-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Some Analysts Just Cut Their Cue Health Inc. (NASDAQ:HLTH) Estimates

Some Analysts Just Cut Their Cue Health Inc. (NASDAQ:HLTH) Estimates

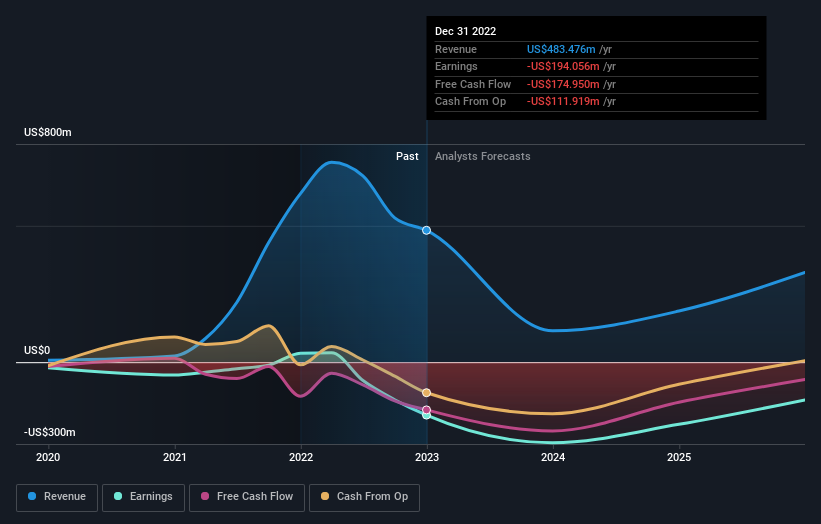

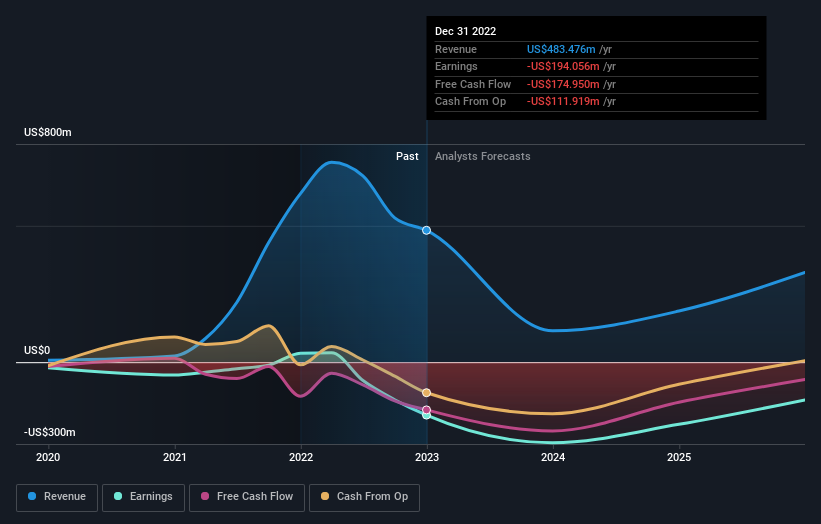

Today is shaping up negative for Cue Health Inc. (NASDAQ:HLTH) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. At US$2.19, shares are up 9.2% in the past 7 days. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

Following the downgrade, the consensus from four analysts covering Cue Health is for revenues of US$115m in 2023, implying a substantial 76% decline in sales compared to the last 12 months. Losses are supposed to balloon 58% to US$2.03 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$262m and losses of US$1.96 per share in 2023. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for Cue Health

The consensus price target fell 14% to US$5.38, implicitly signalling that lower earnings per share are a leading indicator for Cue Health's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Cue Health analyst has a price target of US$8.00 per share, while the most pessimistic values it at US$3.50. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Cue Health's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 76% by the end of 2023. This indicates a significant reduction from annual growth of 66% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.5% annually for the foreseeable future. It's pretty clear that Cue Health's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Cue Health's revenues are expected to grow slower than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Cue Health's future valuation. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Cue Health going forwards.

