Occidental Petroleum plus Institutional Tracking

Occidental Petroleum plus Institutional Tracking

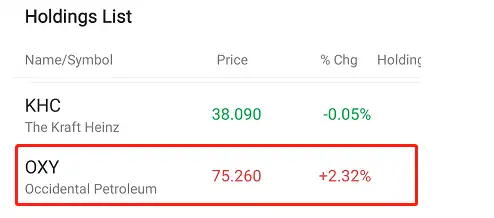

Buffett’sinterest in Occidental shown in Berkshire’s 13F filings.

巴菲特的興趣在於伯克希爾哈撒韋公司13F文件中顯示的西方石油公司。

On Aug19, Berkshire Hathaway, a corporation owned by Warren Buffett, won regulatory approval from the Federal Energy Regulatory Commission (FERC) to buy up to 50% of oil giant Occidental Petroleum’s common stock .

8月19日,沃倫·巴菲特旗下的伯克希爾哈撒韋公司獲得了聯邦能源管理委員會(FERC)的監管批准,將購買石油巨頭西方石油公司50%的普通股。

This recent regulatory approvalhas increased speculation that Berkshire is about to buy Occidental. Shares of Occidental jumped 10% on the news to close at $71.29 apiece, pushing the company’s market value to around $66 billion.

最近的監管批准增加了人們對伯克希爾哈撒韋公司即將收購西方石油公司的猜測。消息傳出後,西方石油的股價上漲了10%,收於每股71.29美元,將該公司的市值推高至約660億美元。

The story between Buffet and Occidental dates back to as early as several months ago. Since March this year, Buffet has been steadily adding his stakes in Occidental.

巴菲特和西方的故事可以追溯到幾個月前。自今年3月以來,巴菲特一直在穩步增持西方石油公司的股份。

His affection for the company is clearly demonstrated in the 13F filings published by Berkshire twice this year.

伯克希爾哈撒韋今年兩次公佈的13F文件清楚地表明瞭他對該公司的喜愛。

In Q1, Apple, Bank of America, American Express, Kraft Heinz, and Coca-Cola were among Berkshire’s five biggest stock holdings. Meanwhile, Berkshire bought an additional 5,887,618 shares of Occidental, with holdings in the oil industry worth over $40 billion.

在第一季度,蘋果、美國銀行、美國運通、卡夫亨氏和可口可樂是伯克希爾哈撒韋公司持有的五大股票之一。與此同時,伯克希爾哈撒韋公司又購買了588.7618股西方石油公司的股票,持有的石油行業股份價值超過400億美元。

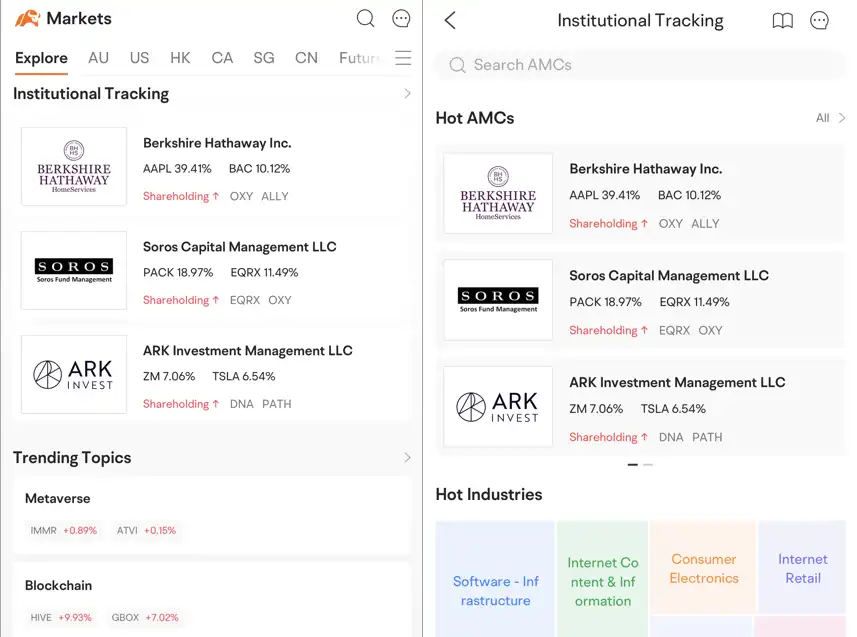

If you wish to check out more on institutional holdings, try 「Institutional Tracking」. Tap 「Quotes」 on the bottom navigation bar, then tap 「Explore」 on the top and swipe down, and there it is.

