According to the “ten working days” principle, the price adjustment window for this round is 24:00 on May 15; real-time turnover and daily quota balance adjustments for Hong Kong Stock Exchange northbound transactions will be officially implemented on the 13th; and on May 17, the National Bureau of Statistics will release the April commercial residential sales price index monthly report.

【Breaking news】

Refined oil products welcome price adjustment window

According to the “ten working days” principle, the price adjustment window for this round is 24:00 on May 15. According to Jin Lianchuang's estimates, as of the sixth working day of May 10, the average price of reference crude oil varieties was 82 US dollars/barrel, with a change rate of -4.54%. The corresponding retail price of domestic gasoline and diesel should be reduced by 210 yuan/ton.

Citigroup Research predicted on Thursday that oil prices will fall somewhat during 2024. The Brent crude oil futures price for the second quarter is expected to be 86 US dollars/barrel per barrel, and 74 US dollars/barrel for the third quarter. “Currently, the trading price of crude oil has dropped from a high point of more than 10 US dollars/barrel. We cannot rule out some speculative purchases, but we still believe that in the face of geopolitical risks and loose fundamentals, the correct strategy is to sell at a higher price.” Citi added.

Real-time turnover and daily quota balance adjustments for northbound trading on the Hong Kong Stock Exchange will be officially implemented on the 13th

The Hong Kong Stock Exchange announced, with reference to the notice issued by the Exchange on May 3, 2024. Following the successful completion of pre-launch testing on May 11, adjustments to the real-time turnover and daily quota balance for northbound transactions will be officially implemented on May 13 (Monday).

Housing prices in 70 cities will be released in April

On May 17, the National Bureau of Statistics will release the April commercial residential sales price index monthly report. Earlier data showed that in March, sales prices of newly built commercial residential homes in first-tier cities fell 0.1% month-on-month, and the decline was 0.2 percentage points narrower than the previous month; sales prices of newly built commercial residential homes in second-tier and third-tier cities fell 0.3% and 0.4% month-on-month, respectively, and the declines were the same as last month.

Multiple meetings will be held

The 2024 Global Trade and Investment Promotion Summit will be held in Beijing on May 13. With the theme of “Mutual Trust and Cooperation: Choices in a Changing Situation”, this summit explores ways to address global challenges through mutual trust and cooperation under 100 years of change, and strives to inject more certainty into the world economy and social development.

The 8th China-Russia Expo will be held in Harbin from May 16 to 21. The Ministry of Commerce said it will continue to take active measures with Russia to consolidate the scale of trade in commodities such as energy, minerals, and food, and expand cooperation in emerging fields such as trade in services, the digital economy, and green and low carbon.

The 2024 Shanghai Information Consumption Festival is scheduled to be held from May 17 to June 17, including innovation contests, ecological bazaars, high-end dialogue, supply and demand docking, etc., to promote digital information consumption in various aspects such as technology, industry, and finance, and unleash the new potential of information consumption.

Economic data for April will be released

On May 17, the National Bureau of Statistics will release economic data such as industrial value added, fixed asset investment, and total retail sales of social consumer goods for April.

Huachuang Securities believes that there may be an increase in the fundamental positive factors reflected in the April economic data, and several sub-readings are expected to improve. On the production side, the April PMI indicates an accelerated expansion of manufacturing production, and the industrial growth rate is expected to rise slightly to more than 5%. In terms of demand, export readings are expected to recover from a low base, continuing the trend of weak recovery, and import price support for readings may weaken; on the investment side, high-frequency data related to infrastructure investment showed more positive performance in April. In particular, the price of investment products rose month-on-month, and the growth rate of fixed assets may rise to around 4.8%. Furthermore, total retail sales of social consumer goods are expected to grow at around 4.5%.

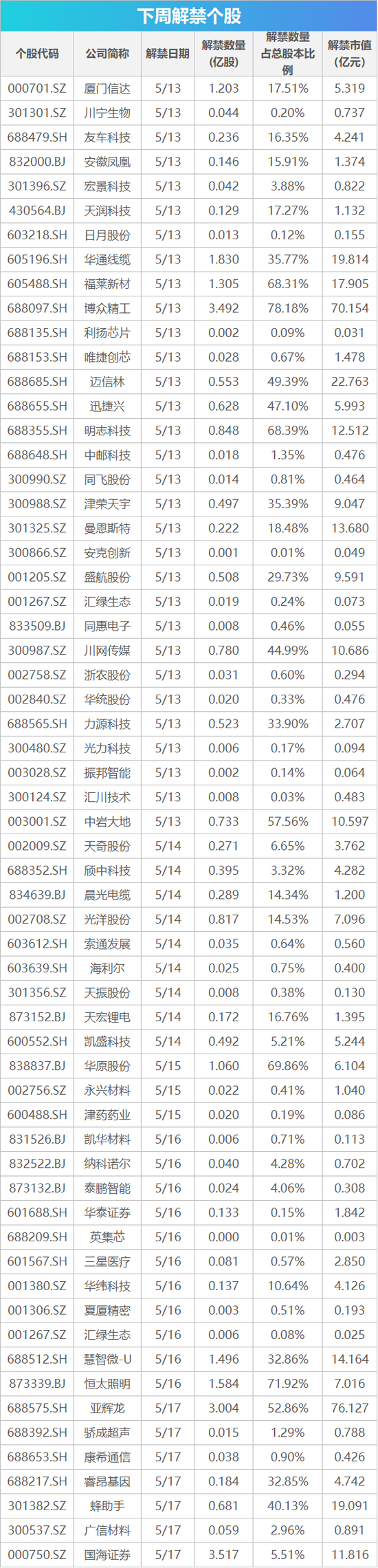

Restricted stock sales ban lifted, market value dropped to less than 40 billion yuan, led by 3 science and technology innovation board companies

According to Wind data, next week (May 13-17), more than 2.8 billion restricted shares will be listed in circulation in the Shanghai and Shenzhen markets. Based on the closing price on May 10, the market value is close to 40 billion yuan, which is a sharp drop from this week's month to month. In terms of individual stocks, companies with the largest market capitalization unbanned include Yahuilong, Bozhong Precision, Maixinlin, Huatong Cable, Bee Helper, and Fulai New Materials. Among them, the top three restricted stocks had the highest unbanned market capitalization, all exceeding 2 billion yuan, and they are all science and technology innovation board companies.

[IPO Opportunities]

According to Wind data, there will be no new shares to be purchased next week, but 1 new stock will be listed. Reddy Smart Drive shares will be listed on the Shenzhen Stock Exchange GEM on May 13.