According to a Bank of America customer survey, demand for longer-term US bonds has soared since the Federal Reserve hinted that interest rate hikes were unlikely and paved the way for interest rate cuts later this year.

An indicator that measures investors' willingness to extend their portfolios for a long time has climbed to a new high in a year, close to the highest level since Bank of America began this survey in 2011. Investors usually avoid long-term periods when monetary policy is uncertain.

These changes show that after the hawkish stance expressed by Jerome Powell last week was lower than some people feared, market participants are more willing to bet that the Federal Reserve will cut interest rates later this year. The weak performance of US employment data also reinforces this view, and bond traders are also ahead of schedule to cut interest rates for the first time.

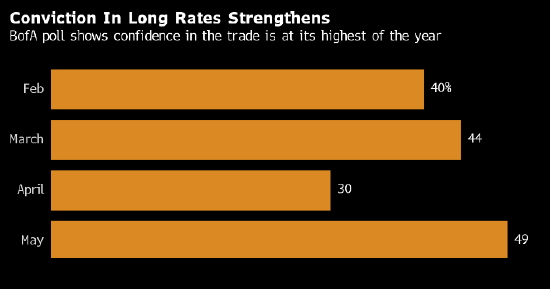

The Bank of America survey was conducted from May 3 to 8 after the Federal Reserve's decision, showing that 49% of respondents said that going long on interest rate products was the most confident transaction during the year. That percentage is up from 30% in April. Another earlier report from the bank showed that global bond fund capital inflows this week hit a new high in more than 3 years.

Bank of America strategists such as Ralf Preusser pointed out in the investigation report that by setting the threshold for further interest rate hikes at a very high level, Powell “triggered the mentality of buying on dips.”

However, the survey also showed that customer positions did not reflect their latest ideas. According to the Bank of America, the difference between sentiment indicators and America's long-term actual bullish exposure has widened to the greatest extent in history.

Investors are also bullish on bonds from other regions, and a measure of global confidence hit a new high since 2021. The ECB and the Bank of England have hinted that interest rates may be cut as soon as next month.

Bank of America's clients' bearish views on the yen also hit a new high since 2022, while previously they had been bullish for a long time. The yen fell to a low of about 30 years against the US dollar last month, triggering suspected intervention by the Japanese authorities to support the exchange rate.

“There are deep doubts about the effectiveness of Japan's foreign exchange intervention,” the strategists said. According to the survey, most respondents expected the yen to retest the $160 level, and no one expected it to rebound to $150 per dollar.