Financial giants have made a conspicuous bullish move on Barrick Gold. Our analysis of options history for $Barrick Gold (GOLD.US)$ revealed 10 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $247,764, and 5 were calls, valued at $216,790.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $22.0 for Barrick Gold, spanning the last three months.

In terms of liquidity and interest, the mean open interest for Barrick Gold options trades today is 11093.0 with a total volume of 5,816.00.

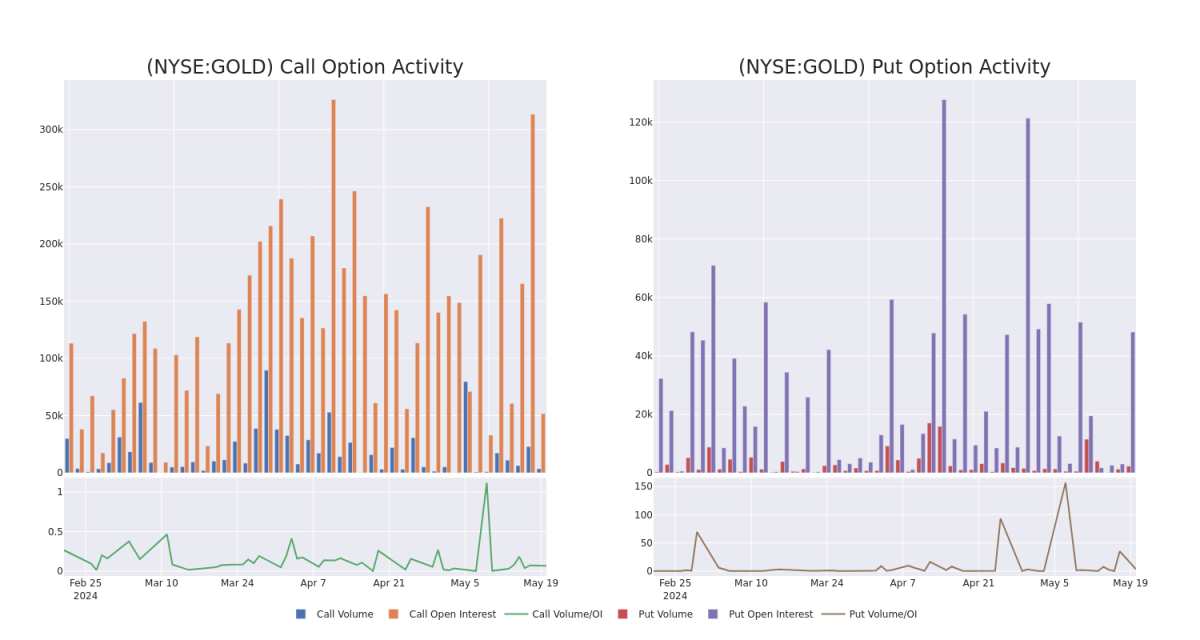

In the following chart, we are able to follow the development of volume and open interest of call and put options for Barrick Gold's big money trades within a strike price range of $15.0 to $22.0 over the last 30 days.

Barrick Gold Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

GOLD | CALL | TRADE | NEUTRAL | 01/16/26 | $2.52 | $2.33 | $2.43 | $20.00 | $97.2K | 11.5K | 401 |

GOLD | PUT | TRADE | NEUTRAL | 08/16/24 | $1.27 | $1.08 | $1.18 | $18.00 | $59.0K | 1.4K | 500 |

GOLD | PUT | SWEEP | BEARISH | 01/17/25 | $0.54 | $0.49 | $0.54 | $15.00 | $54.5K | 46.2K | 1.0K |

GOLD | PUT | SWEEP | BULLISH | 12/20/24 | $1.15 | $1.09 | $1.09 | $17.00 | $54.5K | 149 | 0 |

GOLD | PUT | TRADE | BULLISH | 12/20/24 | $0.77 | $0.72 | $0.72 | $16.00 | $54.0K | 246 | 750 |

About Barrick Gold

Based in Toronto, Barrick Gold is one of the world's largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

After a thorough review of the options trading surrounding Barrick Gold, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Barrick Gold Standing Right Now?

Currently trading with a volume of 5,164,624, the GOLD's price is up by 0.34%, now at $17.95.

RSI readings suggest the stock is currently may be approaching overbought.

Anticipated earnings release is in 78 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Barrick Gold options trades with real-time alerts from Benzinga Pro.