Complete A-share core assets in one place

People who have been in the A-share market for many years must have heard the saying: “Fear the market, the market is always right.”

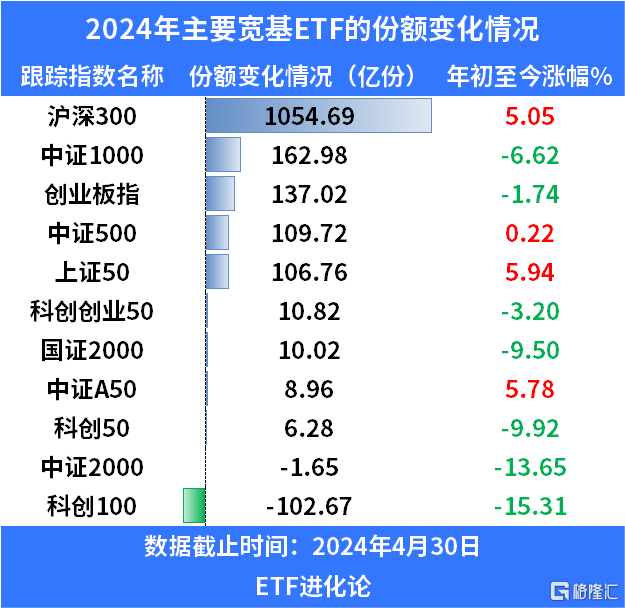

Since this year, large capital has continued to use ETFs to buy A-shares. As of April 30, 2024, ETF shares increased by 133.476 billion shares during the year. Of these, the share of ETFs tracking the Shanghai and Shenzhen 300 Index alone surged to 105.469 billion shares, an increase of 97.68% over the beginning of the year.

In other words, the large amount of money to buy ETFs is basically going to ETFs related to the Shanghai and Shenzhen 300. In just 4 months, the share of ETFs tracking the Shanghai and Shenzhen 300 has nearly doubled.

Coinciding with China's major asset counterattack, it's time to explore the appeal of the Shanghai and Shenzhen 300. It is worth investing in it.

01

China's major asset counterattack

“Suddenly the spring breeze came overnight, and thousands of pear trees bloomed.” This poem should be the best picture of China's recent surge in assets.

It only took two weeks for Hong Kong stocks to recover all of their losses since September last year, leading the world in gains during the May 1st holiday period. On April 26, Northbound Capital also exploded the purchase of A-shares worth 22.469 billion yuan, the highest in history.

Why all of a sudden? Why this moment?

Cheapness is the last word and one of the key factors. Despite a wave of “technical bulls,” the Hang Seng Index PE (TTM) ratio is only 9.43 times, and the Shanghai and Shenzhen 300 Index is 12.18 times (as of May 8), which has a relatively sufficient margin of safety.

Speaking of absolute cheapness, the Hang Seng Index's lowest valuation this year appeared on January 19. At that time, PE (TTM) was as low as 7.5 times, while the valuation of the Shanghai and Shenzhen 300 Index dropped to 10.6 times on February 2.

Hong Kong stocks and A-shares did experience a wave of explosive rebound in February. Northbound Capital bought 60.7 billion yuan of A-shares during the same period.

However, in March, Hong Kong stocks and A-shares entered a sideways fluctuation pattern. The Shanghai and Shenzhen 300 Index rose 0.61% over the same period, and the Hang Seng Index only rose 0.18%. Northbound capital only bought 21.9 billion yuan in 1 month. However, on April 26, foreign investors exploded 22.4 billion yuan in a single day, indicating that a new trading logic must have been born behind it.

