Under the boom in artificial intelligence investment, SoftBank's fiscal year 2023 losses narrowed sharply. Thanks to Arm, which was listed in mid-last year, SoftBank's net assets reached a record high.

The rolling wave of artificial intelligence is pulling SoftBank out of the technology stock investment quagmire — making profits for two consecutive quarters, and losses narrowed sharply last year.

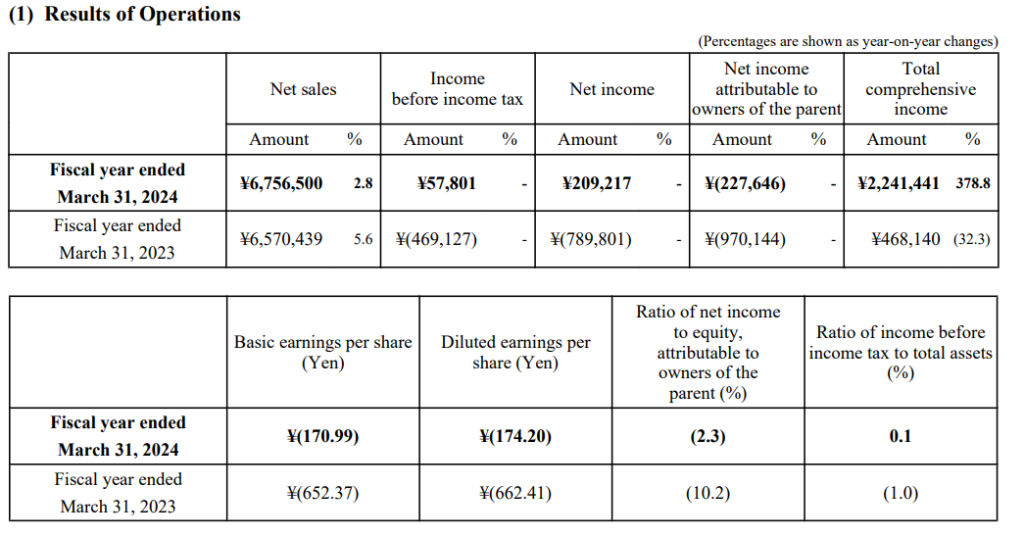

According to the financial report released by SoftBank on Monday, SoftBank's net sales for the full year of fiscal year 2023 (ending March 31, 2024) increased 2.8% year on year to 6.76 trillion yen (about 43.38 billion US dollars), which fell short of market estimates of 6.81 trillion yen; net loss attributable to shareholders of the parent company for the whole year was 227.65 billion yen, a decrease of 76.5% year on year, and better than the market's estimated loss of 283.09 billion yen. The loss per diluted share was 174.2 yen, compared to 662.41 yen per share last year. The annual dividend of 44 yen was in line with market expectations.

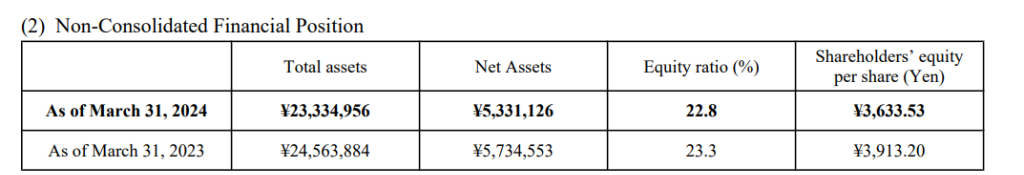

As of March 31, 2024, SoftBank's net assets reached 533.11 billion yen, a record high. According to SoftBank CFO Yoshimitsu Goto at the earnings conference, this was mainly due to Arm, which went public in the middle of last year.

The SoftBank Vision Fund division's annual investment profit (including investment in Arm) was 724.34 billion yen, with a loss of 5.28 trillion yen last year; the division's annual profit was 128.18 billion yen, with a loss of 4.3 trillion yen last year, falling short of market estimates of 362 billion yen.

Looking at a single quarter, SoftBank's fourth quarter sales were 175.46 billion yen, up 3.5% year on year. Net profit attributable to parent company shareholders was 231.08 billion yen, the second consecutive quarter of profit, with a loss of 57.63 billion yen for the same period in 2022.

Among them, the SoftBank Vision Fund division lost 57.53 billion yen in investment in the fourth quarter, down 76% from the previous year. Previously, it had achieved profits for three consecutive quarters; Vision Fund lost 96.74 billion yen in the fourth quarter, falling short of market estimates for profit of 185.14 billion yen, and a loss of 297.54 billion yen for the same period in 2022.

Arm, SoftBank's hope

SoftBank founder Sun Zhengyi has been talking about the potential of AI and robotics for many years, but SoftBank has still been short of investing in generative AI and has not become the founder of popular AI startups such as OpenAI. However, the positive outlook for generative AI drove the market value of Arm, a design company owned by SoftBank, to soar to 110 billion US dollars.

Arm was listed on the US NASDAQ Global Select Market on September 4, 2023. In this IPO, Arm sold 103 million American Depositary Shares (ADS), equivalent to 10% of the issued common shares, and received revenue of US$5.12 billion. Proceeds from the sale were not included in the Group's consolidated income statement.

Financial reports also showed that in fiscal year 2023, SoftBank raised US$4.39 billion through prepaid forward contracts using Alibaba shares.

The realized and unrealized valuation losses for SoftBank's investment in Alibaba stock were 959.9 billion yen, offset by derivative income of 1517.4 billion yen. This derivative income comes from prepaid forward contracts using Alibaba shares and is recorded separately as “derivative income (excluding investment gains and losses).”

SoftBank's net profit improved in the fourth quarter, mainly because funds raised by SoftBank through Alibaba mitigated some of the effects of Vision Fund's value write-down.