Deep-pocketed investors have adopted a bearish approach towards Marvell Tech (NASDAQ:MRVL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRVL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for Marvell Tech. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 45% bearish. Among these notable options, 5 are puts, totaling $379,056, and 15 are calls, amounting to $819,801.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $65.0 to $100.0 for Marvell Tech over the last 3 months.

Analyzing Volume & Open Interest

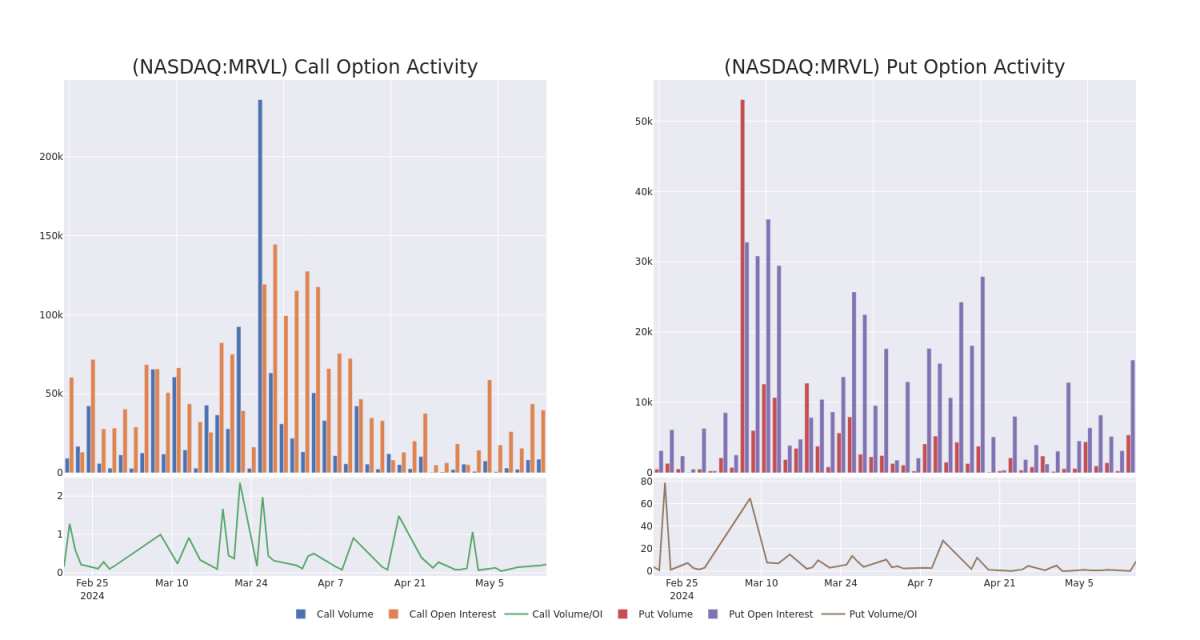

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Marvell Tech's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Marvell Tech's significant trades, within a strike price range of $65.0 to $100.0, over the past month.

Marvell Tech 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | SWEEP | BULLISH | 06/20/25 | $7.1 | $6.85 | $7.1 | $100.00 | $148.3K | 3 | 209 |

| MRVL | PUT | SWEEP | BEARISH | 01/17/25 | $16.85 | $16.65 | $16.7 | $85.00 | $125.2K | 103 | 75 |

| MRVL | CALL | SWEEP | BULLISH | 01/17/25 | $5.8 | $5.7 | $5.8 | $92.50 | $116.0K | 635 | 402 |

| MRVL | PUT | SWEEP | BEARISH | 01/17/25 | $15.2 | $15.0 | $15.0 | $82.50 | $112.5K | 69 | 19 |

| MRVL | CALL | TRADE | BULLISH | 01/17/25 | $15.3 | $14.9 | $15.3 | $67.50 | $76.5K | 1.0K | 50 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Where Is Marvell Tech Standing Right Now?

- With a volume of 2,771,124, the price of MRVL is up 0.57% at $73.5.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 13 days.

What Analysts Are Saying About Marvell Tech

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $85.0.

- In a cautious move, an analyst from Jefferies downgraded its rating to Buy, setting a price target of $85.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.