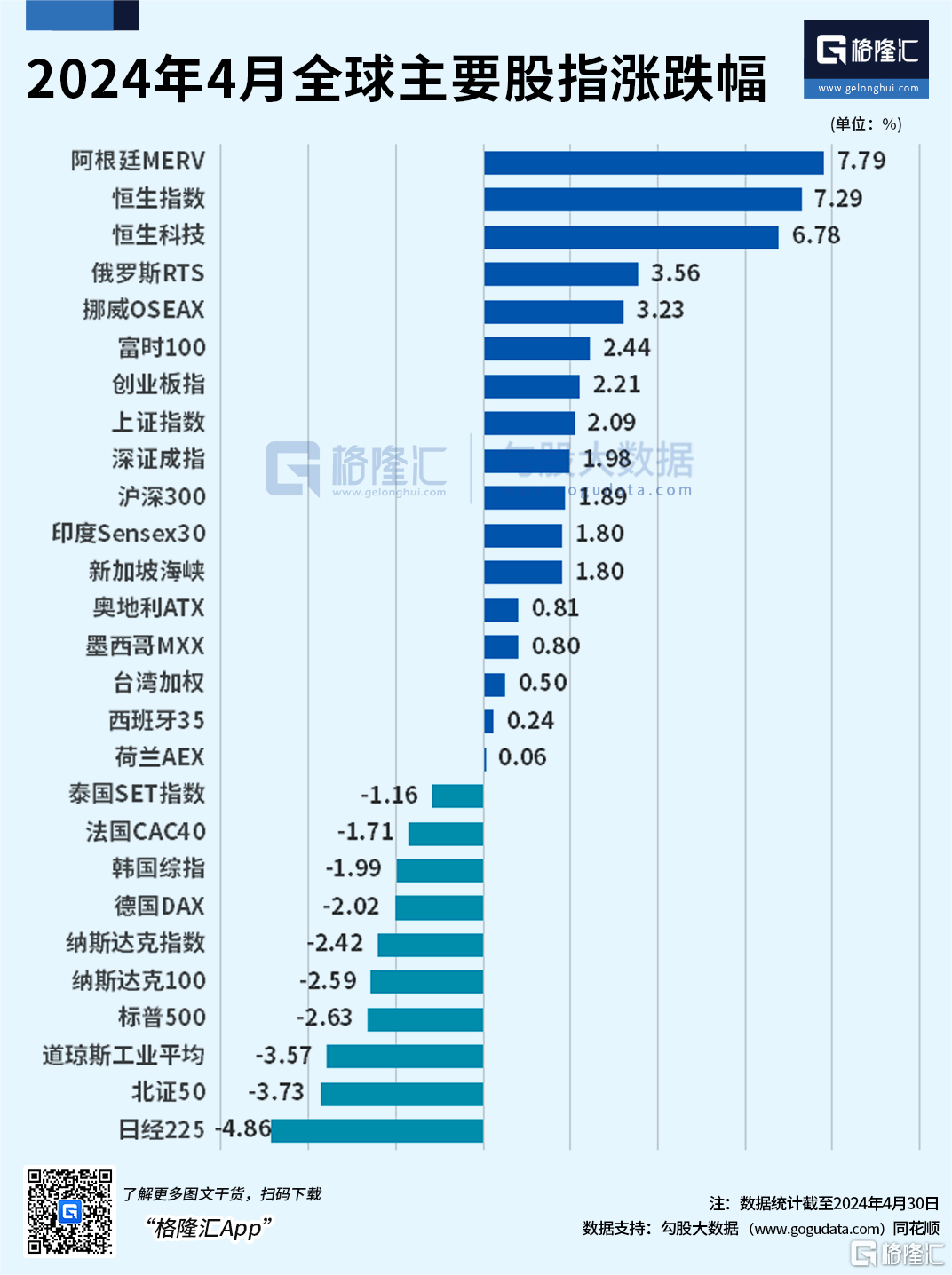

Hong Kong stocks suddenly exploded in mid-April, and A-shares also rose. What happened during the same period was that US stocks, Japanese stocks, and Korean stocks, which had been strong for a long time, all closed down in April.

After two months of rebound, the valuations of Hong Kong stocks and A-shares have recovered to a certain extent. Overall, however, China's asset valuation is still low. Combined with marginal economic and policy improvements, it is clearly a more cost-effective choice.

Looking further, unlike the volatile valuation repair market in February, this time overseas investment banks were the first to sound the horn of a counterattack on Chinese assets.

On April 23, UBS took the lead in upgrading the ratings of A-shares and Hong Kong stocks to “additional allocation” and downgraded the rating of Korean stocks to “neutral”;

On May 4, Goldman Sachs called “China Deals Are Back!” ; On the same day, J.P. Morgan called for a big increase in Chinese stock positions in May and patiently wait for the economy to recover faster;

On May 8, HSBC is strongly optimistic that the Chinese stock market may outperform the Japanese stock market in the future.

Without exception, the reports all point: optimistic about China's economic recovery!

On the one hand, China's marginal economic recovery may drive the Chinese stock market to recover profits on the molecular side. On the other hand, Hong Kong A-shares are still historically low in valuation and have a relatively sufficient margin of safety. They are expected to resonate with profit recovery at the same time, and Chinese assets will actually be double hit by Davis.

