Does Anhui Guangxin Agrochemical (SHSE:603599) Have A Healthy Balance Sheet?

Does Anhui Guangxin Agrochemical (SHSE:603599) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Anhui Guangxin Agrochemical Co., Ltd. (SHSE:603599) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

David·伊本説得好,波動不是我們關心的風險,我們關心的是避免資本的永久性損失。當我們考慮一家公司的風險有多大時,我們總是喜歡看它對債務的使用,因為債務過重可能導致破產。我們注意到安徽廣信農化有限公司(上交所:603599)的資產負債表上確實有債務。但股東是否應該擔心它的債務使用情況?

When Is Debt Dangerous?

債務在什麼時候是危險的?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

債務幫助企業,直到企業難以償還債務,無論是用新資本還是用自由現金流。如果情況真的變得很糟糕,貸款人可以控制業務。然而,一種更常見(但仍然昂貴)的情況是,一家公司必須以低廉的股價稀釋股東的股份,才能控制債務。當然,在企業中,債務可以是一個重要的工具,特別是資本密集型企業。在考慮一家公司的債務水平時,第一步是同時考慮其現金和債務。

Check out our latest analysis for Anhui Guangxin Agrochemical

查看我們對安徽廣信農化的最新分析

How Much Debt Does Anhui Guangxin Agrochemical Carry?

安徽廣信農化揹負着多少債務?

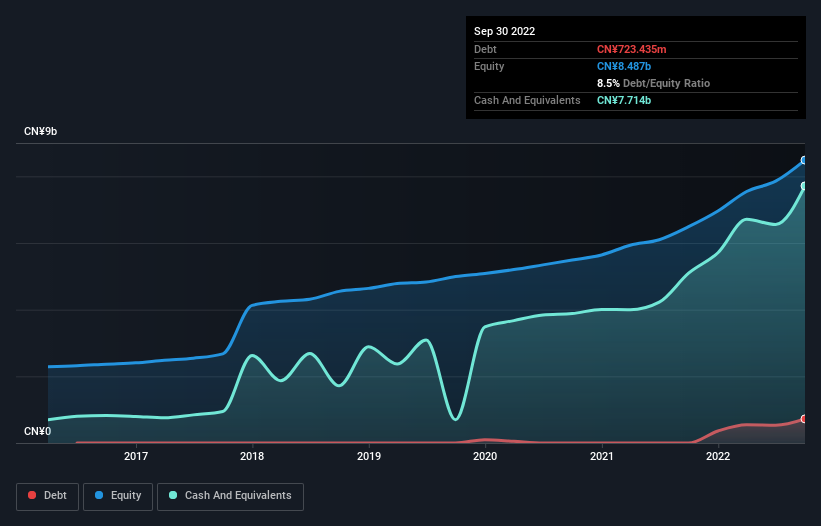

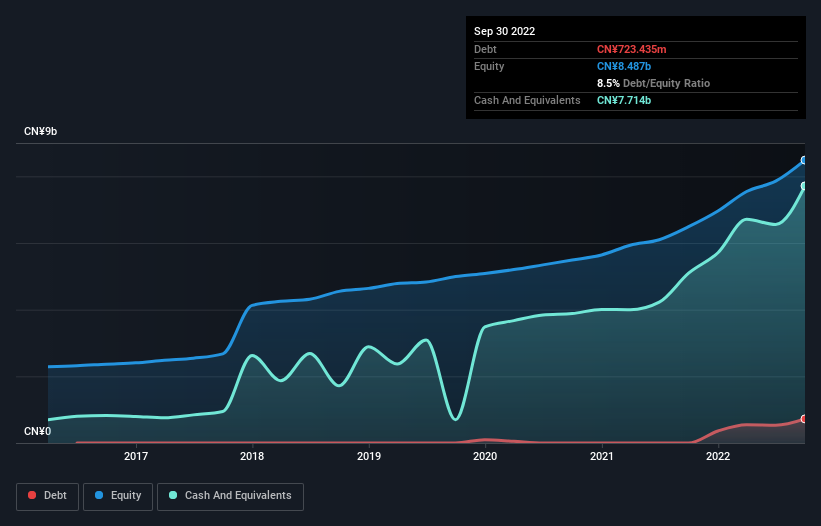

You can click the graphic below for the historical numbers, but it shows that as of September 2022 Anhui Guangxin Agrochemical had CN¥723.4m of debt, an increase on none, over one year. But on the other hand it also has CN¥7.71b in cash, leading to a CN¥6.99b net cash position.

