In early Asian trading on Friday (May 24), spot gold hovered at a low level for nearly two weeks and is currently trading around 2331.98 US dollars/ounce. The price of gold continued to decline on Thursday, hitting a low of 2326.90 US dollars/ounce, a new low since May 9, closing at 2328.35 US dollars/ounce. The cumulative decline in the past two trading days was more than 90 US dollars. The US initial jobless claims data showed strong performance. Investors were concerned about the timing of US interest rate cuts and the strong performance of US corporate activity.

The number of jobless claims in the US fell at the beginning of last week, indicating that the potential strength of the labor market should continue to support the economy. Business activity in the US accelerated to the highest level in more than two years in May, which suggests that economic growth rebounded for half an hour in the second quarter. This helped the US dollar index to record four consecutive increases on a daily basis, causing the attractiveness of gold to decline.

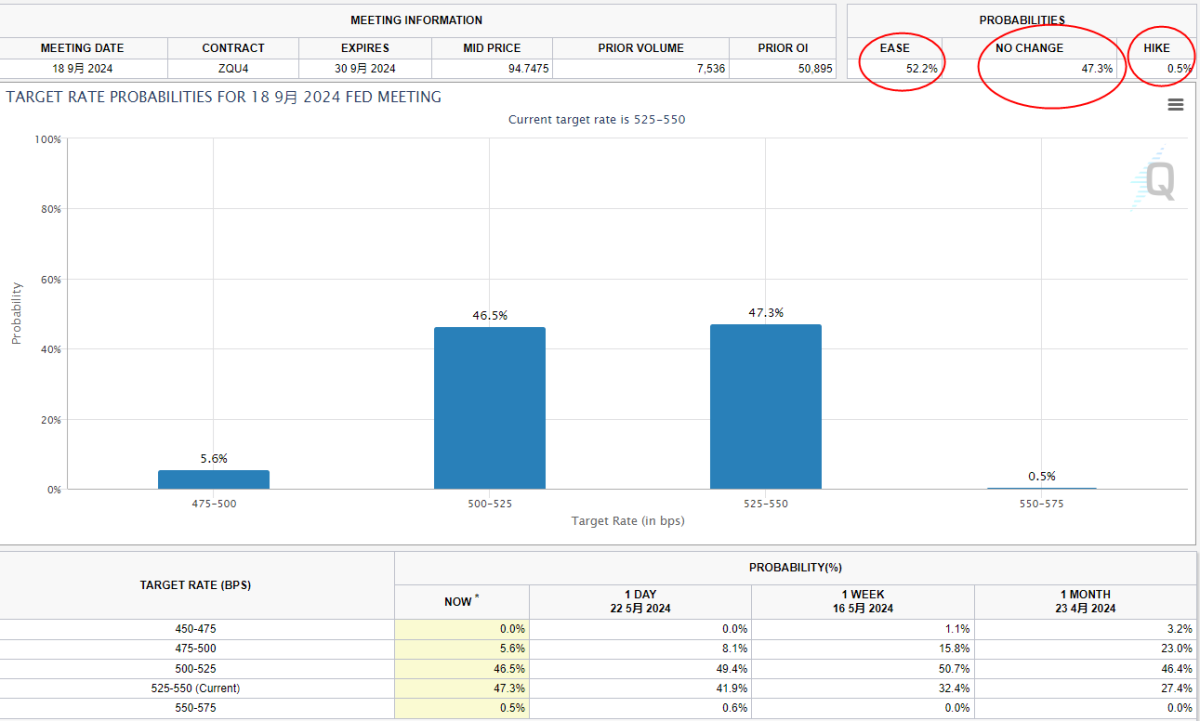

According to the CME “Federal Reserve Watch”, the market expects the probability that the Fed will cut interest rates by 25 basis points in September to drop to 52.2% (64% the day before), the probability of keeping interest rates unchanged is 47.3%, or even a 0.5% chance of raising interest rates.

However, Daniel Ghali, a commodity strategist at TD Securities, said that the rise in the US dollar and the weakening prospects for US interest rate cuts catalyzed the conclusion of a round of gold profits, but there is limited room for decline.

Although the current policy response will “involve maintaining” the target policy interest rate range unchanged at the current level, the latest minutes of the meeting also reflect discussions on possible further increases in borrowing costs.

Ghali said, “Investors who are concerned about the future of the Federal Reserve are not actually bullish on gold. They missed out on gains, and there wasn't that much gold to sell. As a result, although we think there has been a correction in the price of gold at current levels, the magnitude is relatively small.”

UBS Group raised the gold price forecast for the end of 2024 to 2,600 US dollars/ounce and recommended low purchases of around 2,300 US dollars/ounce or less due to a series of weak US data in April, an increase in central bank demand for gold, and continued geopolitical uncertainty.

