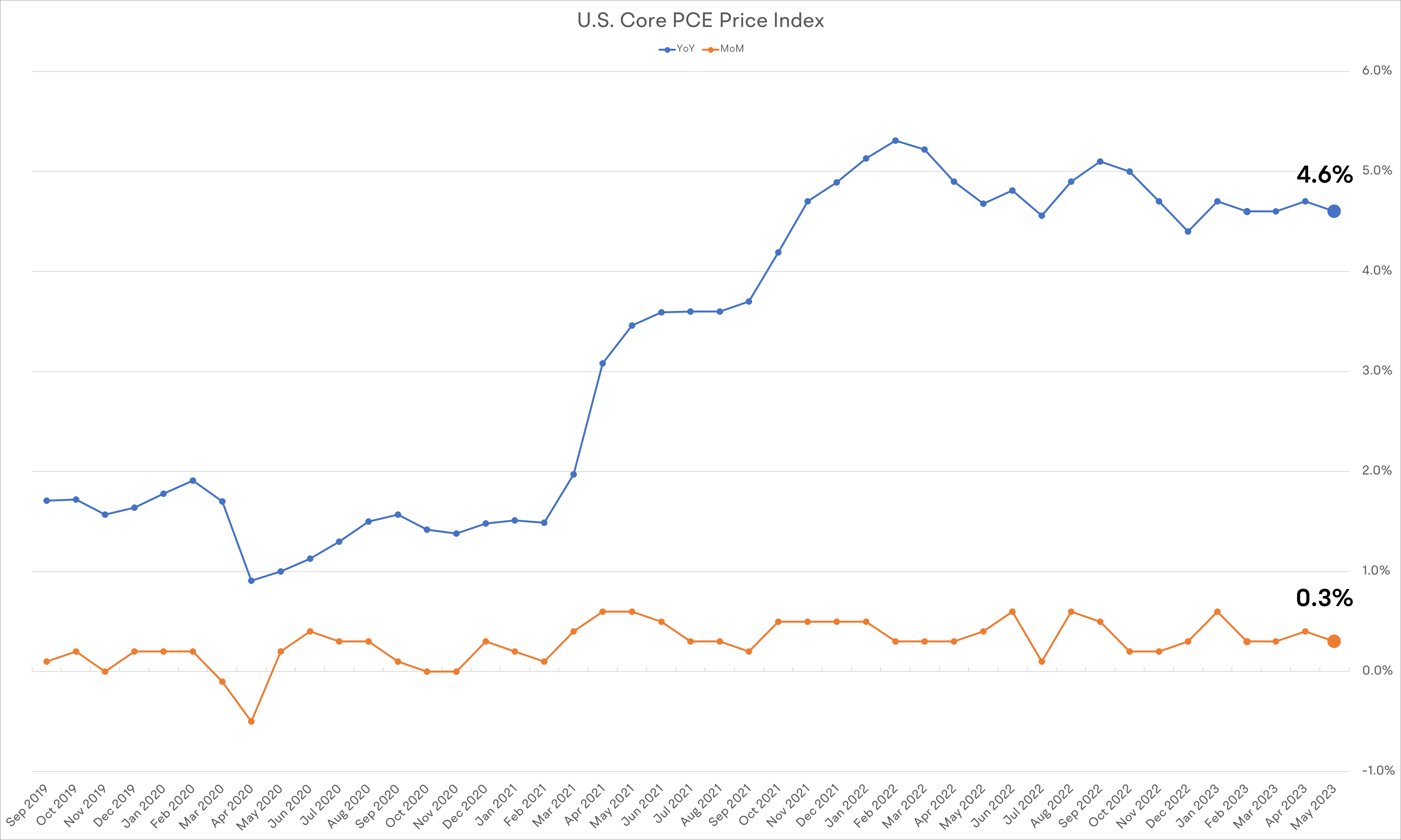

May US Core PCE Price Index rises YoY 4.6% Vs. expected 4.7% gain, prior 4.7% gain.

