Original title: never regarded as "my own son"! The important subsidiary "full firepower", 60 billion of the market value of the medical beauty leader has lost 9 billion in two days.

This may be the "most expensive" piece of news in the capital market recently, directly causing listed companies with a market capitalization of 60 billion to fall by the limit, and the market capitalization has lost nearly 9 billion yuan within two days.

The cost of infighting

August twenty _ sixthEast China medicineOpen low and go low, once lay flat during the session, and finally closed down 9.94%, down more than 14% in the past two days, with a latest market capitalization of 54.7 billion yuan. This stems from an announcement issued by the company the night before last.

On the evening of August 24, East China Medicine announced that the company had recently received legal documents such as "Civil complaint" and "notice of participation in Litigation" served by the people's Court of Beilun District in Ningbo City.

Natural person shareholders Feng Yiying, Zhou Wenbin, Ye Maohua, Xie Lihua and other 20 people sued East China Pharmaceutical's subsidiary East China Ningbo Pharmaceutical Co., Ltd. (referred to as "East China Ningbo"), asking the court to order the dissolution of the company. As the third party in this case, the listed company holds 51% of the shares of the defendant company, and the above 20 people hold 49% of the shares.

Minority shareholders believe that there are serious difficulties in the operation and management of Ningbo in East China, and that the continued operation of Ningbo in East China will cause great losses to the interests of shareholders, and the shareholders of the two sides have not reached an agreement after many consultations, so the plaintiff sued to the court for a decree to dissolve the East China Ningbo Company.

However, the listed company does not agree because there is no agreement with minority shareholders on how to liquidate after dissolution.

East China Pharmaceutical said that the operating term of East China Ningbo expires on December 31, 2021, before which shareholders in East China Ningbo have not yet reached an agreement and made a decision on liquidation after the expiration of the operation of East China Ningbo.

In this case, East China Ningbo natural person shareholders unilaterally sued to the court for early dissolution of East China Ningbo Company. East China Pharmaceutical and East China Ningbo natural person shareholders have disputes over whether the company should be dissolved ahead of time.

According to the semiannual report of East China Pharmaceutical in 2021, the net profit of East China Ningbo in the first half of the year was 50.3337 million yuan, making it the second most profitable subsidiary of a listed company after China and the United States. Therefore, the every move of Ningbo in East China has a direct impact on the performance of listed companies. This is also the reason why the share price of East China Pharmaceutical has fluctuated greatly in the past two days.

Behind the dispute

Ningbo's performance stall in eastern China is the real reason behind the controversy.

In 2013, Ningbo, East China won the agency for the Chinese market of Ewan hyaluronic acid, and listed companies officially entered the medical and beauty track. In the following years, the performance of Ningbo in East China has continued to grow, and it has become an important part of the medical and beauty plate of East China Medicine, and Ningbo has also become an important subsidiary of listed companies.

From 2013 to 2015, Ningbo in East China had the same scenery after winning the agency of Ewan hyaluronic acid in China, with net profits of 67.0439 million yuan, 72.9278 million yuan and 91.9157 million yuan respectively, contributing a lot of profits to listed companies. The performance of Ningbo in East China continued to grow rapidly in 2016, 2017 and 2018, reaching 149 million yuan, 205 million yuan and 229 million yuan respectively.

However, with the rapid development of the domestic hyaluronic acid market in the past two years, the performance growth rate of Ningbo in East China was suddenly pressed the pause button. In 2019 and 2020, the net profit of Ningbo in East China was 192 million yuan and 123 million yuan respectively, declining for two consecutive years. The net profit in the first half of this year was 50.33 million yuan, a decline of 26%.

The reason for the decline in the performance of Ningbo in East China was solved by the announcement of the listed company the night before last.

According to the announcement, the original operating period of Ningbo in East China expires on December 31, 2017. Before that, the natural person shareholders represented by Feng Happiness (who holds 31.5% of the shares in East China Ningbo through her daughter Feng Yiying) asked the listed company Huadong Pharmaceutical to acquire its 49% minority stake in East China Ningbo. Cash out, but the two sides have been unable to reach agreement because of the transfer consideration and performance commitment.

Therefore, since 2018, the extension of the operating term of Ningbo in East China can only be signed once a year under the actual control of Feng Happiness and other natural shareholders, which has seriously affected the continuous operation of Ningbo in East China and the stability of employees, resulting in a significant decline in business growth in Ningbo in East China in the past two years.

Suspected to be out of control

After discovering the abnormal phenomena in the operation of Ningbo in East China, the listed companies immediately carried out the management audit of Ningbo in East China, and preliminarily found that Feng Happiness, as the person in charge of the actual operation and management of Ningbo in East China, obviously violated the relevant regulations of listed companies.

Listed companies have found that in recent years, a large number of related party transactions have taken place between Ningbo in East China and the affiliated companies that dominate its personal investment, which has led to the formation of large accounts receivable in Ningbo, East China. At the same time, it is also found that there are also violations of laws and regulations in some asset transactions in the history of Ningbo in East China.

However, the management layer of Ningbo in East China, represented by Feng Happiness, refused to recognize this, on the grounds that there was a so-called agreement in the "letter of intent" signed before East China Pharmaceutical acquired and reorganized its shares in Ningbo in 2001 and had formed the authorization practice of long-term business cooperation. refused to accept the unified management of listed companies, refused to cooperate with the management audit and investigation of Ningbo in East China.

Based on the above reasons, the listed company believes that East China Ningbo is still in existence, and daily operations should be carried out normally, and before the relevant problems have been clarified, in order to safeguard the interests of all shareholders of East China Ningbo Company and East China Pharmaceutical listed companies, it is not appropriate to dissolve East China Ningbo Company ahead of schedule.

East China Pharmaceutical said that the company is conducting a detailed investigation and collection of evidence on relevant matters, plans to reflect the results to the relevant departments in accordance with the rules and regulations after the end of the investigation, and will safeguard the legitimate rights and interests of Ningbo and the company in East China through various legal channels in accordance with the law. and will fulfill the relevant information disclosure obligations in accordance with the regulations.

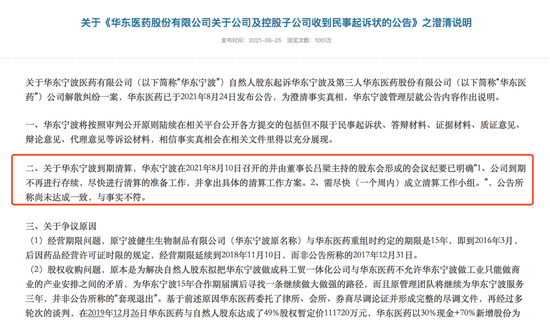

In response to what East China Pharmaceutical said, East China Ningbo posted a clarification on its website on the evening of August 25. "the management does not accept or recognize the smear of East China Medical Bulletin and other channels."