Cerevel Therapeutics Holdings, Inc.'s (NASDAQ:CERE) Intrinsic Value Is Potentially 48% Above Its Share Price

Cerevel Therapeutics Holdings, Inc.'s (NASDAQ:CERE) Intrinsic Value Is Potentially 48% Above Its Share Price

Today we will run through one way of estimating the intrinsic value of Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE) by projecting its future cash flows and then discounting them to today's value. The Discounted Cash Flow (DCF) model is the tool we will apply to do this. Before you think you won't be able to understand it, just read on! It's actually much less complex than you'd imagine.

今天,我們將介紹一種估計Cerevel治療控股公司(納斯達克代碼:CEE)內在價值的方法,即預測其未來的現金流,然後將其折現為今天的價值。貼現現金流(DCF)模型是我們將應用的工具。在你認為你將無法理解它之前,只需繼續閲讀!它實際上比你想象的要簡單得多。

We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

我們要提醒的是,對一家公司進行估值的方法有很多種,與貼現現金流一樣,每種方法在某些情況下都有優缺點。對於那些熱衷於學習股票分析的人來説,這裏的Simply Wall St.分析模型可能會讓你感興趣。

See our latest analysis for Cerevel Therapeutics Holdings

查看我們對Cerevel Treateutics Holdings的最新分析

The Model

模型

We are going to use a two-stage DCF model, which, as the name states, takes into account two stages of growth. The first stage is generally a higher growth period which levels off heading towards the terminal value, captured in the second 'steady growth' period. To start off with, we need to estimate the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

我們將使用兩階段貼現現金流模型,顧名思義,該模型考慮了兩個增長階段。第一階段通常是一個較高的成長期,接近終值,在第二個“穩定增長”階段捕捉到。首先,我們需要估計未來十年的現金流。在可能的情況下,我們使用分析師的估計,但當這些估計不可用時,我們會根據上次估計或報告的價值推斷先前的自由現金流(FCF)。我們假設,自由現金流萎縮的公司將減緩收縮速度,而自由現金流增長的公司在這段時間內的增長速度將放緩。我們這樣做是為了反映出,增長在最初幾年往往比後來幾年放緩得更多。

Generally we assume that a dollar today is more valuable than a dollar in the future, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

一般來説,我們假設今天的一美元比未來的一美元更有價值,因此我們需要對這些未來現金流的總和進行貼現,以得出現值估計:

10-year free cash flow (FCF) forecast

10年自由現金流(FCF)預測

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF ($, Millions) | -US$348.4m | -US$376.7m | -US$358.5m | -US$109.5m | US$187.5m | US$287.4m | US$396.4m | US$503.9m | US$602.6m | US$688.8m |

| Growth Rate Estimate Source | Analyst x5 | Analyst x4 | Analyst x4 | Analyst x4 | Analyst x4 | Est @ 53.30% | Est @ 37.90% | Est @ 27.13% | Est @ 19.58% | Est @ 14.30% |

| Present Value ($, Millions) Discounted @ 7.0% | -US$326 | -US$329 | -US$292 | -US$83.5 | US$134 | US$191 | US$247 | US$293 | US$327 | US$350 |

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| 槓桿式FCF(百萬美元) | --3.484億美元 | --3.767億美元 | --3.585億美元 | --1.095億美元 | 1.875億美元 | 2.874億美元 | 3.964億美元 | 5.039億美元 | 6.026億美元 | 6.88億美元 |

| 增長率預估來源 | 分析師X5 | 分析師x4 | 分析師x4 | 分析師x4 | 分析師x4 | Est@53.30% | Est@37.90% | Est@27.13% | Est@19.58% | Est@14.30% |

| 現值(美元,百萬)貼現@7.0% | --326美元 | --329美元 | --292美元 | --83.5美元 | 134美元 | 191美元 | 247美元 | 293美元 | 327美元 | 350美元 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$511m

(“EST”=Simply Wall St.預估的FCF成長率)

10年期現金流現值(PVCF)=5.11億美元

We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.0%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 7.0%.

我們現在需要計算終端價值,它説明瞭這十年之後的所有未來現金流。出於一些原因,使用了一個非常保守的增長率,不能超過一個國家的國內生產總值增長率。在這種情況下,我們使用了10年期政府債券收益率的5年平均值(2.0%)來估計未來的增長。與10年“增長”期一樣,我們使用7.0%的權益成本,將未來現金流貼現到今天的價值。

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = US$689m× (1 + 2.0%) ÷ (7.0%– 2.0%) = US$14b

終端值(TV)=FCF2032×(1+g)?(r-g)=6.89億美元×(1+2.0%)?(7.0%-2.0%)=140億美元

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$14b÷ ( 1 + 7.0%)10= US$7.1b

