Author: edited by Zhitong

This article compiles the self-confidence Securities Energy Industry report, analyst: Zuo Qianming

At present, it is in the early stage of a new upward cycle of the coal economy, and the fundamentals, policies, and companies resonate. At this stage, when it is appropriate to allocate the coal plate, continue to be bullish on the coal plate in an all-round way, and continue to suggest paying attention to the historic opportunity of coal allocation.

Events:Recently, Russia recognized the republic established by civil society organizations in the east and launched a special military operation in Ukraine. The United States and the G7 said they would impose "devastating sanctions" on Russia. Global stock markets fell sharply under the influence of the conflict between Russia and Ukraine. Global energy prices have risen sharply.

1. Impact on the global energy situation in the short term, conflicts will affect global energy supply and push up energy prices further.

Russia is a big exporter of oil, natural gas and coal. In 2020, Russia accounted for 11.08% of the world's oil exports, 16.07% of the world's natural gas exports and 17.08% of the world's coal exports. therefore, any policy to restrict Russian energy exports will directly affect the global energy supply, thus driving up energy prices.

Although the United States has not yet explicitly imposed direct sanctions on Russian energy, Germany has announced that it has suspended the certification of the Beixi No.2 natural gas pipeline under US pressure. At present, disturbed by the conflict between Russia and Ukraine, the expected supply of energy has decreased and prices have risen sharply.

On February 24, the price of Brent crude oil exceeded 100 US dollars per barrel for the first time since 2014. British natural gas futures prices rose for three consecutive days, with the biggest increase of 50.34% in a single day. The spot price of Newcastle thermal coal reached $248.35 a tonne, up nearly 50 per cent from the end of last year.

In the medium and long term, energy prices driven by the fundamental capacity cycle are expected to remain high and show an upward trend.

Although the United States says it will impose "devastating" sanctions on Russia, we think it is unlikely that the United States will impose sanctions on Russian energy, because according to the estimates of our energy team, Russia exports 5 million barrels per day, while the global crude oil destocking rate is about 1 million barrels per day from January to February this year, so if this part of Russian supply disappears or decreases significantly, it may greatly push up energy prices such as oil and gas. At the same time, it also exacerbates domestic inflation in the United States.

We believe that the rise in global energy prices since last year is essentially due to the shortage caused by the supply capacity cycle, which will be far more persistent and intense than expected, and the conflict between Russia and Ukraine, as an uncertain event, has only aggravated the energy tension. Therefore, even if Russia does not cut off energy supply, energy prices will remain high under the contradiction of mismatch between supply and demand, and will show an upward trend in the medium to long term.

2. The impact on European energy structure the structure of European energy trade may change.

Germany will have to buy natural gas and coal from other countries after the conflict between Russia and Ukraine, while the Italian prime minister said on the 25th that he plans to reopen coal-fired power plants in response to a possible energy crisis, the German economy minister said on the 24th.

In the future, Europe is expected to rely more on coal to provide basic energy supply due to a decline in oil and gas imports. In addition, Europe is likely to increase energy imports from the United States and other countries. In January 2022, U.S. liquefied natural gas exports to Europe almost doubled from November last year, according to the U.S. Energy Information Administration. We believe that the energy trade structure of Europe will change, the proportion of coal may increase, and the energy export status of the United States will rise.

The conflict between Russia and Ukraine is expected to accelerate the transformation of renewable energy in Europe. Europe's demand for fossil energy is heavily dependent on imports. In 2020, Europe consumed 379.94 billion cubic meters of natural gas, of which imports accounted for 85.84 per cent. Europe's dependence on Russian fossil energy has been one of the reasons why it has been restricted in its diplomacy with Russia.

Russia supplies more than 41% of natural gas, nearly 27% of crude oil and liquid products separated from natural gas to the European Union in 2021. Last year, the lack of new energy output in Europe led to an increase in demand for natural gas, superimposed by tight supply in the market, and natural gas prices in Europe rose rapidly.

In recent years, it has been determined to expand the share of renewable energy in order to reduce the impact of geopolitics on energy security, and the conflict between Russia and Ukraine is expected to become a catalyst for the development of clean energy in Europe. However, the transformation of the energy structure is a long-term solution, and if there are substantial measures against Russia in the short term, it is expected that Europe may need to go through a very difficult period of transition.

