Bitcoin, Ethereum Lag Behind as Dogecoin Becomes Top Gainer — Why One Analyst Thinks 'Things Could Get Ugly' Soon

Bitcoin, Ethereum Lag Behind as Dogecoin Becomes Top Gainer — Why One Analyst Thinks 'Things Could Get Ugly' Soon

$Bitcoin(BTC.CC)$ and $Ethereum(ETH.CC)$ traded in negative territory Tuesday evening as the global cryptocurrency market cap fell 0.7% to $1.14 trillion.

$位元幣(BTC.CC)$和$以太(ETH.CC)$週二晚間,全球加密貨幣市值下跌0.7%,至1.14萬億美元,交易價格為負值。

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -1% | 3.2% | $23,859.03 |

| Ethereum (CRYPTO: ETH) | -1.2% | 10.4% | $1,876.73 |

| Dogecoin (CRYPTO: DOGE) | +13.2% | 25.45% | $0.09 |

| 錢幣 | 24小時 | 7天 | 價格 |

|---|---|---|---|

| 位元幣(密碼:BTC) | -1% | 3.2% | 23,859.03美元 |

| 以太(加密:ETH) | -1.2% | 10.4% | 1,876.73美元 |

| 道格考因(Dogecoin)(密碼:Doge) | +13.2% | 25.45% | 0.09美元 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Dogecoin (DOGE) | +13.2% | $0.09 |

| EOS (EOS) | +8.1% | $1.38 |

| Chiliz (CHZ) | +6.5% | $0.21 |

| 加密貨幣 | 24小時百分比更改(+/-) | 價格 |

|---|---|---|

| 道格考因(Dogecoin)(Doge) | +13.2% | 0.09美元 |

| 埃奧斯(EOS) | +8.1% | 1.38美元 |

| Chiliz(Chz) | +6.5% | 0.21美元 |

Why It Matters: Even as the two largest coins struggled to gain upwards momentum, $Dogecoin(DOGE.CC)$, the bellwether meme coin with the 10th largest market cap, shot up over 13% to emerge as the top intraday gainer.

為什麼這很重要:儘管這兩種最大的硬幣難以獲得上漲勢頭,$Dogecoin(DOGE.CC)$市值排名第十的領頭羊表情幣暴漲超過13%,成為盤中漲幅最大的貨幣。

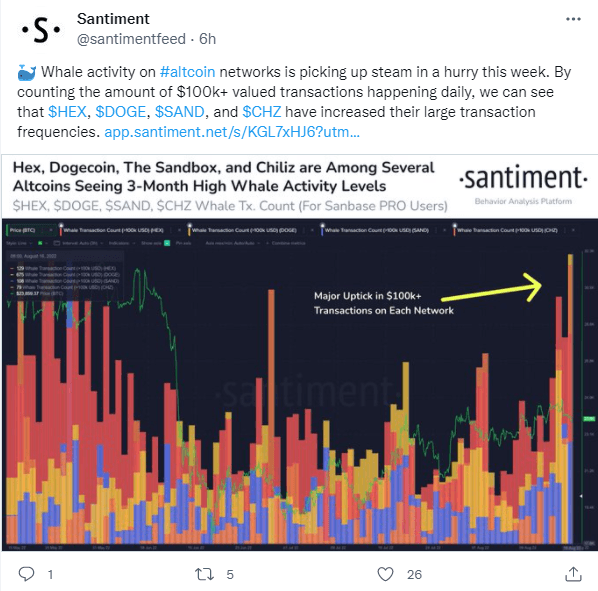

Whale activity in altcoins picked up steam this week, according to Santiment. The market intelligence platform said by counting the amount of $100,000+ transactions it is possible to see that coins like DOGE, The Sandbox (SAND), and Chilliz (CHZ) have "increased their large transaction frequencies."

據大戶稱,本週替代幣上的支付寶活動升溫聖誕老人。市場情報平臺表示,通過計算10萬美元以上的交易金額,可以看到像Doge這樣的硬幣,沙盒(沙子),以及奇利茲(CHZ)已經“增加了他們的大額交易頻率。”

Among the two top coins, Ethereum is "acting significantly stronger" than Bitcoin on account of the upcoming Merge — the shift of Ethereum from a proof-of-work to a proof-of-stake network, said Michaël van de Poppe.

在兩個最大的硬幣中,由於即將到來的合併-以太從工作證明網路向風險證明網路的轉變,以太“表現出明顯比位元幣更強大”,表示米歇爾·範·德·普普。

The cryptocurrency trader said the crucial area to hold for ETH is $1,780 to $1,800. If that holds, then according to Van de Poppe investors could buy the "dip season" to $2,300 or $2,700.

這位加密貨幣交易員表示,ETH需要持有的關鍵區域是1,780至1,800美元。如果這一點成立,那麼根據範德普普的說法,投資者可能會以2,300美元或2,700美元的價格買入“下跌季節”。

Meanwhile, the amount of staked Ethereum rose to a new all-time high of 13.29 million ETH across 415,314 validators as of Aug. 16, said Delphi Digital.

與此同時,截至8月16日,415,314名驗證者的以太賭注數量升至1329萬ETH,創歷史新高德爾福數位。

The independent research boutique said the amount of staked ETH has doubled over the past year despite the price of the second-largest coin falling by 43% in the same period.

這家獨立研究機構表示,儘管第二大硬幣的價格在同一時期下跌了43%,但在過去一年中,押注的ETH數量翻了一番。

On the Bitcoin side, "things could get ugly" if the S&P 500 decides to test the 3,400 pre-COVID-19 high, tweeted Justin Bennett. The cryptocurrency trader said it was "more than likely" that the U.S. benchmark index could do so.

推特上寫道,在位元幣方面,如果標準普爾500指數決定測試3,400點新冠肺炎之前的高點,“情況可能會變得很糟糕”賈斯汀·班尼特。這位加密貨幣交易員表示,美國基準指數很有可能做到這一點。

On Tuesday, the $S&P 500 index(.SPX.US)$ closed 0.2% higher at 4,305.20, while $Nasdaq Composite Index(.IXIC.US)$ was down 0.2% at 13,102.55.

週二,美國政府$標準普爾500指數(.SPX.US)$收盤上漲0.2%,至4305.20點,而美國股市$納斯達克綜合指數(.IXIC.US)$下跌0.2%,報13,102.55點。

Bitcoin can't yet break above the $25,000 level, but it seems to be maintaining a bullish trajectory here."

- said Edward Moya, a senior market analyst at OANDA.

位元幣目前還不能突破25,000美元關口,但在這裡似乎保持著看漲軌跡。

--他說。愛德華·莫亞,OANDA的高級市場分析師。

It appears the institutional money is mostly behind this recent rebound, which suggests it could have a better chance of lasting."

機構資金似乎主要是最近這輪反彈的幕後推手,這表明這輪反彈更有可能持續下去。