risk for default, if interest rates were to increase. However, debt-ratios vary widely across different industries. A debt ratio of 25% might be higher for one industry, but average for another.

投資者通過查看債務比率來了解一家公司的財務槓桿率。ABB的總資產爲391.5億美元,因此債務比率爲0.2。根據經驗,債務比率超過1表示相當一部分債務由資產融資。更高的債務比率也可能意味着,如果利率上升,公司可能會面臨違約風險。但是,不同行業的債務比率差異很大。一個行業的債務比率爲25%可能更高,但另一個行業的債務比率爲平均水平。

Why Debt Is Important

爲甚麼債務很重要

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

債務是公司資本結構中的重要因素,可以幫助其實現增長。債務的融資成本通常相對低於股權,這使其成爲高管的有吸引力的選擇。

Interest-payment obligations can impact the cash-flow of the company. Equity owners can keep excess profit, generated from the debt capital, when companies use the debt capital for its business operations.

利息支付義務可能會影響公司的現金流。當公司將債務資本用於業務運營時,股權所有者可以保留債務資本產生的超額利潤。

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.

正在尋找負債與權益比率低的股票?看看Benzinga Pro,這是一個市場研究平臺,它爲投資者提供了近乎即時的數十種股票指標,包括債務與權益比率。點擊此處瞭解更多信息。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動內容引擎生成,並由編輯審閱。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