The weakness of the dollar has pushed up global currencies, and for the rally to continue, we need to get past this week's US jobs data.

The New Zealand won, the South Korean won and the South African rand led gains on Tuesday, while the dollar weakened across the board. Federal Reserve Chairman Colin Powell said on Friday that the Fed is likely to start scaling back its asset purchases this year while keeping interest rates unchanged, with the dollar falling 0.6% against the euro. However, he is cautious about the employment situation.

"after Powell's Jackson Hole speech last week, the market continued to close long dollar positions," said Khoon Goh, head of Asian research at ANZ. "Friday's non-farm report will be key data for the market," and if the data are much better than expected, it could pause the dollar's decline.

NatWest Markets Plc. Said that if the U.S. jobs report is strong, it could increase the likelihood that the Fed will start reducing the size as soon as next month. This will be bad for higher-yielding emerging market assets. Us non-farm payrolls growth is likely to slow in August after the biggest increase in nearly a year the previous month, according to median forecasts by economists surveyed by Bloomberg.

The Bloomberg euro index is set to rise for the eighth day in a row, the longest rally since the COVID-19 epidemic swept the world in March 2020. The South African rand has led emerging market currencies higher over the past week, reversing the worst monthly performance of emerging market currencies.

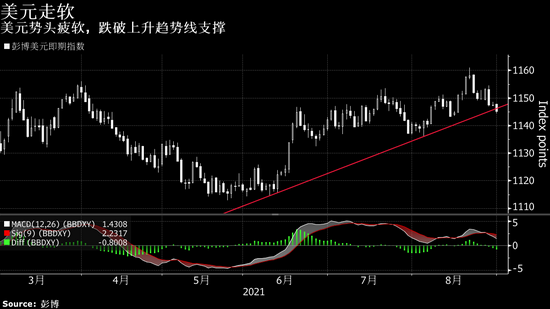

The technical chart suggests that the dollar has room to fall further. The Bloomberg dollar spot index fell below the uptrend line support formed by the June and August lows, with technical indicators such as MACD and random indicators showing weakness in the dollar.

"the market is no longer worried about the Fed cutting its size and raising interest rates," Bank of Nova Scotia said.Said Qi Gao, a foreign exchange strategist based in Singapore.