你可以點擊下圖查看歷史數據,但它顯示,截至2022年9月,安徽廣信農化的債務為7.234億元人民幣,較一年前沒有增加。但另一方面,它也有77.1億元人民幣的現金,導致69.9億元的淨現金頭寸。

A Look At Anhui Guangxin Agrochemical's Liabilities

安徽廣信農化負債一瞥

The latest balance sheet data shows that Anhui Guangxin Agrochemical had liabilities of CN¥3.85b due within a year, and liabilities of CN¥130.7m falling due after that. On the other hand, it had cash of CN¥7.71b and CN¥606.0m worth of receivables due within a year. So it actually has CN¥4.34b more liquid assets than total liabilities.

最新的資產負債表數據顯示,安徽廣信農化一年內到期負債38.5億元,一年內到期負債1.307億元。另一方面,它有77.1億加元的現金和6.06億加元的應收賬款在一年內到期。所以它實際上有43.4億元人民幣更多流動資產超過總負債。

This surplus suggests that Anhui Guangxin Agrochemical is using debt in a way that is appears to be both safe and conservative. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Anhui Guangxin Agrochemical has more cash than debt is arguably a good indication that it can manage its debt safely.

這一盈餘表明,安徽廣信農化利用債務的方式似乎既安全又保守。由於它擁有充足的資產,它不太可能與其貸款人發生麻煩。簡而言之,安徽廣信農化的現金多於債務,可以説是一個很好的跡象,表明它有能力安全地管理債務。

Better yet, Anhui Guangxin Agrochemical grew its EBIT by 105% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Anhui Guangxin Agrochemical's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

更好的是,安徽廣信農化去年息税前利潤增長了105%,這是一個令人印象深刻的進步。如果保持這樣的增長,未來幾年的債務將變得更加可控。在分析債務水平時,資產負債表顯然是一個起點。但決定安徽廣信農化未來能否保持健康資產負債表的,最重要的是未來的收益。所以,如果你關注未來,你可以看看這個免費顯示分析師利潤預測的報告。

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Anhui Guangxin Agrochemical may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Anhui Guangxin Agrochemical recorded free cash flow worth a fulsome 83% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

最後,一家公司只能用冷硬現金償還債務,而不是會計利潤。安徽廣信農化的資產負債表上可能有淨現金,但看看該業務將息税前利潤(EBIT)轉換為自由現金流的情況仍很有趣,因為這將影響其對債務的需求和管理債務的能力。過去三年,安徽廣信農化錄得的自由現金流相當於其息税前利潤的83%,比我們通常預期的要好。這使其在償還債務方面處於非常有利的地位。

Summing Up

總結

While it is always sensible to investigate a company's debt, in this case Anhui Guangxin Agrochemical has CN¥6.99b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 83% of that EBIT to free cash flow, bringing in CN¥1.7b. When it comes to Anhui Guangxin Agrochemical's debt, we sufficiently relaxed that our mind turns to the jacuzzi. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Anhui Guangxin Agrochemical (1 doesn't sit too well with us!) that you should be aware of before investing here.

雖然調查一家公司的債務總是明智之舉,但安徽廣信農化擁有人民幣69.9億元的淨現金和可觀的資產負債表。最重要的是,它將息税前利潤的83%轉化為自由現金流,帶來17億元人民幣的收入。當談到安徽廣信農化的債務時,我們足夠放鬆,我們的注意力轉向了按摩浴缸。毫無疑問,我們從資產負債表中瞭解到的債務最多。但歸根結底,每家公司都可能包含存在於資產負債表之外的風險。例如,我們發現安徽廣信農化2個警示信號(%1與我們的關係不太好!)在這裏投資之前你應該意識到這一點。

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

如果你對一家增長迅速、資產負債表堅如磐石的公司更感興趣,那麼請立即查看我們的淨現金成長型股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。