Meanwhile, imports from India, the world's second-largest gold consumer, could drop by nearly one-fifth in 2024 as high prices spur retail consumers to replace old jewellery, according to an industry body.

On this trading day, we will continue to pay attention to the speeches of Federal Reserve officials and keep an eye on the final value of the US University of Michigan Consumer Confidence Index in May and news related to the geographical situation.

The US labor market remains strong

The number of jobless claims in the US fell at the beginning of last week, indicating that the potential strength of the labor market should continue to support the economy.

According to data released by the US Department of Labor on Thursday, the number of initial jobless claims fell for the second week in a row, taking back most of the increase at the beginning of this month. At that time, the number hit the highest level since the end of August. The Federal Reserve raised interest rates sharply in 2022 and 2023, causing employment growth to slow, but the number of layoffs is still minimal.

“The number of initial jobless claims fell from the previous week, so the acceleration that some people feared did not occur,” said Robert Frick, a corporate economist at Navy Federal Credit Union. “The labor market is still strong. If the number of jobless claims is a canary in a coal mine, then it doesn't even have a slight cough.”

The number of initial jobless claims from the state government fell by 8,000 for the week ending May 18, to 215,000 after seasonal adjustments. Accepted economists had previously predicted that the number of applicants would be 220,000.Claimants declined significantly in California and Indiana.

After experiencing difficulties in recruiting jobs during and after the COVID-19 pandemic, companies generally made efforts to retain workers. According to a survey report released by S&P Global on Thursday, the rate of decline in employment in factories and services slowed in May, which was also emphasized.

As manufacturing employment rebounded, the initial value of the employment index in the US purchasing managers' index (PMI) for May climbed to 49.9 from 48.4 in April. However, employment in the service sector remains weak, partly due to a shortage of workers. A reading below 50 indicates a contraction in private sector employment.

According to the minutes of the US Federal Reserve's April 30-May 1 policy meeting released on Wednesday, officials believe that “overall labor market supply and demand continue to balance, albeit at a slower pace.” However, they also pointed out that market conditions “are still generally tight.”

Last week's unemployment benefit data is in the survey period of the government's survey of employers for the non-farm payrolls section of the May employment report. There was a slight increase in the number of petitions between the April and May survey weeks.

Next week's unemployment claims renewal data may give more clues about the labor market. It's a measure of recruitment. The US added 175,000 new jobs in April.

The number of renewed jobless claims increased by 8,000 for the week ending May 11, to 1.794 million seasonally adjusted. Historically, the number of people renewing unemployment benefits has been low.

Business activity in the US accelerated in May, and price pressure increased

Business activity in the US accelerated to the highest level in more than two years in May, but manufacturers reported a sharp rise in the prices of a range of inputs, suggesting that commodity inflation may pick up in the next few months.

S&P Global said on Thursday that the US Composite Purchasing Managers' Index (PMI), which tracks manufacturing and services, jumped to 54.4 in early May. This is the highest level since April 2022, and the final value for April was 51.3.

A reading above 50 indicates private sector expansion. Economists interviewed by Reuters had previously predicted that the initial composite PMI for May would be 51.1. The service sector is driving this growth. The initial value of the service sector PMI rose to 54.8 in May, and the final value in April was 51.3. The initial manufacturing PMI rose slightly from 50.0 to 50.9.

“Business confidence has increased, which indicates a brighter outlook for the year ahead,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. “However, the future path of inflation and interest rates is uncertain, and companies remain cautious about the economic outlook and continue to worry about geopolitical instability and the presidential election.”

The index for measuring new orders from private companies in the S&P Global Survey rose to 51.7 from 49.1 in April. Employment indicators have been shrinking for the second month in a row, but the rate of decline has slowed somewhat.

Williamson said, “What is interesting is that currently the main driver of inflation is manufacturing rather than the service sector, which means that cost and sales price inflation in both industries are now higher than pre-pandemic standards, which suggests that there is still a long way to go to achieve the Federal Reserve's 2% target.”

Federal Reserve Bostic: The US is not yet out of the “point of concern” of inflation, and may have to wait longer to cut interest rates

Atlanta Federal Reserve President Raphael Bostic (Raphael Bostic) said on Thursday that the US Federal Reserve (Fed/FED) may have to wait longer to cut interest rates because even if the April inflation data cools slightly, prices are still facing continuous upward pressure.

Bostic said in an online course at Stanford University Business School, “As far as inflation returns to our target, we are not out of our concerns.” He pointed out that even in the latest consumer price index (CPI) readings, the share of goods with a price increase of more than 3% or 5% is higher than the level in a normal environment.