終值現值(PVTV)=TV/(1+r)10=140億美元?(1+7.0%)10=71億美元

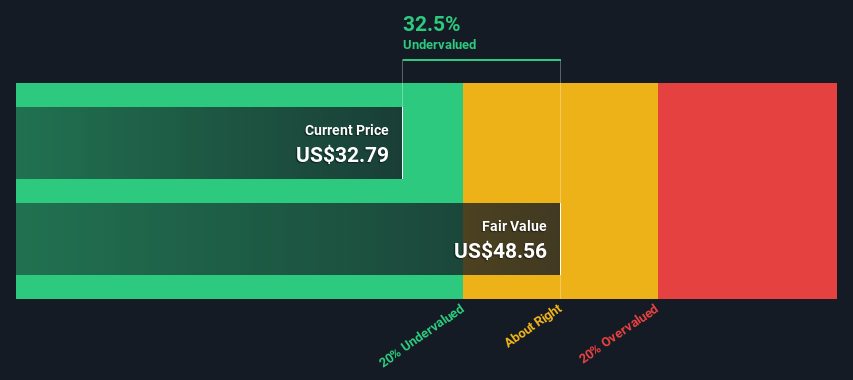

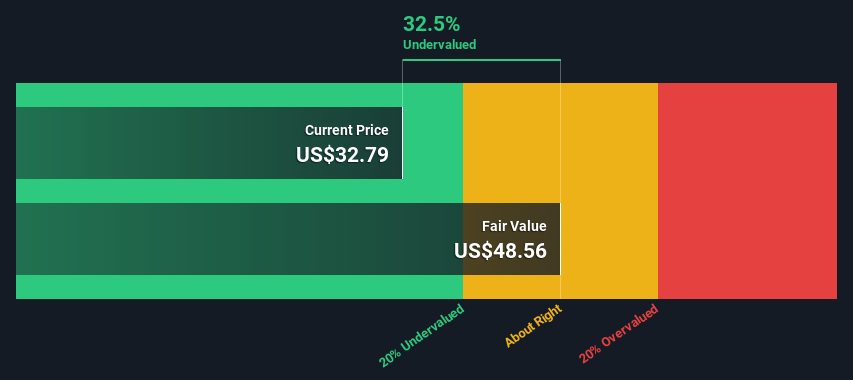

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$7.6b. In the final step we divide the equity value by the number of shares outstanding. Compared to the current share price of US$32.8, the company appears quite good value at a 32% discount to where the stock price trades currently. Valuations are imprecise instruments though, rather like a telescope - move a few degrees and end up in a different galaxy. Do keep this in mind.

那麼,總價值或股權價值就是未來現金流的現值之和,在這種情況下,現金流為76億美元。在最後一步,我們用股本價值除以流通股的數量。與目前32.8美元的股價相比,該公司的價值似乎相當不錯,較目前的股價有32%的折讓。然而,估值是不精確的工具,更像是一臺望遠鏡--移動幾度,就會到達另一個星系。一定要記住這一點。

The Assumptions

假設

Now the most important inputs to a discounted cash flow are the discount rate, and of course, the actual cash flows. You don't have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Cerevel Therapeutics Holdings as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 7.0%, which is based on a levered beta of 0.838. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

現在,貼現現金流最重要的投入是貼現率,當然還有實際現金流。您不必同意這些輸入,我建議您自己重新計算並使用它們。DCF也沒有考慮一個行業可能的週期性,也沒有考慮一家公司未來的資本要求,因此它沒有給出一家公司潛在業績的全貌。鑑於我們將Cerevel Treateutics Holdings視為潛在股東,股權成本被用作貼現率,而不是佔債務的資本成本(或加權平均資本成本,WACC)。在這個計算中,我們使用了7.0%,這是基於槓桿率為0.838的測試版。貝塔係數是衡量一隻股票相對於整個市場的波動性的指標。我們的貝塔係數來自全球可比公司的行業平均貝塔係數,強制限制在0.8到2.0之間,這是一個穩定業務的合理範圍。

SWOT Analysis for Cerevel Therapeutics Holdings

Cerevel治療控股公司的SWOT分析

- Debt is well covered by earnings.

- 盈利很好地彌補了債務。

- Balance sheet summary for CERE.

- CERE的資產負債表摘要。

- Shareholders have been diluted in the past year.

- 在過去的一年裏,股東被稀釋了。

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- 根據目前的自由現金流,擁有足夠的現金跑道超過3年。

- Trading below our estimate of fair value by more than 20%.

- 交易價格比我們估計的公允價值低20%以上。

- Debt is not well covered by operating cash flow.

- 運營現金流無法很好地覆蓋債務。

- Not expected to become profitable over the next 3 years.

- 預計在未來3年內不會實現盈利。

- Is CERE well equipped to handle threats?

- CERE是否做好了應對威脅的準備?

Next Steps:

接下來的步驟:

Valuation is only one side of the coin in terms of building your investment thesis, and it shouldn't be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Rather it should be seen as a guide to "what assumptions need to be true for this stock to be under/overvalued?" For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. Why is the intrinsic value higher than the current share price? For Cerevel Therapeutics Holdings, there are three important elements you should further examine:

就構建你的投資論文而言,估值只是硬幣的一面,它不應該是你在研究一家公司時唯一考慮的指標。貼現現金流模型並不是一個完美的股票估值工具。相反,它應該被視為“什麼假設需要成立才能讓這隻股票被低估或高估”的指南。例如,如果終端價值增長率稍有調整,可能會極大地改變整體結果。為什麼內在價值高於當前股價?對於Cerevel Treateutics Holdings,有三個重要因素你應該進一步檢查:

- Risks: You should be aware of the 3 warning signs for Cerevel Therapeutics Holdings (1 is potentially serious!) we've uncovered before considering an investment in the company.

- Future Earnings: How does CERE's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

- 風險:你應該意識到Cerevel Treateutics Holdings的3個警告信號(%1可能很嚴重!)我們在考慮投資該公司之前發現了這一點。

- 未來收益:與同行和更廣泛的市場相比,CERE的增長率如何?通過與我們的免費分析師增長預期圖表互動,更深入地挖掘分析師對未來幾年的共識數字。

- 其他穩固的企業:低債務、高股本回報率和良好的過去業績是強勁業務的基礎。為什麼不探索我們具有堅實商業基本面的股票的互動列表,看看是否有其他您可能沒有考慮過的公司!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NASDAQCM every day. If you want to find the calculation for other stocks just search here.

PS.Simply Wall St.應用程序每天對納斯達克市場上的每隻股票進行現金流貼現估值。如果你想找到其他股票的計算方法,只需搜索此處。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。