Investors Don't See Light At End Of Directel Holdings Limited's (HKG:8337) Tunnel And Push Stock Down 38%

Investors Don't See Light At End Of Directel Holdings Limited's (HKG:8337) Tunnel And Push Stock Down 38%

Directel Holdings Limited (HKG:8337) shares have retraced a considerable 38% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

Directel 控股有限公司 (HKG: 8337)股價在上個月大幅回落了38%,在很大程度上扭轉了近期穩健的表現。過去30天的下跌結束了股東艱難的一年,在此期間,股價下跌了24%。

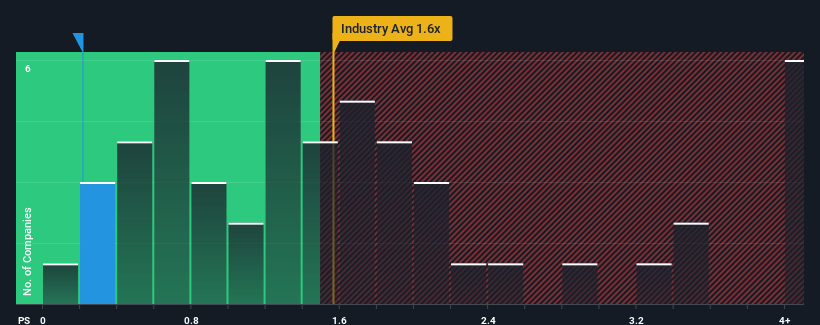

Following the heavy fall in price, it would be understandable if you think Directel Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Hong Kong's Wireless Telecom industry have P/S ratios above 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

在價格大幅下跌之後,考慮到香港無線電信行業近一半的公司的市盈率超過1.3倍,如果你認爲Directel Holdings是一隻投資前景良好的股票,市售比(或 “市盈率”)爲0.2倍,那是可以理解的。儘管如此,我們需要更深入地挖掘以確定降低P/S是否有合理的基礎。

Check out our latest analysis for Directel Holdings

看看我們對Directel Holdings的最新分析

How Directel Holdings Has Been Performing

Directel Holdings 的表現如何

For example, consider that Directel Holdings' financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

例如,假設由於收入不存在增長,Directel Holdings最近的財務表現相當普通。可能是許多人預計平淡無奇的收入表現將惡化,這壓制了市盈率。否則,現有股東可能會對股價的未來走向感到樂觀。

How Is Directel Holdings' Revenue Growth Trending?

Directel Holdings 的收入增長趨勢如何?

In order to justify its P/S ratio, Directel Holdings would need to produce sluggish growth that's trailing the industry.

爲了證明其市盈率的合理性,Directel Holdings需要實現落後於該行業的緩慢增長。

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 38% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

回想起來,去年的公司收入幾乎與前一年相同。缺乏增長對公司三年的總體業績沒有任何幫助,即收入下降了38%,令人不快地下降了38%。因此,不幸的是,我們必須承認,在那段時間裏,該公司在增加收入方面做得不好。

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.8% shows it's an unpleasant look.

將中期收入軌跡與整個行業一年來對8.8%的擴張預測進行權衡,這表明情況令人不快。

With this information, we are not surprised that Directel Holdings is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

有了這些信息,Directel Holdings的市盈率低於該行業也就不足爲奇了。但是,我們認爲,從長遠來看,收入萎縮不太可能導致市盈率穩定,這可能會使股東未來感到失望。如果該公司不改善收入增長,市盈率有可能降至更低的水平。

What Does Directel Holdings' P/S Mean For Investors?

Directel Holdings的市盈率對投資者意味着甚麼?

Directel Holdings' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Directel Holdings的市盈率及其股價均下跌。僅使用價格與銷售比率來確定是否應該出售股票是不明智的,但是它可以作爲公司未來前景的實用指南。

As we suspected, our examination of Directel Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

正如我們所懷疑的那樣,我們對Directel Holdings的審查顯示,鑑於該行業即將增長,其中期收入萎縮是其低市盈率的原因。目前,股東們正在接受低市盈率,因爲他們承認未來的收入可能也不會帶來任何驚喜。除非最近的中期條件有所改善,否則它們將繼續構成股價在這些水平附近的障礙。

Plus, you should also learn about these 3 warning signs we've spotted with Directel Holdings.

另外,你還應該瞭解這些 我們在Directel Holdings發現了3個警告信號。

If you're unsure about the strength of Directel Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你是 不確定 Directel Holdings 的業務實力,爲甚麼不瀏覽我們的互動股票清單,爲你可能錯過的其他一些公司提供堅實的商業基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂? 取得聯繫 直接和我們聯繫。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是一般性的。 我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章無意提供財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能未將最新的價格敏感型公司公告或定性材料考慮在內。簡而言之,華爾街對上述任何股票都沒有頭寸。