BOE Varitronix Limited (HKG:710) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

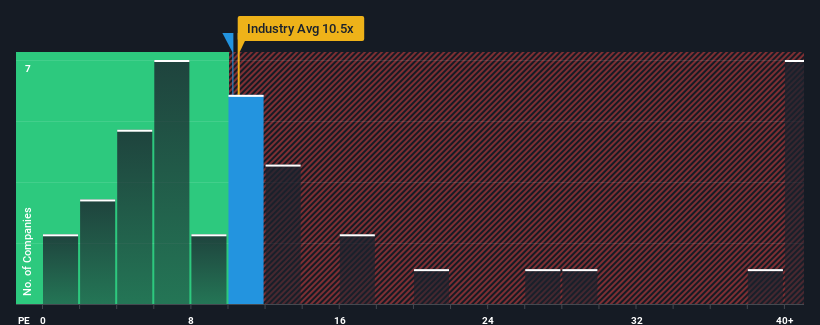

In spite of the firm bounce in price, it's still not a stretch to say that BOE Varitronix's price-to-earnings (or "P/E") ratio of 10.2x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, BOE Varitronix's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

What Are Growth Metrics Telling Us About The P/E?

BOE Varitronix's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 543% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 20% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 16% per annum, which is noticeably less attractive.

In light of this, it's curious that BOE Varitronix's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

BOE Varitronix appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of BOE Varitronix's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for BOE Varitronix with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.