Meanwhile, the labor market showed little sign of distress, Bostic said. “Employment growth has been strong... It tells me that the economy is still very dynamic, which reassures me that it remains at a more restrictive level because we are not currently at risk of falling into a shrinking environment, and I don't think so.”

Bostic's views are a bit more hawkish than some of his Federal Reserve colleagues, but higher-than-expected inflation readings for the first three months of this year made more Fed officials hold similar views: they need to keep the policy rate target range of 5.25% to 5.5% longer than they had previously thought.”

Bostic said earlier that he believes the Federal Reserve may need to postpone interest rate cuts until the last three months of this year. He thinks this wait is reasonable, partly because he heard from business owners that they will have to wait until borrowing costs become more attractive before deploying capital.

“This may stimulate some recovery in economic activity and may be counterproductive to the goals we are working to achieve,” Bostic said on Thursday. “I've actually taken this into account... before we cut interest rates, we may need to be more patient and more certain that inflation is moving closer to the Fed's 2% target.”

Bostic said that he will not consider adjusting this target until the Federal Reserve reaches the 2% inflation target, but once this target is achieved, given that structural changes in the economy since the COVID-19 pandemic may drive up inflation, it may be discussed at that time whether a new benchmark is needed.

Bostic said that the Federal Reserve will begin a new round of framework reviews in 2025, which may include this topic.

New home sales fell year on year for the first time in over a year

Mortgage interest rates and house prices rose, overshadowing the strong performance of the first quarter in the real estate market.

The US Bureau of Statistics said in a report that new home sales fell 4.7% month-on-month in April, at an annual rate of 634,000 households after seasonal adjustments.

In March, sales were reduced from 693,000 households to 665,000 households. The government revised sales, inventory, and monthly supply data from January 2019.

New home sales, which account for about 13.3% of US housing sales, fell 7.7% year-on-year in April. This is the first year-on-year decline since March 2023.

According to data from mortgage finance agency Mortgage America, the average interest rate for the most commonly used 30-year fixed-rate mortgage rose above 7% in April, but this week it is back below 7%.

The median price of new homes rose 3.9% year on year in April to US$433,500. Most of the new homes sold in April cost between $300,000 and $49,900. The Government has updated the sales price range groups to better reflect the current distribution of new home prices.

By the end of April, there were 480,000 new homes on the market, compared to 470,000 at the end of March. Houses under construction account for most of the stock. According to the sales rate in April, it would take 9.1 months to sell out supply in the market, compared to 8.5 months in March.

US yields rose, and unemployment and business activity data were stronger than expected

US bond yields rose on Thursday. Previously released data showed that the labor market and business activity were still strong, strengthening expectations that the Federal Reserve will wait some time before cutting interest rates this year.

The US 10-year bond yield US10YT=RR hit a one-week high of 4.498% earlier, rising 4.1 basis points at the end of the session to 4.474%.

The yield on US 30-year bonds rose 3.1 basis points to 4.580%.

The two-year bond yield US2YT = RR, which reflects expectations of changes in interest rates, hit a three-week high of 4.959% earlier, rising 5.5 basis points at the end of the session to 4.933%.

Ellis Phifer, managing director of fixed income capital markets at Raymond James, said: “S&P PMI never really had an impact on the market in the past, but suddenly (Thursday) it did. The only thing I can think of... the manufacturing industry is picking up a little better than what the market expected.”

Phifer added, “My guess is that there has been a lack of activity in the market. The market did not respond much to initial jobless claims. But when you combine better-than-expected unemployment reports and PMI, quiet market decisions take action.”

The dollar rose due to the acceleration of US corporate activity

The US dollar rose 0.1% on Thursday to close at 105.03, rising for four consecutive trading days. Earlier data showed that US business activity accelerated in May and reached the highest level in more than two years, indicating that economic growth rebounded halfway through the second quarter.

(US dollar index daily chart)

“Foreign exchange trends show that the market is still reacting to strong US economic data in an expected manner,” said Marc Chandler, chief market strategist at Bannockburn Global Forex LLC. “I think the dollar still has some room to rise.”

Chandler said, “Given the FOMC's remarks, the market is still exaggerating the possibility of cutting interest rates twice this year.”

Technical analysis

Looking at the daily chart, the MACD peak diverged from the back dead cross, KDJ's dead cross, and the price of gold fell below the 21-day EMA. It suggests that short-term downward momentum is strong. Currently, it has also initially fallen below the May 13 low of 2332, which may further lower the support near the 2300 mark. You can also refer to the May 8 low of 2303.59, where the 55-day EMA support is around 2296.67.

The upper 21-day EMA of 2347.15 has been transformed into initial resistance. Before breaking through this position, the market is biased towards bears in the short term.

(Daily chart of spot gold, source: Easy Huitong)

At 08:22 Beijing time, spot gold was currently reported at 2330.27 US dollars/ounce.