Optimistic Investors Push Wing Fung Group Asia Limited (HKG:8526) Shares Up 69% But Growth Is Lacking

Optimistic Investors Push Wing Fung Group Asia Limited (HKG:8526) Shares Up 69% But Growth Is Lacking

Wing Fung Group Asia Limited (HKG:8526) shares have continued their recent momentum with a 69% gain in the last month alone. But the last month did very little to improve the 82% share price decline over the last year.

永豐集團亞洲有限公司 (HKG: 8526) 股價延續了最近的勢頭,僅在上個月就上漲了69%。但是上個月對改善去年82%的股價跌幅收效甚微。

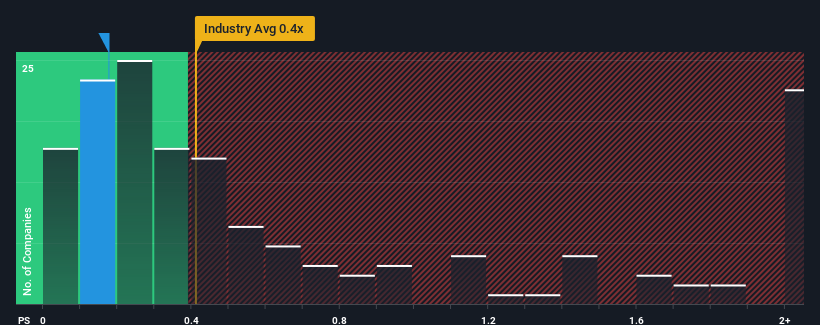

Even after such a large jump in price, there still wouldn't be many who think Wing Fung Group Asia's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Hong Kong's Construction industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

即使在價格大幅上漲之後,仍然沒有多少人認爲永豐集團亞洲0.2倍的市售比率(或 “市盈率”)值得一提,而香港建築業的市盈率中位數也差不多,約爲0.4倍。但是,如果市盈率沒有合理的基礎,投資者可能會忽視明顯的機會或潛在的挫折。

Check out our latest analysis for Wing Fung Group Asia

查看我們對永豐集團亞洲的最新分析

How Has Wing Fung Group Asia Performed Recently?

永豐集團亞洲最近表現如何?

Wing Fung Group Asia has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Wing Fung Group Asia will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

永豐集團亞洲最近表現不錯,收入一直以合理的速度增長。一種可能性是市盈率適中,因爲投資者認爲這種良好的收入增長可能只會在不久的將來與整個行業平行。那些看好永豐集團亞洲的人會希望情況並非如此,這樣他們就可以以較低的估值買入該股。

What Are Revenue Growth Metrics Telling Us About The P/S?

關於P/S,收入增長指標告訴我們甚麼?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wing Fung Group Asia's to be considered reasonable.

有一種固有的假設是,一家公司應該與行業相匹配,這樣像永豐集團亞洲這樣的市盈率才能被認爲是合理的。

Retrospectively, the last year delivered a decent 5.3% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 3.4% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

回顧過去,去年該公司的收入增長了5.3%。但是,歸根結底,它無法扭轉前一時期的糟糕表現,在過去三年中,總收入減少了3.4%。因此,可以公平地說,最近的收入增長對公司來說是不可取的。

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

相比之下,該行業預計將在未來12個月內實現14%的增長,根據最近的中期收入業績,該公司的下行勢頭髮人深省。

With this in mind, we find it worrying that Wing Fung Group Asia's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

考慮到這一點,我們感到擔憂的是,永豐集團亞洲的市盈率超過了業內同行。看來大多數投資者都無視最近增長率不佳的情況,並希望公司的業務前景有所好轉。如果市盈率跌至與最近的負增長率更加一致的水平,現有股東很可能會爲未來的失望做好準備。

The Bottom Line On Wing Fung Group Asia's P/S

永豐集團亞洲P/S的底線

Its shares have lifted substantially and now Wing Fung Group Asia's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

其股價已大幅上漲,現在永豐集團亞洲的市盈率已恢復到行業中位數的區間內。通常,我們傾向於將價格與銷售比率的使用限制在確定市場對公司整體健康狀況的看法上。

We find it unexpected that Wing Fung Group Asia trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

我們出乎意料的是,永豐集團亞洲的市盈率與該行業其他部門相當,儘管中期收入有所下降,而整個行業有望增長。儘管它與行業相符,但我們對目前的市盈率感到不舒服,因爲這種令人沮喪的收入表現不太可能長期支持更積極的情緒。除非最近的中期條件明顯改善,否則投資者將很難接受股價作爲公允價值。

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Wing Fung Group Asia that you should be aware of.

在投資之前,還有其他重要的風險因素需要考慮,我們已經發現 永豐集團亞洲的三個警告信號 你應該知道的。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然, 盈利增長曆史悠久的盈利公司通常是更安全的選擇。所以你可能希望看到這個 免費的 彙集了市盈率合理且收益強勁增長的其他公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂? 取得聯繫 直接和我們聯繫。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是一般性的。 我們僅使用不偏不倚的方法根據歷史數據和分析師預測提供評論,我們的文章並非旨在提供財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能未將最新的價格敏感型公司公告或定性材料考慮在內。簡而言之,華爾街對上述任何股票都沒有頭寸。