02

The trumpet of core assets is sounding

It is an unquestionable fact that foreign investors are optimistic about Chinese assets, so what are they buying with real money?

As always, foreign investment in this round favors Big White Horse stocks. At the industry level, in April, Kitakami Capital mainly increased its holdings in non-ferrous metals, banking, power equipment, pharmaceuticals, biotechnology, chemicals, real estate, etc.

(The industry where Northbound Capital mainly increased its positions in April, Source: Choice)

At the individual stock level, foreign capital increases are also concentrated in leading Baima, such as the Ningde Era, China Merchants Bank, BOE A, Haier Smart Home, Chifeng Gold, and Ping An of China.

At the same time, ETFs, insurance funds, and public funds are also important incremental funds for Hakuba stocks. Central Huijin continued to increase its holdings of ETFs tracking the Shanghai and Shenzhen 300, driving a net inflow of over 300 billion yuan into equity ETFs this year.

As one of the most anticipated long-term funds, insurance capital has gradually increased its allocation to the equity market since last year. Overall, insurance capital was added to non-bank finance, electronics, pharmaceuticals, food and beverage sectors in the first quarter of this year.

There was a tendency for public fund holdings to decline in market capitalization in the second half of last year, but in the first quarter of this year, fund managers refocused on core assets and basically concentrated on core assets represented by leaders in various industries.

Judging from the core asset performance, the Wande Micro Market Index continued to outperform the Shanghai and Shenzhen 300 Index after January 29.

Compared to the industry itself, the industry's leaders have made significant excess profits this year, and the Shanghai and Shenzhen 300 has once again begun to reap excess profits.

Today, funds such as foreign capital, ETFs, insurance capital, and public funding are all driving the market to further focus on core assets. Predictably, as foreign capital continues to enter the market with great fanfare, it is bound to resonate with domestic capital, and the trumpet for core assets has already sounded.

03

300 ETF, all A-share core assets in one network

As a “weather vane” for A-share investment, the Shanghai and Shenzhen 300 Index is one of the benchmark indices for the Chinese stock market.

The 300ETF (fund code: 159300) tracks only the A-share flagship index “Shanghai and Shenzhen 300.”

As we all know, the Shanghai and Shenzhen 300 Index covers the 300 largest and highly liquid companies in the Shanghai and Shenzhen markets, with a total market value of over 51 trillion yuan of constituent stocks. The Shanghai and Shenzhen 300 Index accounts for 67% of the total market value of A-shares with less than 6% of the total market value of A-shares, which is worthy of “exhausting” A-share hard-core assets.

Index characteristic 1: favored by large sums

Nearly 80% of this year's ETF share increase was contributed by ETFs tracking the Shanghai and Shenzhen 300. The capital nearly doubled the share of related ETFs in just four months, from 107.97 billion shares at the beginning of the year to 213.439 billion shares at the end of April, an increase of 97.68%.

Index characteristic 2: full and balanced industry coverage

Looking at industry distribution, the industries covered by the Shanghai and Shenzhen 300 Index are mainly concentrated in banking (13.09%), food and beverage (11.49%), non-bank finance (9.17%), electronics (8.09%), power equipment (7.95%), and pharmaceutics (6.41%), with a total weight of more than 50%.

It is worth mentioning that the constituent stocks of the Shanghai and Shenzhen 300 change every six months. The share of financial real estate, steel and other industries has declined significantly in the past ten years, while the share of emerging growth industries such as electronics, power equipment, and new energy has increased.

This is exactly in line with the trend of alternating old and new momentum in China. It shows that the index evolves with the times and can represent new changes in the dynamics of China's economic development.

Index characteristic 3: Large market blue chip attributes stand out

The Shanghai and Shenzhen 300 Index focuses on A-share core assets. The total market value is about 51.19 trillion yuan, and the average market value of constituent stocks is about 170.619 billion yuan.

According to the distribution of market value in circulation, the weight of 600 billion dollars or more accounts for 4%; the weight of 300 billion to 600 billion dollars accounts for 28%; and the weight of 50 billion to 100 billion dollars is 33.33%. The constituent stocks as a whole show the characteristics of leading market capitalization.

The Shanghai and Shenzhen 300 also has 31% of its weight distributed among companies with a market capitalization of 10 billion to 50 billion dollars, which shows the characteristics of the Shanghai and Shenzhen 300 largest market capitalization and equal emphasis on growth. In addition to ensuring the stability of the index, it is also somewhat aggressive.

