Vietnam Manufacturing and Export Processing (Holdings) Limited (HKG:422) Stock Rockets 43% As Investors Are Less Pessimistic Than Expected

Vietnam Manufacturing and Export Processing (Holdings) Limited (HKG:422) Stock Rockets 43% As Investors Are Less Pessimistic Than Expected

Vietnam Manufacturing and Export Processing (Holdings) Limited (HKG:422) shares have continued their recent momentum with a 43% gain in the last month alone. The last month tops off a massive increase of 118% in the last year.

越南製造及出口加工(控股)有限公司 (HKG: 422) 股價延續了最近的勢頭,僅在上個月就上漲了43%。上個月比去年大幅增長了118%。

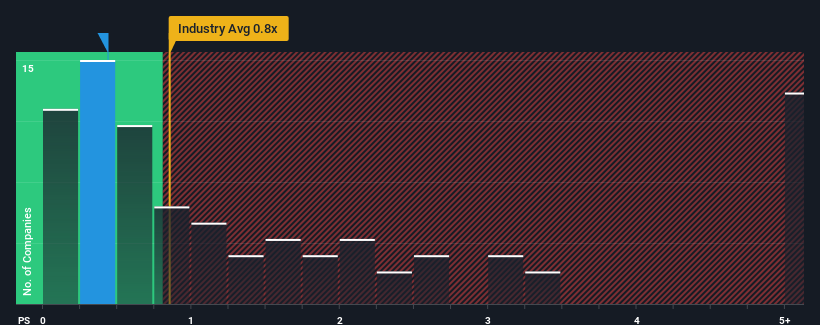

Although its price has surged higher, you could still be forgiven for feeling indifferent about Vietnam Manufacturing and Export Processing (Holdings)'s P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Auto industry in Hong Kong is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

儘管其價格已經飆升,但你對越南製造業和出口加工(控股)0.4倍的市盈率漠不關心還是可以原諒的,因爲香港汽車行業的市盈率(或 “P/S”)中位數也接近0.6倍。但是,在沒有解釋的情況下簡單地忽略市盈率是不明智的,因爲投資者可能忽略了明顯的機會或代價高昂的錯誤。

Check out our latest analysis for Vietnam Manufacturing and Export Processing (Holdings)

查看我們對越南製造業和出口加工(控股)的最新分析

How Has Vietnam Manufacturing and Export Processing (Holdings) Performed Recently?

越南製造業和出口加工(控股)最近表現如何?

Recent times have been quite advantageous for Vietnam Manufacturing and Export Processing (Holdings) as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

最近,越南製造和出口加工(控股)的收入增長非常迅速,這對越南製造業和出口加工(控股公司)來說是相當有利的。也許市場預計未來的收入表現將逐漸減弱,這使市盈率無法上漲。如果最終沒有發生這種情況,那麼現有股東就有理由對股價的未來走向感到樂觀。

Is There Some Revenue Growth Forecasted For Vietnam Manufacturing and Export Processing (Holdings)?

預計越南製造業和出口加工(控股)的收入會有所增長嗎?

In order to justify its P/S ratio, Vietnam Manufacturing and Export Processing (Holdings) would need to produce growth that's similar to the industry.

爲了證明其市盈率的合理性,越南製造業和出口加工(控股)需要實現與該行業相似的增長。

If we review the last year of revenue growth, the company posted a terrific increase of 43%. The latest three year period has also seen an excellent 34% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

如果我們回顧一下去年的收入增長,該公司公佈了43%的驚人增長。在最近三年的短期表現的推動下,總收入也大幅增長了34%。因此,股東們肯定會歡迎這些中期收入增長率。

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 38% shows it's noticeably less attractive.

將最近的中期收入趨勢與該行業的38%一年增長預測進行比較,可以看出它的吸引力明顯降低。

With this information, we find it interesting that Vietnam Manufacturing and Export Processing (Holdings) is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

有了這些信息,我們發現有趣的是,與該行業相比,越南製造和出口加工(控股)的市盈率相當相似。看來大多數投資者無視最近相當有限的增長率,願意爲該股的敞口付出代價。維持這些價格將很難實現,因爲近期收入趨勢的延續最終可能會壓低股價。

What We Can Learn From Vietnam Manufacturing and Export Processing (Holdings)'s P/S?

我們可以從越南製造業和出口加工(控股)的市盈中學到什麼?

Its shares have lifted substantially and now Vietnam Manufacturing and Export Processing (Holdings)'s P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

其股價已大幅上漲,現在越南製造業和出口加工(Holdings)的市盈率已回到了行業中位數的範圍內。有人認爲,在某些行業中,價格與銷售比率是衡量價值的劣等指標,但它可以成爲有力的商業情緒指標。

Our examination of Vietnam Manufacturing and Export Processing (Holdings) revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

我們對越南製造業和出口加工(控股)的審查顯示,其糟糕的三年收入趨勢並沒有導致市盈率低於我們的預期,因爲這些趨勢看起來比當前的行業前景還要糟糕。目前,我們對市盈率感到不舒服,因爲這種收入表現不太可能在很長一段時間內支持更積極的情緒。除非最近的中期狀況有所改善,否則很難接受當前的股價作爲公允價值。

Before you settle on your opinion, we've discovered 1 warning sign for Vietnam Manufacturing and Export Processing (Holdings) that you should be aware of.

在你確定自己的觀點之前,我們已經發現 越南製造業和出口加工(控股)有 1 個警告標誌 你應該知道的。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果你喜歡盈利的實力雄厚的公司,那麼你會想看看這個 免費的 以低市盈率交易(但已證明可以增加收益)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂? 取得聯繫 直接和我們聯繫。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是一般性的。 我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章無意提供財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能未將最新的價格敏感型公司公告或定性材料考慮在內。簡而言之,華爾街對上述任何股票都沒有頭寸。