A Great Week That Adds to Veru Inc.'s (NASDAQ:VERU) One-year Returns, Institutional Investors Who Own 49% Must Be Happy

A Great Week That Adds to Veru Inc.'s (NASDAQ:VERU) One-year Returns, Institutional Investors Who Own 49% Must Be Happy

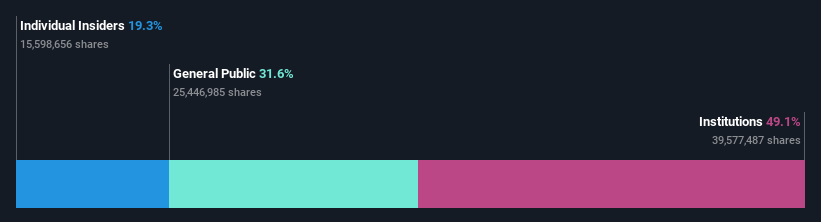

If you want to know who really controls Veru Inc. (NASDAQ:VERU), then you'll have to look at the makeup of its share registry. With 49% stake, institutions possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

如果你想知道誰真正控制了VERU公司(納斯達克代碼:VERU),那麼你就必須看看它的股票登記簿的構成。持有49%股份的機構擁有該公司的最高股份。換句話説,該集團面臨着最大的上行潛力(或下行風險)。

And last week, institutional investors ended up benefitting the most after the company hit US$497m in market cap. The gains from last week would have further boosted the one-year return to shareholders which currently stand at 4.6%.

上週,在該公司市值達到4.97億美元后,機構投資者最終受益最大。上週的漲幅將進一步提振一年的股東回報率,目前為4.6%。

Let's take a closer look to see what the different types of shareholders can tell us about Veru.

讓我們仔細看看不同類型的股東能告訴我們關於Veru的什麼。

Check out our latest analysis for Veru

查看我們對Veru的最新分析

What Does The Institutional Ownership Tell Us About Veru?

關於Veru,機構所有制告訴了我們什麼?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

機構通常在向自己的投資者報告時,以基準來衡量自己,因此一旦一隻股票被納入主要指數,它們往往會對這隻股票變得更加熱情。我們預計,大多數公司都會有一些機構登記在冊,特別是在它們正在增長的情況下。

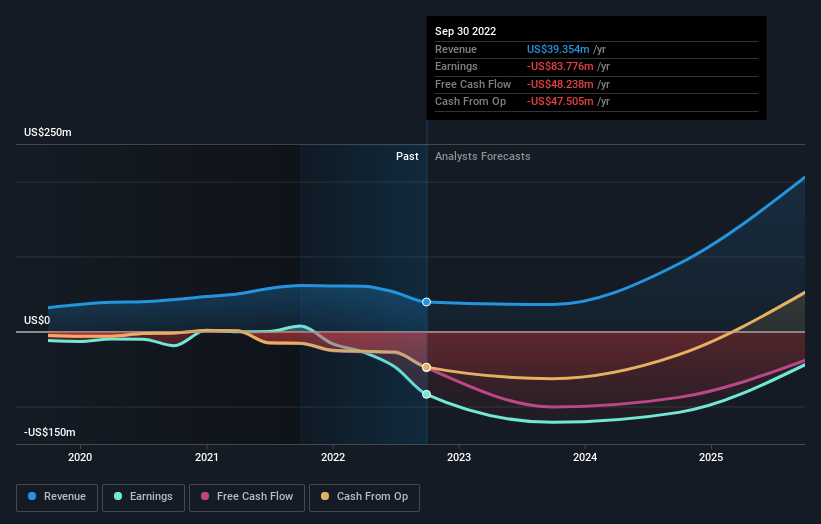

Veru already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Veru's earnings history below. Of course, the future is what really matters.

Veru已經在股票登記處登記了機構。事實上,他們在該公司擁有可觀的股份。這表明在專業投資者中有一定的可信度。但我們不能僅僅依靠這一事實,因為機構有時會做出糟糕的投資,就像每個人一樣。如果多家機構同時改變對一隻股票的看法,你可能會看到股價迅速下跌。因此,值得看看下面Veru的收益歷史。當然,未來才是真正重要的。

Hedge funds don't have many shares in Veru. From our data, we infer that the largest shareholder is Harry Fisch (who also holds the title of Senior Key Executive) with 9.9% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. Mitchell Steiner is the second largest shareholder owning 9.1% of common stock, and Morgan Stanley, Investment Banking and Brokerage Investments holds about 7.8% of the company stock. Interestingly, the second-largest shareholder, Mitchell Steiner is also Chief Executive Officer, again, pointing towards strong insider ownership amongst the company's top shareholders.

對衝基金在Veru的股份並不多。根據我們的數據,我們推斷最大的股東是Harry Fisch(他也擁有高級關鍵執行官的頭銜),持有9.9%的流通股。當內部人持有公司大量股份時,這通常被認為是一個好兆頭,在這種情況下,我們很高興看到公司內部人扮演關鍵利益相關者的角色。米切爾·施泰納是第二大股東,持有9.1%的普通股,摩根士丹利、投資銀行和經紀投資公司持有該公司約7.8%的股份。有趣的是,第二大股東米切爾·施泰納也是首席執行官,他再次指出,公司最大股東中存在強大的內部人所有權。

We did some more digging and found that 9 of the top shareholders account for roughly 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

我們做了更多的挖掘,發現9個大股東約佔登記的51%,這意味着除了大股東外,還有一些小股東,從而在一定程度上平衡了彼此的利益。

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

研究機構持股是衡量和篩選股票預期表現的好方法。通過研究分析師的情緒,也可以達到同樣的效果。相當多的分析師追蹤這隻股票,所以你可以很容易地研究預測增長。

Insider Ownership Of Veru

Veru的內部人所有權

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

公司內部人的定義可能是主觀的,而且在不同的司法管轄區之間確實有所不同。我們的數據反映了個別內部人士,至少捕捉到了董事會成員。管理層最終要向董事會負責。然而,經理人擔任執行董事會成員並不少見,尤其是如果他們是創始人或首席執行官的話。

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

內部人持股是積極的,當它標誌着領導層像公司的真正所有者一樣思考時。然而,高內部人持股也可以給公司內部的一個小團體帶來巨大的權力。在某些情況下,這可能是負面的。

It seems insiders own a significant proportion of Veru Inc.. Insiders have a US$96m stake in this US$497m business. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

內部人士似乎擁有Veru Inc.相當大的比例。在這項價值4.97億美元的業務中,內部人士持有9600萬美元的股份。我們會説,這表明了與股東的一致,但值得注意的是,該公司仍相當小;一些內部人士可能創建了這家企業。你可以點擊這裏,看看這些內部人士是一直在買入還是賣出。

General Public Ownership

一般公有制

The general public-- including retail investors -- own 32% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

包括散户投資者在內的普通公眾持有該公司32%的股份,因此不能輕易忽視。這種規模的所有權雖然可觀,但如果決策與其他大股東不同步,可能不足以改變公司政策。

Next Steps:

接下來的步驟:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Veru you should be aware of, and 2 of them are significant.

我發現看看到底是誰擁有一家公司是非常有趣的。但為了真正獲得洞察力,我們還需要考慮其他信息。一個恰當的例子:我們發現了Veru的3個警告標誌你應該知道,其中兩個是重要的。

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

如果你像我一樣,你可能會想一想這家公司是會增長還是會萎縮。幸運的是,您可以查看這份顯示分析師對其未來預測的免費報告。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的數字是使用過去12個月的數據計算的,指的是截至財務報表日期的最後一個月的12個月期間。這可能與全年的年度報告數字不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。