That said, the analysts might have good reason to be negative on Cue Health, given dilutive stock issuance over the past year. Learn more, and discover the 3 other warning signs we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Today is shaping up negative for Cue Health Inc. (NASDAQ:HLTH) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. At US$2.19, shares are up 9.2% in the past 7 days. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

今天正在塑造負面的 提示健康有限公司 (NASDAQ:HLTH)股東,與分析師對今年的預測進行了重大負面修訂。這份報告集中在收入估計上,看起來好像業務的共識觀點已經變得更加保守。股價 2.19 美元在過去 7 天內上漲 9.2%。我們很好奇,看看降級是否足以扭轉投資者對業務的情緒。

Following the downgrade, the consensus from four analysts covering Cue Health is for revenues of US$115m in 2023, implying a substantial 76% decline in sales compared to the last 12 months. Losses are supposed to balloon 58% to US$2.03 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$262m and losses of US$1.96 per share in 2023. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

在降級之後,四位涵蓋 Cue Health 的分析師的共識在 2023 年的收入達到 1.15 億美元,這意味著與過去 12 個月相比,銷售額大幅下降了 76%。虧損應該使每股 58% 增至 2.03 美元。然而,在此共識更新之前,分析師一直在預測 2023 年的收入為 2,600 萬美元,每股虧損為 1.96 美元。因此, 有一個明顯的變化情緒, 與分析師管理顯著削減到今年的收入估計, 而在同一時間增加他們的每股損失預測.

View our latest analysis for Cue Health

查看我們關於 Cue Health 的最新分析

The consensus price target fell 14% to US$5.38, implicitly signalling that lower earnings per share are a leading indicator for Cue Health's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Cue Health analyst has a price target of US$8.00 per share, while the most pessimistic values it at US$3.50. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

共識價格目標下跌 14% 至 5.38 美元,暗示著每股收益較低是 Cue Health 估值的主要指標。不過,要注意單個价格目標可能是不明智的,因為共識目標實際上是分析師价格目標的平均值。因此,一些投資者喜歡查看估計範圍,看看對公司估值是否存在分歧的意見。最樂觀的 Cue Health 分析師的目標價格為每股 8.00 美元,而最悲觀的價值為 3.50 美元。這是估計的一個相當廣泛的傳播,這表明分析師正在預測廣泛的業務可能的結果。

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Cue Health's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 76% by the end of 2023. This indicates a significant reduction from annual growth of 66% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.5% annually for the foreseeable future. It's pretty clear that Cue Health's revenues are expected to perform substantially worse than the wider industry.

這些估計很有趣,但是在看到預測的比較方式(與 Cue Health 過去的表現和同行在同一行業中的同行)相比時,繪製一些更廣泛的筆劃可能很有用。這些估計意味著銷售預計會放緩,預計到 2023 年底,年度化收入將下降 76%。這表明過去三年的每年增長 66% 大幅減少。相比之下,我們的數據顯示,同一行業中的其他公司(具有分析師覆蓋率)預計他們的收入將在可預見的未來每年增長 7.5%。很明顯,Cue Health 的收入預計將比更廣泛的行業表現差很多。

The Bottom Line

底線

The most important thing to take away is that analysts increased their loss per share estimates for this year. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Cue Health's revenues are expected to grow slower than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Cue Health's future valuation. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Cue Health going forwards.

最重要的是,分析師今年增加了他們的每股估計虧損。不幸的是,分析師還降級了他們的收入估計,行業數據表明,Cue Health 的收入預計將比更廣泛的市場增長慢。共識價格目標大幅下跌,分析師似乎對最近的業務發展沒有放心,導致 Cue Health 未來估值的較低。總體而言,鑑於今年的預測大幅降級,我們會對 Cue Health 的前進感到更加警惕。

That said, the analysts might have good reason to be negative on Cue Health, given dilutive stock issuance over the past year. Learn more, and discover the 3 other warning signs we've identified, for free on our platform here.

也就是說,鑑於過去一年中股票發行稀釋,分析師可能有充分的理由對 Cue Health 表示負面影響。在我們的平台上免費了解更多信息,並發現我們已識別的其他 3 個警告標誌。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

當然,看公司管理 投資大筆資金 在股票可以只是知道分析師是否降低他們的估計一樣有用。所以你可能還希望搜索這個 自由 內部人士正在購買的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?關注內容? 取得聯繫 直接與我們聯繫。 或者,通過電子郵件發送電子郵件給編輯團隊。

這篇文章由簡單牆聖是一般性質. 我們僅使用公正的方法,根據歷史數據和分析師預測提供評論,我們的文章並不打算作為財務建議。 它並不構成購買或出售任何股票的建議,也不會考慮您的目標或您的財務狀況。我們的目標是為您帶來由基本數據驅動的長期集中分析。請注意,我們的分析可能不會考慮最新的價格敏感公司公告或定性材料。簡易華街在提及的任何股票中都沒有倉位。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