3. Impact on China's energy and coal industry

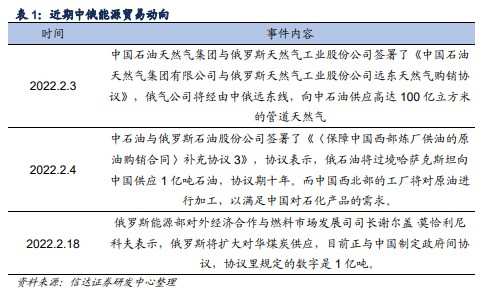

Sino-Russian energy cooperation is expected to deepen to a certain extent.China is an important direction of Russia's energy exports. Of the 5 million barrels of oil (including condensate) exported per day in 2020, 2 million barrels went to China, and crude oil imports from Russia accounted for about 15% of the total imports in 2021. At the same time, China is also Russia's largest natural gas exporter in the Asian region.

Russia is expected to increase its energy exports to China while reducing the flow of energy to Europe, but there is uncertainty about infrastructure.

Earlier, China and Russia signed a large natural gas bill, announcing an additional 10 billion cubic meters in addition to the promised annual delivery of 38 billion cubic meters of natural gas to China in the next 30 years from 2019 (5 billion cubic meters in the first year, gradually reaching 38 billion cubic meters). Russian officials have also said that coal exports to China will increase from about 53 million tons now to 100 million tons in the future. We believe that this volume is subject to infrastructure problems and is not immediately achievable.

Because Russia's energy exports have been taking the layout of "looking around", Europe has a relatively perfect natural gas transportation and consumption system, and the development of the east is still in its infancy.

There are two natural gas supply and demand channels between China and Russia, one is the natural gas eastern pipeline, with a designed gas transmission capacity of 38 billion square meters, and the other is a large-scale Arctic LNG project, with about 4 million tons of LNG exported to China. In the long run, Sino-Russian energy cooperation will be closer, but it will take 3-4 years for infrastructure construction.

The rise in oil and gas prices will lead to an increase in global demand for coal, and the gap between supply and demand for coal may further widen.

Due to the significant price advantage, the price of coal per unit of heat is significantly lower than that of oil and gas, and the expected rise in oil and gas prices is expected to tilt global energy consumption towards coal, while Russian coal is subject to lagging infrastructure construction such as railways and ports. to a large extent, it will not be transferred to the international coal market soon, thus aggravating the contradiction between global coal supply and demand and driving up international coal prices.

In the coal market price formation mechanism newly released by the National Development and Reform Commission on the 24th, it is clear that the medium-and long-term trading price of coal under Qinhuangdao is within a reasonable operating range of 5500 kcal / ton, compared with the long-term Association price of 500,770 yuan / ton implemented in 17-21, the previous upper limit has become the current lower limit, and the certainty of the coal price center has increased.

Therefore, the rise in international coal prices and the trend of high domestic coal prices may cause prices to hang upside down, and the demand for overseas coal will shift to China. Coal prices fluctuated sharply last year, and driven by the policy of stabilizing prices and ensuring supply, the contradiction between supply and demand eased at the end of last year, but we believe that the problem of periodic mismatch of production capacity in the industry has not changed, and the demand side continues to increase. Under the circumstances of little elasticity on the supply side, coal prices are easy to rise and difficult to fall, and it will be a major trend to keep high shocks and then rise again, and the industry business cycle will continue to improve.

In terms of investment opportunities, we believe that at present, it is at the beginning of a new upward cycle of the coal economy, and the fundamentals, policies, and companies resonate. At this stage, when it is appropriate to allocate the coal plate, we will continue to be bullish on the coal sector in an all-round way. continue to suggest paying attention to the historic allocation opportunities of coal.

Focus on three main lines:

First, there are favorable listed thermal coal companies with tight domestic coal supply and demand, low inventory, high price and policy encouragement to increase production and guarantee supply: Yanzhou Coal, Shaanxi Coal, China Shenhua Energy and China Coal Energy.

Second, it is suggested to pay attention to Panjiang shares, the leader of southwest coking coal with large endogenous extension space, and the shares of Pingping Coal, a pioneer in the reform of state-owned enterprises with excellent resource endowments; third, it is suggested to pay attention to Shanxi coking coal and Shanxi controlled coal industry with great potential for extension expansion brought about by the improvement of asset securitization by state-owned coal groups.

Risk factors:There is a crisis economic decline at home and abroad; the uncertainty after the deterioration of the war between Russia and Ukraine; the uncertainty of international and domestic energy-related policies.

Edit / tina