Investor Optimism Abounds Shanghai International Airport Co., Ltd. (SHSE:600009) But Growth Is Lacking

Investor Optimism Abounds Shanghai International Airport Co., Ltd. (SHSE:600009) But Growth Is Lacking

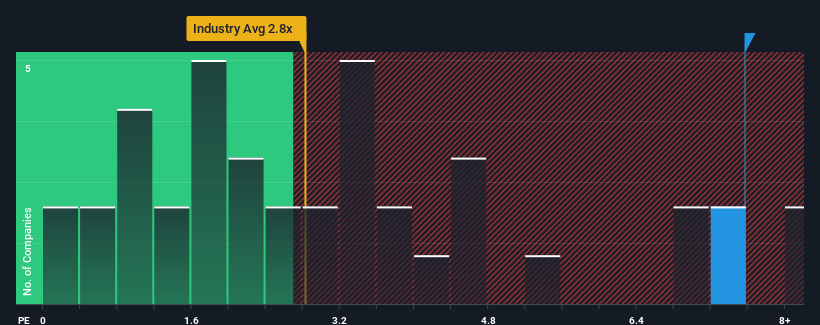

When close to half the companies in the Infrastructure industry in China have price-to-sales ratios (or "P/S") below 2.8x, you may consider Shanghai International Airport Co., Ltd. (SHSE:600009) as a stock to avoid entirely with its 7.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Shanghai International Airport's Recent Performance Look Like?

Shanghai International Airport certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai International Airport.Is There Enough Revenue Growth Forecasted For Shanghai International Airport?

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai International Airport's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 105%. The latest three year period has also seen an excellent 237% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 13% each year growth forecast for the broader industry.

With this information, we find it interesting that Shanghai International Airport is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Shanghai International Airport's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Shanghai International Airport with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Shanghai International Airport, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.