如果你想了解更多有關機構所持資產的信息,可以試試“機構追蹤”。點擊底部導航欄上的“報價”,然後點擊頂部的“探索”並向下滑動,它就在那裏。

(08/30/2022)

(08/30/2022)

Tap the pic to access Institutional Tracking (on app) directly

點擊圖片直接訪問機構追蹤(在APP上)

Institutional Tracking intuitively displays position details of institutions via charts, providing key data of industries, market value, position changes, etc. For more details, click the link below:(earn up to 300 points)

機構追蹤通過圖表直觀展示機構持倉明細,提供行業、市值、倉位變動等關鍵數據,更多詳情,請點擊以下鏈接:(最高賺取300分)

Back to Occidental Petroleum, it does live up to Buffet’s expectations. Since the beginning of this year, its revenue, driven by the booming crude oil market and Buffet’s operations, has surged by 129%. The earnings report(Occidental Petroleum(OXY) Financial Reports - Data and Analysis - Moomoo)shows that its net sales volume has reached $10.676 billion with a net profit of $3.755 billion, a year-on-year increase of 36 times, 16% higher than what analysts have expected. At the end of Q2, the cash flow generated by its operations stood at $5.329 billion, a record high among all quarters.

回到西方石油公司,它確實沒有辜負巴菲特的期望。自今年年初以來,在蓬勃發展的原油市場和巴菲特業務的推動下,其收入飆升了129%。收益報告(西方石油(OXY)財務報告-數據與分析-moomoo)顯示,其淨銷售額達到106.76億美元,淨利潤為37.55億美元,同比增長36倍,高於分析師預期的16%。在第二季度末,現金流其運營產生的收入為53.29億美元,創下所有季度的最高紀錄。

Will Occidental finally be part of Buffet’s commercial empire? Let’s wait and see!

西方航空最終會成為巴菲特商業帝國的一部分嗎?讓我們拭目以待!

Disclaimer:

免責聲明:

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

本演示文稿僅供參考和教育之用,並不是對任何特定投資或投資戰略的推薦或認可。本內容中提供的投資信息是一般性的,僅用於説明目的,可能並不適合所有投資者。它的提供不考慮個人投資者的財務成熟程度、財務狀況、投資目標、投資時間範圍或風險承受能力。在作出任何投資決定前,你應考慮該等資料的適當性,並考慮你的相關個人情況。過去的投資業績並不預示或保證未來的成功。回報會有所不同,所有投資都有風險,包括本金損失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC). In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS).Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore. In Australia, financial products and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our websites https://www.moomoo.com/au. Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd. and Futu Securities (Australia) Ltd are affiliated companies.

Moomoo是moomoo科技公司提供的一款金融信息和交易應用程序。在美國,通過moomoo應用程序提供的投資產品和服務是由moomoo金融公司提供的,moomoo金融公司是一家在美國證券交易委員會(SIC)註冊的經紀自營商,也是金融業監管局/證券投資者保護公司(SIPC)的成員。在新加坡,通過moomoo應用提供的投資產品和服務是通過moomoo金融新加坡私人有限公司提供的。新加坡金融管理局(MAS)監管的Moomoo Financial新加坡有限公司。有限公司為資本市場服務牌照(牌照編號:CMS101000)持有者,具有豁免財務顧問身份。此廣告未經新加坡金融管理局審核。在澳大利亞,通過moomoo應用程序提供的金融產品和服務由富途證券(澳大利亞)有限公司提供,該證券(澳大利亞)有限公司是受澳大利亞證券和投資委員會監管的澳大利亞金融服務許可證持有人(澳大利亞證券交易許可證編號224663)。請閲讀和理解我們的金融服務指南、條款和條件、隱私政策和其他披露文件,這些文件可以在我們的網站https://www.moomoo.com/au.上找到Moomoo科技股份有限公司、moomoo金融股份有限公司、moomoo金融新加坡有限公司。有限公司與富途證券(澳大利亞)有限公司為聯營公司。