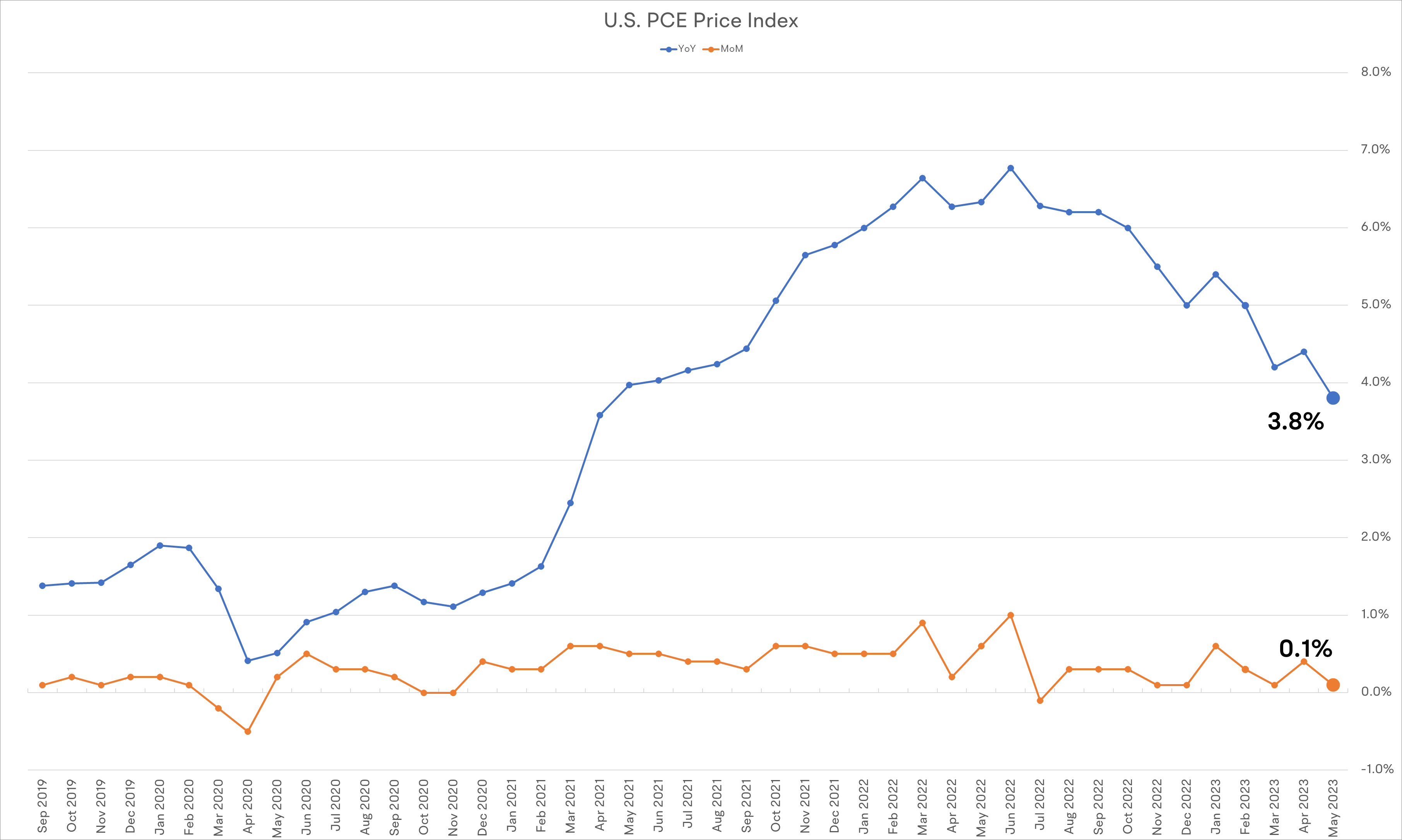

The increase prices over the past year slowed to 3.8% from 4.3% and dropped to the lowest level in two years, the government said Friday. Waning gas and food prices have played a big role in restraining inflation this year.

A separate gauge that omits food and energy rose a sharper 0.3%, however. Wall Street expected a 0.3% increase.

The rise in the so-called core PCE rate of inflation over the past year dipped to 4.6% from 4.7%. It’s fallen more slowly than the headline number and suggests inflation is likely to persist for some time.

Inflation is slowing, but it’s still too high for the Fed. Senior Fed officials worry that rising labor costs and price increases in major parts of the economy such as housing could keep inflation at elevated levels for a few more years. The latest PCE report is unlikely to give the Fed reason to continue to pause rate hikes at its next big meeting in July, MarketWatch reported.