Zhitong Financial APP learned that according to the disclosure of the Hong Kong Stock Exchange on November 11, Dongyuan Renzi City Operation Services Group Co., Ltd. (DOWELL SERVICE GROUP CO. LIMITED) submitted its listing application to the main board of the HKEx, with Guotai Junan International as the exclusive sponsor.

Company profile:

Dongyuan Renzhi City Operation Services Group Co., Ltd. is a property management service provider with a long history, providing comprehensive services for many property projects in China and has a fast-growing track record. According to the data of the Middle Index Research Institute, in terms of comprehensive strength, Dongyuan Renzhi Service ranks 20th among the "Top 100 property Service Enterprises in China in 2021". According to the data of the Middle Index Research Institute, in terms of comprehensive strength, Dongyuan Renzhi Service ranks 5th and 9th among the "Top 100 property Service Enterprises in 2021" with headquarters in southwest China and the Yangtze River Delta region, respectively.

Dongyuan Renji Service has provided property management services in China for more than 17 years. On September 30, 2021, the company operates in two major regions of China, namely, Southwest China and East China. Over the years, the company's development strategy has been to expand its business portfolio in existing cities where the company's property projects are located, while entering new cities that the company believes have high growth potential. As at September 30, 2021, the company has 289 property projects under management, including residential and non-residential properties, covering 46 cities in 15 provinces, autonomous regions and municipalities directly under the Central Government, with a total construction area of about 24.7 million square meters. Of these, 115 were residential properties and 174 were non-domestic properties. As at 30 September 2021, the total floor area under management of residential and non-residential properties was approximately 17.6 million square metres and 7.1 million square metres respectively. On September 30th, 2021, approximately 52.0% of the total managed construction area of the property projects managed by the company originated from the Dumas Group and its affiliated companies.

Business model:

Dongyuan Renzhi City Operation Services Group Co., Ltd. provides diversified services through three main business lines: (I) provide property management services for the following types of properties, including security services, cleaning services, horticultural services, facility management, maintenance and maintenance services: residential properties of property developers, owners and tenants Non-residential properties of owners or enterprises operating in the relevant premises, such as commercial properties, hospitals, government buildings and schools; (ii) Community value-added services for owners and residents of property projects managed by the company, including: parking space management services; parking spaces and property sales services; public resource management services; property agency services; community event planning services; public utility maintenance services Decoration waste disposal service. (iii) value-added services of non-owners (mainly property developers), including: co-marketing services; maintenance and decoration services; pre-referral consultation and inspection services; additional customized services.

Financial profile:

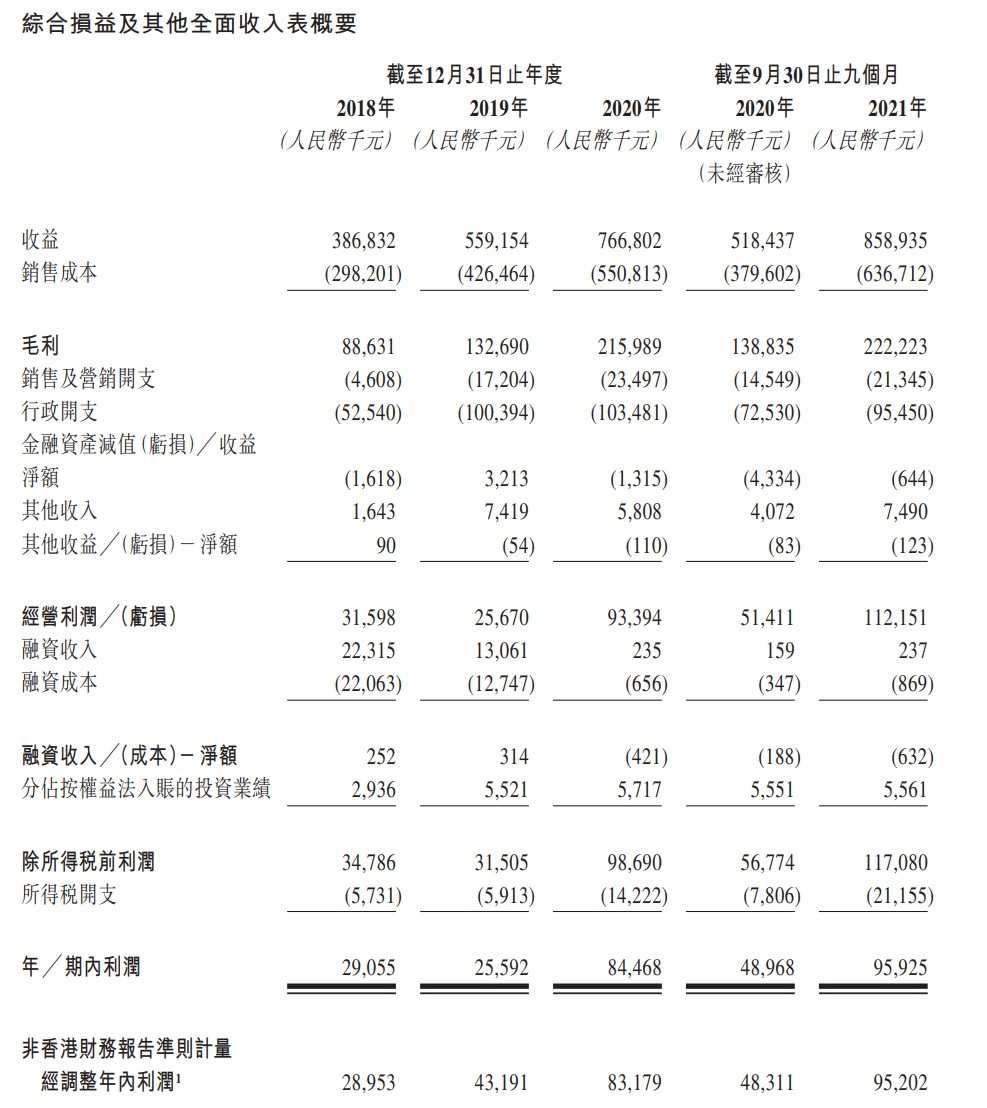

Dongyuan Renzhi City Operation Service Group Co., Ltd. recorded income of approximately RMB 387 million, RMB 559 million, RMB 767 million, RMB 518 million and RMB 859 million respectively from 2018 to 2020 and before September 2021. The increase was mainly due to the increase in income from the company's property management services, community value-added services and non-owner value-added services during the track record period.

The gross profit of the company was approximately RMB 89 million, RMB 133 million, RMB 216 million, RMB 139 million and RMB 222 million in 2018-2020 and September before 2021, respectively. The increase in the company's overall gross margin is due to the combined effect of the increase in gross profit margin on the line of business.

In 2018-2020 and September before 2021, the company's net profit was approximately RMB 29 million, RMB 43 million, RMB 83 million, RMB 48 million and RMB 95 million respectively.