Among them, the top ten major stocks in Shanghai and Shenzhen are all core assets, namely Kweichow Moutai, Ningde Times, Ping An of China, China Merchants Bank, Midea Group, Wuliangye, Zijin Mining, Changjiang Electric Power, Industrial Bank, and Hengrui Pharmaceuticals, accounting for a total share of 22.55%.

Needless to say, as a leading stock in the industry, the average profit growth rate outperforms the industry it belongs to. In the future, core leaders are expected to further exert scale effects, and long-term growth momentum will be more obvious.

Index characteristic 4: relatively generous dividends

As an index that includes leading stocks in various industries, the strength of the Shanghai and Shenzhen 300 dividends should not be underestimated. It has basically stabilized above 2% in the past ten years. The dividend rate of the Shanghai and Shenzhen 300 Index reached 3.16% in 2023, and the total cash dividend was 1.2 trillion yuan, accounting for 70% of all A-shares. It is a small expert in proper dividends.

04

The economy is stabilizing, and the time is right for 300 ETF (159300) investment

Since February, with the intensive introduction of various policies to stabilize the market and stabilize expectations, the results of the current steady growth policy are gradually showing.

China's GDP grew 5.3% year-on-year in the first quarter. The manufacturing PMI “steady rise in volume and price” in April was 50.4, higher than the forecast of 50.3, indicating that China's nominal economy is expected to continue to improve.

Caixin China's service sector PMI recorded 52.5 in April, and has been in the expansion range for 16 consecutive months.

The latest May Day travel data also shows that domestic demand is gradually recovering. During the three-day “May Day” holiday in 2024, 295 million domestic tourist trips were made, an increase of 28.2% over the same period in 2019 according to a comparable scale; domestic tourism revenue reached 166.89 billion yuan, an increase of 13.5% over the same period in 2019.

Historical data shows that in the early stages of economic stabilization, leading stocks have a good profit advantage. When the economy recovers, they often face a market where valuation is repaired first and profit is repaired later.

The profits of blue-chip companies represented by the Shanghai and Shenzhen 300 Index (non-financial) have bottomed out since the second half of last year. As corporate profits continue to recover, it is expected that large-cap value stocks such as the Shanghai and Shenzhen 300 will be significantly superior to the China Securities 1000 small-cap stocks in the second quarter.

As of April 19, the price-earnings ratio (TTM) of the Shanghai and Shenzhen 300 Index was 11.74 times, at the 28.07% level since listing; the net market ratio was 1.26, which was in the 6.85% position in the past ten years. Both are at a relatively low level in history. There is plenty of room for future growth and a high margin of safety.

Currently, the valuation of the Shanghai and Shenzhen 300 is at a historically low level. In the context of the main capital purchasing large amounts of ETFs related to the Shanghai and Shenzhen 300, its downside risk is limited.

Against the backdrop of scarce assets, this year's high-dividend and high-dividend indices have the strength to strengthen, and core assets related to high dividends may provide additional upward flexibility. Among the constituent stocks of the Shanghai and Shenzhen 300 Index, the total weight of pro-cyclical listed companies is close to 50%, so it can be said that the 300 ETF (159300) is a type that combines offense and defense.

At a time when foreign investors are strongly optimistic about the Chinese economy and expect a significant recovery, it is expected to resonate with helping capital to boost core assets. At this time, focusing on the 300 ETF (159,300) can be described as the old saying “can attack, retreat can be defended.”

The 300ETF (159300) will be issued from May 13 to May 24. The 300 ETF rate is also one of the lowest in tracking the Shanghai and Shenzhen 300 Index. The annual management fee rate is 0.15%, and the escrow fee rate is 0.05%, for a total of 0.2%. For investors, the 300 ETF (159300) has a significant cost advantage.

Standing at this point, the Chinese economy continues to release signs of recovery. After three years of intensive refinement, the core assets are expected to usher in a day of nirvana. In other words, whether the game rebounds in the short term or long-term optimism, the 300 ETF (159300) is one type of investment worth studying and paying attention to.

Risk warning:

The above views, opinions, and ideas are based on current market conditions and may change in the future. The index's past performance does not represent its future performance, nor does it constitute a guarantee of the fund's investment income or any investment advice. The index operates for a short period of time and does not reflect all stages of market development. Funds are risky, and investments must be made with caution.